S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Mar, 2025

By Nick Lazzaro

|

A stock market trader watches monitors on the trading floor of the Frankfurt Stock Exchange in Germany on March 20, 2025. Amid macroeconomic uncertainty and a recent stock market correction in the US, investors may look to shift capital away from US large-cap stocks and toward other assets such as international equities, with German stocks representing one attractive opportunity. |

International equities are attracting more investor attention this year as market jitters intensify over US large-cap stocks.

The S&P 500 is down nearly 2% in 2025 through March 24 this year while benchmark indexes for Europe, Asia and China have all posted gains, according to S&P Global Market Intelligence data. This is a stark reversal from 2024, when the S&P 500 led with a return of more than 23%.

Investors in March cited the US macroeconomic environment as having a larger drag on domestic equities than the global macroeconomic environment, according to the survey results for the latest monthly S&P Global Investment Manager Index released March 11. Beyond macroeconomic factors, only high stock valuations and the domestic political environment were viewed as more concerning pressure points for market returns. These dynamics may be encouraging investors to consider more exposure to markets outside of the US.

"We have seen a shift toward global stocks, including European stocks that have been outperforming recently, and Chinese stocks to varying degrees have been performing well," said David Russell, global head of market strategy at TradeStation, in an interview. "When you look at a lot of the areas that have been performing well … they all trade at lower multiples compared to the large US growth stocks, so I think there has been an exodus out of the expensive large secular growth names that dominate the S&P 500.

In China, companies that are making advances with electric vehicles and artificial intelligence, but whose stocks are trading at lower multiples relative to US technology companies, may attract investor interest, Russell said. Stocks in Germany may also garner more attention as the country's new government potentially pursues more deficit spending and economic growth strategies.

Meanwhile, recent indicators point to a slowing US economy this year. The US Federal Reserve's Federal Open Market Committee now expects US real GDP to grow only 1.7% this year, down from a 2.1% improvement projected in December 2024, according to its latest economic projections released March 19. S&P Global's Purchasing Managers Index has also showed a slowdown in US service sector and manufacturing activity growth, with a headline composite index reading of 51.6 in February, down from 52.7 in January, according to data released March 5. Any value higher than 50 represents expansion.

Diversifying from US mega-caps

S&P 500 stocks, collectively, traded at about 21 times forward earnings on March 24, according to Market Intelligence data. This forward price-to-earnings ratio, a key measure of valuation, is well above the index's pre-pandemic average and much of the period from 2022-2024.

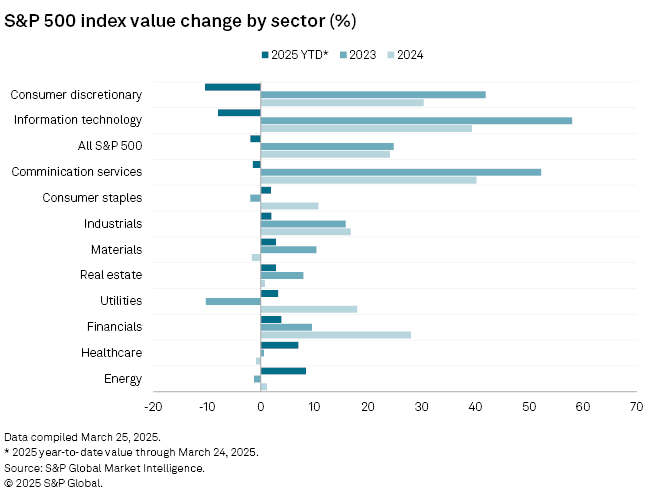

Stretched valuations have been a specific concern for IT mega-cap stocks, which drove the US stock market's bull run over the last two years. The S&P 500's IT sector's returns declined about 10% this year through March 24 after growth over 50% in 2023 and over 30% in 2024, according to Market Intelligence data.

"For those with existing positions that may have been overinvested in the mega-cap stocks, that trade worked really well for a long time, and these trades work well until they don't," said Tara Shulman, principal wealth advisor at Compound Planning, in an interview. "There's a little bit of a lesson being learned as far as concentration risk, both in mega-cap stocks and domestically in the United States."

Any moves out of overweighted equity positions create opportunity to deploy capital more broadly across a diverse portfolio.

"We always think about tactical rotations and how can we reasonably take advantage of the shifting market environment and use that to our clients' advantage — potentially thinking about the mix of domestic and international equities, maybe shifting some capital into the options market," Shulman said.

Domestically, investors surveyed in the S&P Global Investment Manager Index also signaled a growing preference away from cyclical sectors, such as IT, and toward defensive sectors such as healthcare and consumer staples. However, some defensive sectors such as real estate could still be viewed with heightened risk by investors.

"Until investors are comfortable that we are not at risk of an immediate sell off and resulting rise in rates it will take some time for this to translate into improved conditions and sentiment for real estate investors," said Chuck Taylor, managing director for real estate investments at Domain Capital Advisors, in an email. "The market just saw the whipsaw from last summer through the end of the year on the rate side and it feels like the market will want to see some stability before jumping back in this time."

International credit exposure

Fixed-income investors may also identify evolving opportunities among international securities this year as global central banks potentially pursue divergent paths and pacing for interest rate policy and as governments alter their spending patterns.

The European Central Bank has already cut its deposit facility interest rate twice this year to a current rate of 2.5% while the US Fed has kept its benchmark rate unchanged so far this year after two meetings at a target range between 4.25% and 4.5%.

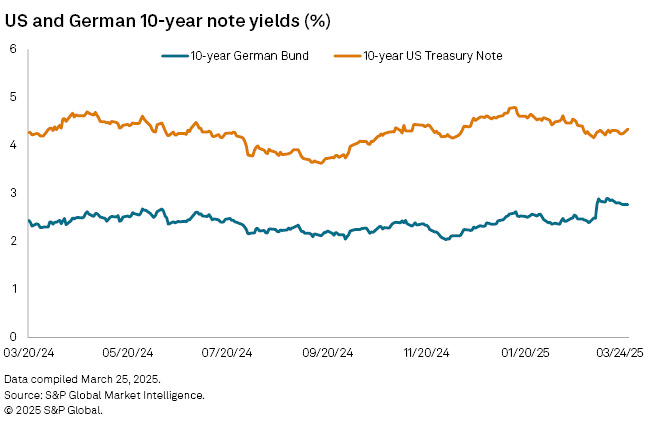

European countries may also issue greater volumes of sovereign debt in 2025. Germany, Europe's largest economy, is expected to boost government spending under the country's next likely chancellor, Friedrich Merz. The yield on the 10-year German Bund reached a 17-month high of 2.90% on March 11 from 2.47% on Feb. 24, the day after Germany's elections. The 10-year US Treasury note yield has steadily retreated this year to 4.34% on March 24 from nearly 4.8% in January.

"Europe is becoming attractive because of the increase in their sovereign bond yields," said Karen Manna of Federated Hermes in an interview. "In turn, that potentially takes away a buyer of US dollar-based securities and high-yield and investment-grade corporate debt because there might be a more attractive market by looking at Europe."