Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Mar, 2025

Global private equity and venture capital deal value reached $37.93 billion in February, up 26.6% from January, according to S&P Global Market Intelligence data.

Year over year, deal value fell 28% from $52.64 billion in February 2024. During the same period, the number of deals fell by roughly 12.7%.

Looking at the first two months of 2025, deal volume and value were down compared with the same period in 2024. Investment value decreased about 20% to $67.89 and the number of deals were down to 1,670 from 1,788, Market Intelligence data showed.

|

– Download a spreadsheet with data featured in this article. – Read our latest In Play reports on rumored deals. – Explore more private equity coverage. |

Favored sectors

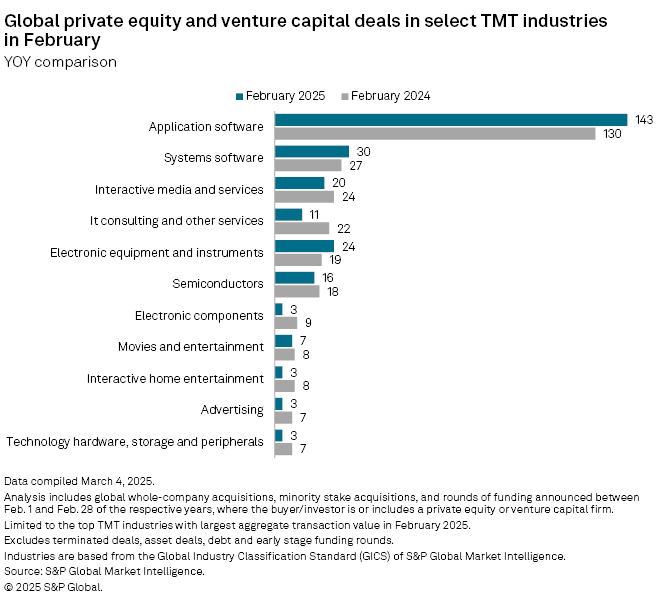

Technology, media and telecommunications (TMT) led global private equity and venture capital transactions in February with 278 deals totaling $13.72 billion, followed by the industrial sector with $7.41 billion across 103 transactions.

Application software remained the most invested segment within TMT, recording 143 deals. Systems software was a far second with 30 deals.

Top deals in February

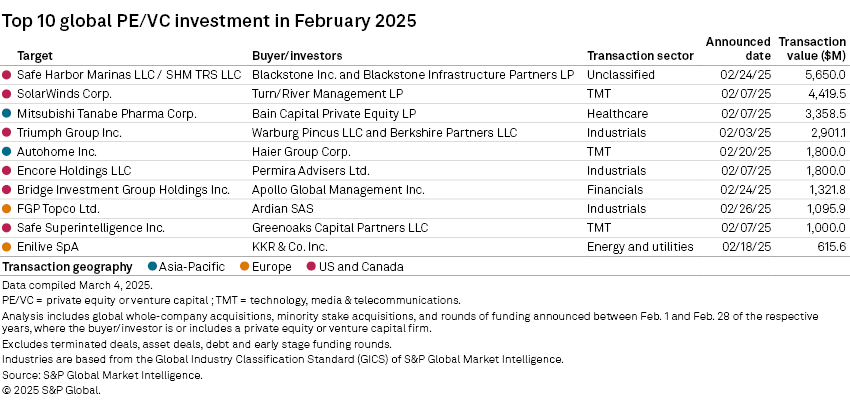

Six of the top 10 deals during the month were in the US and Canada. The largest private equity transaction was Blackstone Inc.'s planned $5.65 billion purchase of US marina operator Safe Harbor Marinas LLC from Sun Communities Inc. through the private equity giant's Blackstone Infrastructure Partners LP fund.

The second-largest deal was Turn/River Management L.P.'s pending $4.42 billion buyout of US-based systems software provider SolarWinds Corp.

Third was Bain Capital Pvt. Equity LP's $3.36 billion deal to acquire Japanese pharmaceutical company Mitsubishi Tanabe Pharma Corp.