S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2025

By Meerub Anjum and Shambhavi Gupta

Global private equity and venture capital-backed rounds of funding continued to decline in 2025, with the total amount raised dropping to $15.9 billion in February, down 26% from January, according to S&P Global Market Intelligence data.

The year-over-year deal value also decreased by 23% in February, compared to $20.63 billion during the same period in 2024.

The number of rounds declined to 1,014 from 1,186 in the same period last year.

Both deal value and the number of rounds through February were below 2024 levels. The aggregate amount raised in 2025 through February dropped 30.2% year over year to $37.28 billion. Similarly, the number of rounds fell to 2,336 from 2,568.

– Download a spreadsheet with data featured in this article.

– Read private equity deal entries in February.

– Explore more private equity coverage.

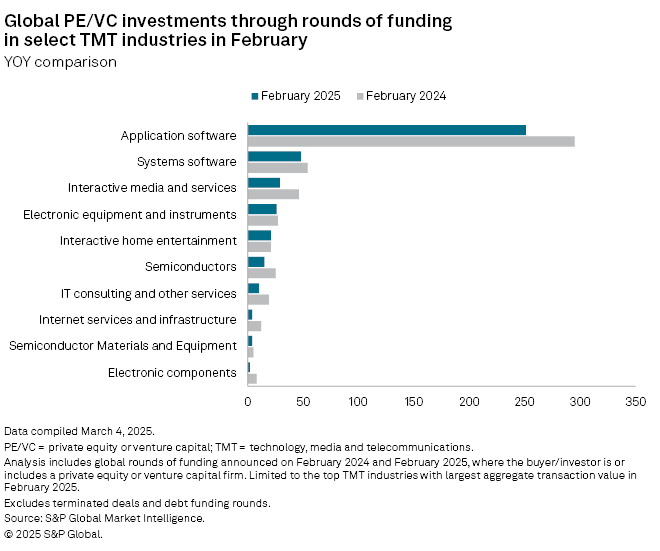

Technology, media and telecommunications (TMT) remained the most invested sector in February, receiving 48.9% of total investments. The sector raised $8.27 billion across 431 rounds of funding. This was followed by the healthcare sector representing 22% of the aggregate investments, raising $3.7 billion.

Within TMT, application software companies recorded the most private equity and venture capital-backed investment rounds at 251, down from 295 deals in February last year. Systems software companies followed with 47 investment rounds.

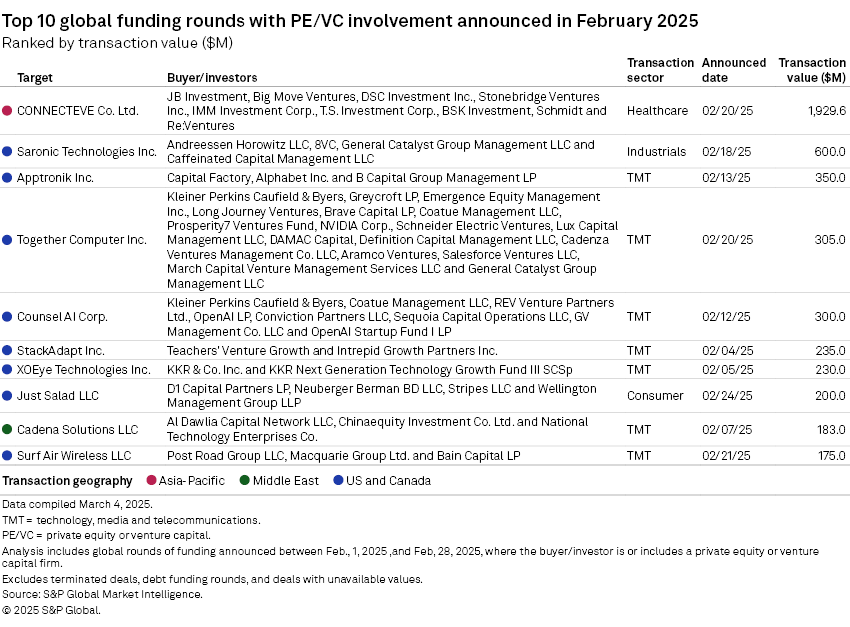

In the largest rounds of funding, healthcare equipment company Connecteve Co. Ltd. raised $1.92 billion from Big Move Ventures, BSK Investment, T.S. Investment Corp., JB Investment, IMM Investment Corp., DSC Investment Inc., Stonebridge Ventures Inc., Schmidt and Re:Ventures.

Unmanned surface vehicles manufacturer Saronic Technologies Inc.'s $600 million round from 8VC, Andreessen Horowitz LLC, Caffeinated Capital Management LLC, General Catalyst Group Management LLC and Lightspeed Ventures LLC was the second largest investment round in February.

AI-powered robotics company Apptronik Inc.'s $350 million series A round of funding co-led by B Capital Group Management LP and Capital Factory was the third largest investment round in the month.