Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Mar, 2025

By Nick Lazzaro

|

Traders work on the floor of the New York Stock Exchange during morning trading March 14, 2025, opening on an upward swing after days of volatility and stock market losses. Corporate bond spreads have risen over the last month amid the uncertain market backdrop, but their upward movement is likely to be limited. |

Debt spreads for US companies reached their highest levels in six months but are unlikely to rise significantly this year despite market turmoil amid policy changes from US President Donald Trump's administration.

The option-adjusted spread in the S&P 500 investment-grade corporate bond index reached 83 basis points March 13, up from a 10-year low of 62 bps on Nov. 12, 2024, in the days following Trump's reelection. The S&P US high-yield corporate bond index spread also increased, to 316 bps on March 13 from a 10-year low of 241 bps in January. The spreads measure the difference in yields between corporate and Treasury debt, with wider spreads representing a higher premium demanded by investors.

The Trump administration has unsettled markets with rapid and sometimes temporary changes to economic and trade policy. Although US corporate bond spreads widened in March amid the accompanying market uncertainty, they remain at historically low levels and are unlikely to increase significantly due to mostly sound corporate debt fundamentals.

"One of the goals of the Trump administration, given polling, should be focusing on lowering inflation, and that requires weaker demand, and weaker demand requires lower asset prices, and lower asset prices would be connected to slightly wider credit spreads," Eric Souders, lead strategist of global unconstrained fixed income for Payden & Rygel, told S&P Global Market Intelligence during a webinar. "Spreads should be relatively rangebound, but likely to drift wider from here."

Default rates are likely to remain low in the near term, supporting the foundation underpinning US corporate debt, though stretched asset valuations present pressure, Souders said.

Yields remain elevated

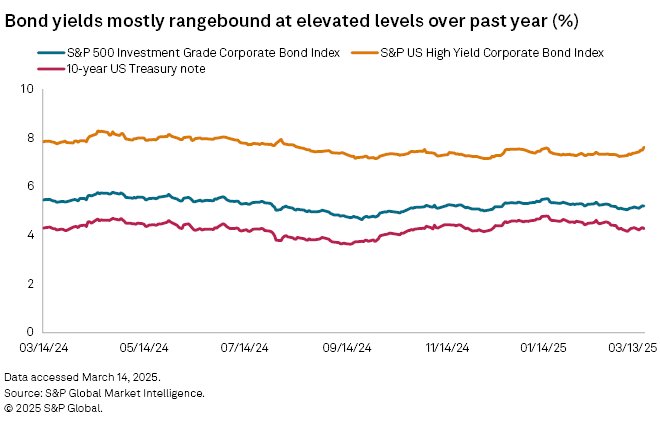

Corporate bond yields generally move in tandem with US Treasury yields. While current spreads are low, corporate bond yields are still historically high due to elevated Treasury yields. The 10-year Treasury note settled at 4.32% on March 12, higher than at any point from 2018 to 2022.

While corporate yields are attractive compared to historical levels, the current pricing for debt, as reflected by lower spreads, "leaves less room for error now," said Niladri Mukherjee, chief investment officer for TIAA Wealth Management, in an email.

"Given the recent sentiment shift and appearance that tariffs may materialize to a larger degree than many expected, there is an increased chance of elevated inflation, growth hits, and consumer pullback which could weaken earnings and [encourage] flight to quality, which makes all-in yields less attractive," Mukherjee said.

Still, ongoing market uncertainty is likely to prevent corporate bond spreads from widening too far, Mukherjee said.

Much of the market uncertainty has been connected to Trump's on-and-off tariff policy. High-yield corporate bond spreads did rise relative to more predictable tariff policy during Trump's first term, according to Lawrence Gillum, chief fixed income strategist for LPL Financial.

"In 2019, for every $10 billion increase in tariff revenue, US high-yield index spreads widened by 2-13 bps," Gillum said in a February research note.

In response to tariffs, investors tend to divert more capital toward US Treasuries, causing their yields to fall in contrast to rising bond spreads, Gillum said.

Tight spreads pose risk for high-yield debt

The low-spread, high-yield environment particularly favors bonds issued by investment-grade corporations — those with stronger debt profiles that are rated BBB- or higher by S&P Global Ratings. But for high-yield bonds from weaker corporate issuers — those rated below BBB- and known as speculative-grade companies — the lower spreads may not offer an adequate risk premium for investors amid near-term market uncertainty.

"When there's stress and when the headlines start hitting in the corporate market, where the defaults are maybe starting to increase, then that will give people a reason to question why they are in corporate investment funds when spreads are super tight and credit risk seems to be starting to increase," said Jay Menozzi, chief investment officer and portfolio manager at Easterly Orange, in an interview.

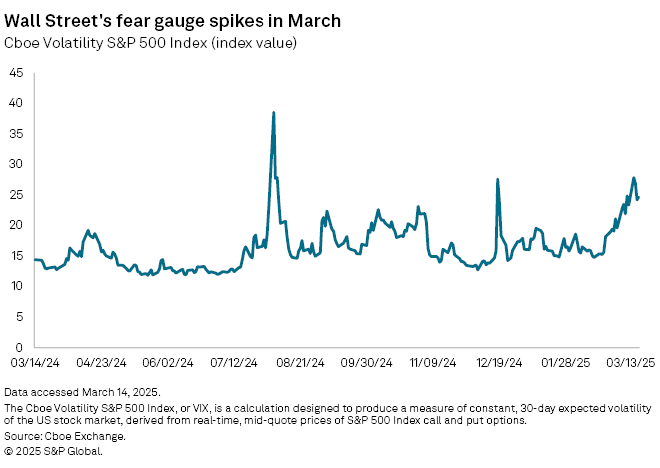

The CBOE Volatility S&P 500 Index, known as the market's "fear gauge," has climbed in recent weeks and on March 10 hit its highest point since August 2024's market selloff.

Short-duration, high-quality assets with fixed rates in markets such as structured credit would be less susceptible to market shocks, Menozzi said. Structured credit includes assets such as residential mortgage-backed securities, commercial mortgage-backed security and collateralized loan obligations.

"When you think about your total return going forward and you look at the projected yield of maturity on those assets, there's not an implicit spread widening or negative price component that's going to happen in these volatile economic scenarios like there is in corporate bonds that are priced to perfection," Menozzi said.