Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Mar, 2025

| A coal miner at the Enlow Fork mine, Pa., prepares to head to the longwall face. US coal miners have increasingly come to depend on export markets, but the Trump administration's proposed port fees are endangering that crucial outlet for coal supplies. Source: S&P Global Commodity Insights |

US coal miners are scrambling to thwart a new rule that would impose high fees on Chinese-built ships entering US ports, saying that the proposal is already chasing away international customers.

Though US President Donald Trump is a vocal supporter of coal, mining companies could be among the collateral damage of an intensifying trade dispute with countries around the world. Advancing a proposal from the US Trade Representative that seeks to impose fees of up to $1.5 million for each China-built ship that enters a US port would deal yet another blow to the already weakened sector. Coal miners say the proposal will obliterate the industry's export prospects, destroying a lucrative source of alternative revenue in the face of declining domestic demand.

"The proposed actions, if implemented, will kill the US coal export business," the American Coal Council wrote in a March 17 public comment on the proposal.

Coal producers were among Trump's earliest supporters in the campaign that secured his first term. While Trump deployed relatively little rhetoric around the coal industry in the 2024 campaign, the industry has expressed optimism that the president could boost the ailing industry. However, coal companies have not only been caught in back-and-forth tariff exchanges between countries following the president's trade actions, but they also now face a major threat to valuable export markets for coal.

The White House did not immediately respond to a request for comment.

Trump targeting China's shipping dominance

The USTR is proposing charging $1 million per instance for vessel operators from China to enter a US port. Fleets with Chinese-built vessels would be charged up to $1.5 million per entrance based on the percentage of such vessels in the fleet. The rule also proposed fees on ships that are simply a part of a fleet that includes Chinese-built vessels.

"Given the widely acknowledged atrophy in the shipbuilding capacity around the world and in the United States, it is likely impossible for coal exporting companies to secure an adequate number of appropriately designed and sized vessels to avoid the proposed port fees," a coalition of 11 state coal and mining trade associations said March 19 in written comments on the proposal. "With no alternative capacity available, imposition of proposed port fees will most certainly price American coal out of the market."

The USTR said in the rule that China owns over 19% of the world's commercial fleet, and its share of the shipbuilding market went from less than 5% of global tonnage in 1999 to over 50% in 2023. However, the language of the fee proposal is so expansive as to impact about 98% of ships that call on US ports, the National Mining Association (NMA) warned in its public comments on the rule.

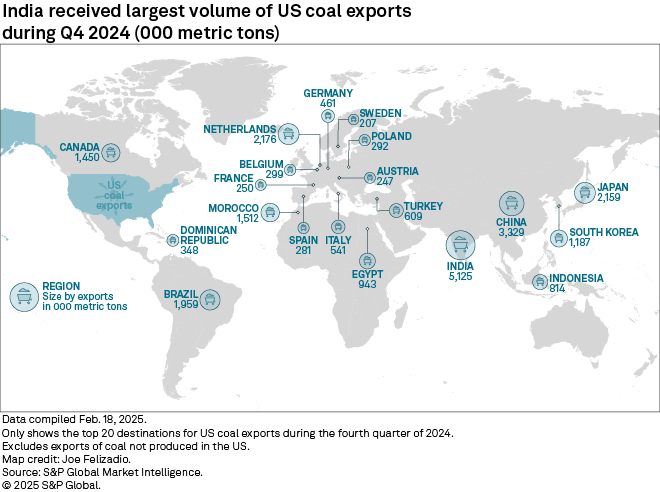

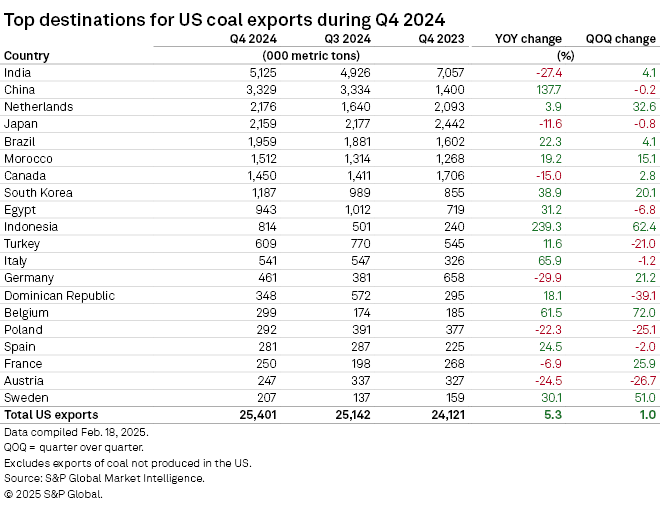

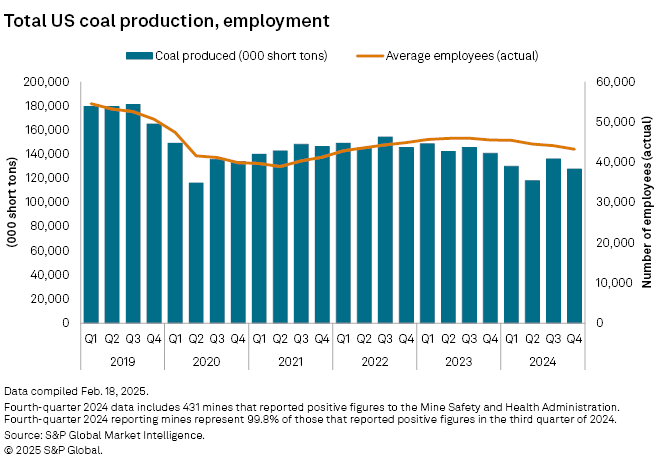

Export markets have become increasingly vital to sustaining the US coal industry as much of the nation's coal-fired fleet has been retired or scheduled to retire. The US shipped 107.6 million short tons of coal abroad in 2024, according to the US Energy Information Administration's latest Short-term Energy Outlook. That represents more than one-fifth of 511.7 million short tons produced that year.

"These international markets are critical since there is very little current domestic market demand for met coal," the Alabama Mining Association wrote March 24 in its comments. Until American steelmaking blast furnaces are modernized and expanded, staying "competitive in export markets remains our only way of staying in business," the industry group added

The written comment period on the rule ended March 24, and the USTR held a hearing on the issue on March 24 and 26. Stakeholders have seven days from the last hearing to submit rebuttal comments, but as some commenters pointed out, the timeline beyond that is unclear and exacerbates uncertainty in the market.

"Thousands of coal miners stand to lose their jobs within months as well as the tens of thousands of those who work in jobs which rely on the coal industry," wrote Cecil Roberts, president of United Mine Workers Association International, adding that the union supports building more ships in the US in the longer-term. "Yet even if we start today, building out such a fleet will take years. The job losses in coal country, however, will happen in a matter of days."

'Specter of port fees' rattling markets

Already, the effects are being felt from the mere "specter of port fees," NMA President and CEO Rich Nolan warned in March 20 comments.

The Trump administration's rule would have the opposite effect of the president's goal to "reestablish the United States as an industrial powerhouse," Nolan said. trading partners are already looking to other sources of coal, including Russia, Indonesia, and South Africa and that is rapidly eroding the sector's customer base, the executive added.

"Several coal company members have reported the loss of nearly all their export orders for the remainder of the year due to uncertainty surrounding the proposed action's service fee," Nolan wrote. "As a result, companies must now reassess their current contract demand and production levels, which may lead to significant cutbacks or even closures at their mines."

Comments from several coal companies and other stakeholders confirmed the impacts of the rule are being felt in the sector's business dealings already and likely to get worse.

Javelin Global Commodities (UK) Ltd., a global trading, logistics, operations and investment group, estimated that the costs from shouldering these fees would fall in the range of $129 million to $140 million a year each for two of the private coal companies it is associated with, Foresight Coal Sales LLC and American Consolidated Natural Resources Inc. Javelin said that the two companies shipped a combined 16.9 million metric tons of coal to export markets in 2024.

"Clearly, these are financial burdens which cannot be absorbed by US producers," wrote Peter Bradley, CEO of Javelin Global Commodities.

Core Natural Resources Inc. CEO Pal Lang wrote that the proposed rule has the potential to render its operations uneconomic in export markets and could "shut us out of these markets entirely." Core, the largest producer and exporter of coal in the US, estimates the actions would add $15-$20 per ton of additional cost to each coal shipment.

Companies that charter vessels are now adding language into their charter agreements that put US coal companies on the hook for the additional fee, Lang said. Core noted it has already lost customers to suppliers in Australia, Russia and Colombia as a result of mere talk of the rule.

"The global industry is such that once you lose a customer to a competitor, it can be difficult to get them back," Lang wrote. "While US coals enjoy unique advantages, substitutes are nevertheless available."

Rule gets support from US steelmakers

The rule did garner support from an industry group adjacent to coal producers. The American Iron and Steel Institute (AISI) applauded the administration's efforts to "address China's unfair trade practices targeting the maritime, logistics and shipbuilding sectors." The AISI's website lists of associate members include Core and XCoal Energy & Resources, one of the early companies to publicly flag the potential economic dangers of the rule.

"Currently, there is plenty of available plate production capacity domestically and American steel producers are ready to meet any increase in demand that may result from remedies the administration may put in place," wrote Kevin Dempsey, president and CEO of AISI. By addressing China's shipbuilding practices, "the administration can help restore demand for American-made steel and create good-paying jobs in communities across the country," Dempsey said.