Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Mar, 2025

By Nick Lazzaro

|

NATO Secretary General Mark Rutte and British Prime Minister Keir Starmer arrive at a summit of international leaders held in London on March 2, 2025, to discuss European security and the Russia-Ukraine war. European governments are expected to increase defense spending and contributions to NATO in the coming years, a factor that has driven up share prices this year for European defense companies. |

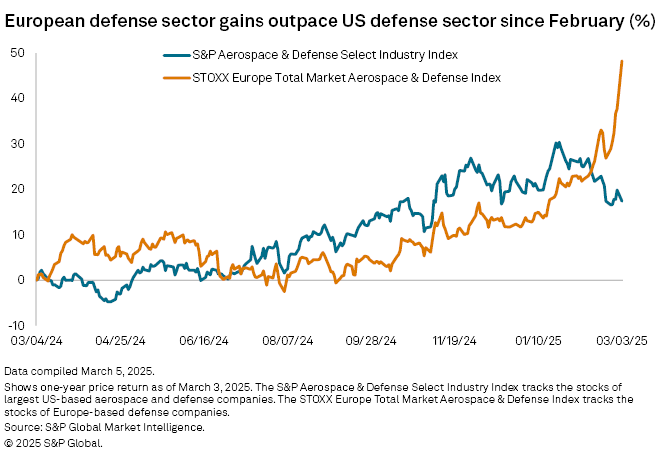

European defense stocks have outperformed their US counterparts since February, and that trend could continue as domestic and foreign policy shifts are altering defense spending in both regions.

The STOXX Europe Total Market Aerospace & Defense index posted a 48.32% one-year return as of March 3, more than doubling the 17.43% one-year return for the S&P Aerospace & Defense Select Industry Index, according to S&P Global Market Intelligence data. Those indexes track defense stocks of companies based in Europe and the US, respectively.

Expectations for the defense sector are evolving as European governments consider greater military expenditures while US President Donald Trump's administration has signaled for a slowdown in defense spending as part of larger budget cuts and reduced contributions to international security organizations such as NATO.

"The Trump administration is making clear that they intend to reduce the role of the US as the 'world's policeman' and are giving notice to our European allies that they will need to shoulder a greater financial responsibility for their own defense in the future," Gary Brode, managing partner and founder of Deep Knowledge Investing, said in an email. "President Trump and Elon Musk are trying to reduce the size and expense of the government. Defense spending increases are unlikely while cuts are increasingly likely. That's why the European defense stocks have outperformed."

Geopolitical changes drive recent gains

European defense stocks received shot higher after a contentious Feb. 28 meeting at the White House between Trump and Ukraine President Volodymyr Zelenskyy. The meeting cast doubt on a potential ceasefire in the Russia-Ukraine war, the future roles of the US and European nations in Ukraine's defense, and the future relationship between the US and Russia.

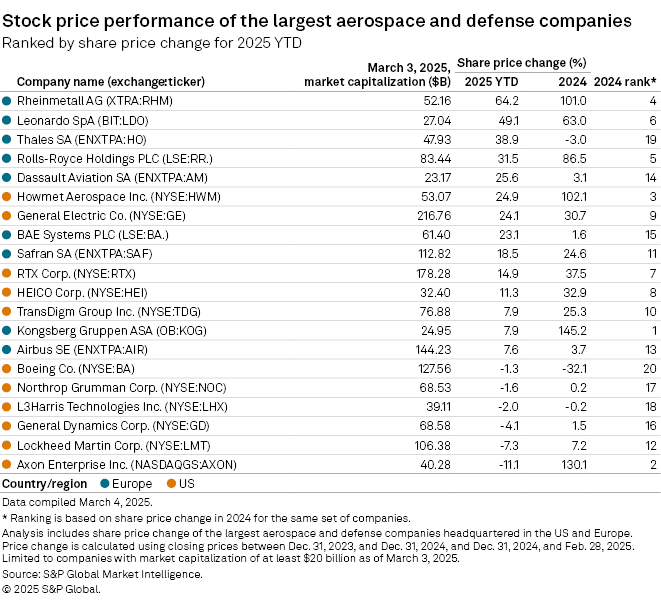

The STOXX Europe Total Market Aerospace & Defense index rose more than 7% on March 3, the Monday following the meeting. Shares of major European defense companies — including Leonardo SpA, Thales SA, Kongsberg Gruppen ASA, Dassault Aviation SA, BAE Systems PLC and Rheinmetall AG — each climbed more than 10% on the day.

European leaders have increasingly suggested in recent weeks a need to bolster their militaries in the coming years. Friedrich Merz, the expected incoming chancellor of Germany, said in February that his "absolute priority" would be to strengthen Europe's defense as quickly as possible to achieve independence from US aid. After Trump's meeting with Zelenskyy, the EU proposed a $158 billion fund to bolster military spending and support Ukraine, representing the European bloc's largest defense spending package in decades.

The surge seen from February to March is just the latest upward push for stock prices of Europe's largest defense companies, which have been on the rise since 2022 amid the Russia-Ukraine war and the Israel-Hamas war. Even before the onset of these conflicts, positive fundamentals began forming for the sector as European governments increased their defense spending contributions for NATO in response to requests from Trump.

"Trump pressured Europe to fulfill its defense spending promises in his first term, and just over a month into his second term, EU countries are already publicly affirming plans to spend more," Brode said. "In the past, the US tended to fund some international organizations disproportionately. President Trump is insisting on greater reciprocity in the future and reshaping arrangements to reflect that view. To us, this appears to be a structural change."

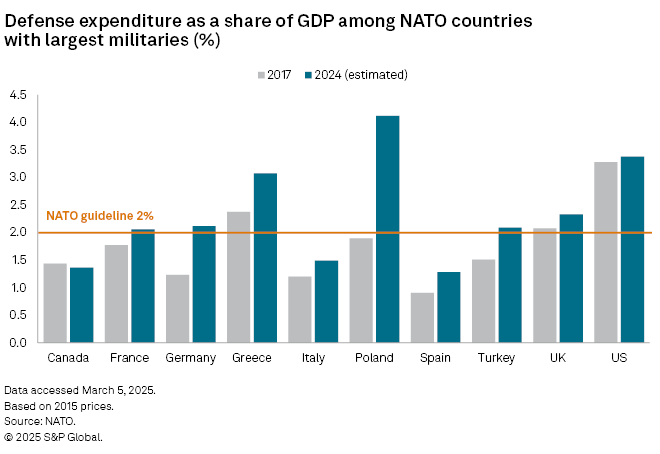

Defense spending outlook

NATO members have ramped up military spending since Trump's first presidential term began in 2017. The alliance recommends that defense expenditures among each of its member nations should represent 2% of their respective GDP. In 2024, six of the eight European NATO member countries with the largest militaries were estimated to have met this 2% guideline, according to NATO data. That compares to only two that met this guideline in 2017.

European countries may begin to view the 2% guideline as a minimum requirement rather than a target as the US potentially reduces its military presence in the region, according to Jeffrey Kleintop, managing director and chief global investment strategist at Charles Schwab.

"If the percentage climbs to 3%, it may translate to 800 billion euros by 2029 [in defense spending], almost four times the level of the mid-2010s," Kleintop said in a February commentary.

The UK said it plans to lift its defense spending to 2.5% of its GDP by 2027 with a longer-term target of 3%. Current expenditures are at about 2.33% of its GDP, according to NATO data.

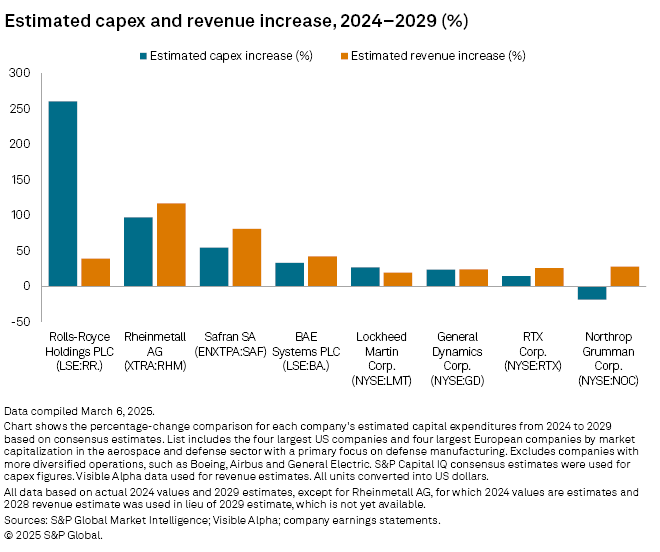

Rolls-Royce Holdings PLC, the UK's largest defense sector company, is expected to increase capital expenditures the most through the end of the decade from current levels compared to its industry peers in the US and Europe, according to Market Intelligence estimates. The company is targeting a greater share of its investments through 2028 and beyond into its power systems production for drive, propulsion and power generation, according to CEO Tufan Erginbilgic.

"Power systems capital and research and development right now is at the highest in their history of 100-plus years. That should tell you how we're thinking about it," Erginbilgic said during a Feb. 27 earnings call. "There is a growth potential that's immense with proper returns."

Increased European defense spending will also benefit US defense companies with large European customer bases, such as Lockheed Martin Corp.

"There's a litany of programs and services that we provide to the European customer base," Lockheed Martin CEO James Taiclet said Feb. 20 during an industry conference. "[The company's F-35 fighter jet] has run the table in Europe as far as fighter competitions over the last 10 years. ... It's the only fifth generation in production that those countries know they need that to stave off the Russian threat to deter it."

Underlying technology trends

While geopolitical and political influences have shaped the recent trajectories of US and European defense stock prices, advances in military technology have also played an ongoing role.

"In some ways, militarily speaking, we're at a secular change in terms of military and technology as we are seeing advances, like with the use of drones in Ukraine, that challenge some of the assumptions that we've had about war fighting and military weapon systems for decades," said David Russell, global head of market strategy at TradeStation, in an interview.

Companies advancing in the development of newer military technologies, such as drones, may now be operating at a more competitive level with legacy defense companies that have dominated the manufacturing of traditional military equipment such as fighter jets, thus expanding market opportunity for companies in both the US and Europe.

"We started a certain model of what defense spending looked like in the '90s that really took off with the war on terror, and that's been more than 20 years now of a certain kind of technology and product," Russell said. "That period seems to be ending. ... Companies that are connected to that old type of military technology now could see a longer-running shift in their business."