Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Mar, 2025

By Iuri Struta

Venture capital investors have increasingly turned away from the financial technology sector as the once-thriving industry has been overshadowed by AI.

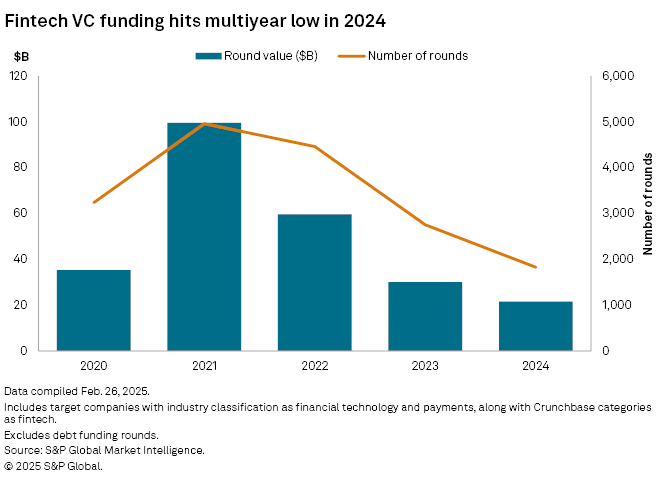

According to data from S&P Global Market Intelligence, venture capitalists invested $21.5 billion in 2024 across more than 1,800 funding rounds. Investment activity in 2024 was the slowest since 2016, when fintechs attracted a comparable amount of funding.

Several factors are driving the decline, investors say. After hitting a peak during the pandemic, fintech valuations have come down, and the sector's breakneck growth rates, including in terms of head count, have slowed. As a result, many venture capital investors have moved toward the next technology shift — generative AI.

"With AI 'revolutionizing' multiple industries, venture capital is flowing where the next big breakthrough is expected," John Clark, a partner at fintech-focused investment bank Royal Park Partners, told Market Intelligence.

Growth out, profits in

In late 2022, rising interest rates and declining valuations compelled many unprofitable fintechs to become more agile and accelerate their path to profitability.

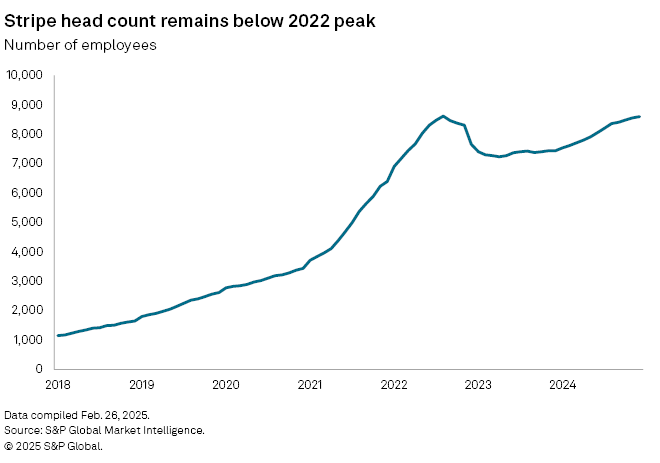

To achieve that, many companies began reducing their head count. Stripe Inc., the poster child of the fintech multiyear hype, was among the first to do so. Stripe's number of employees started to decline for the first time in its history in September 2022, from about 8,600 to a low of 7,270 in March 2023. Stripe has resumed its upward trajectory since then but at a much smaller rate, indicating a more measured pace of growth.

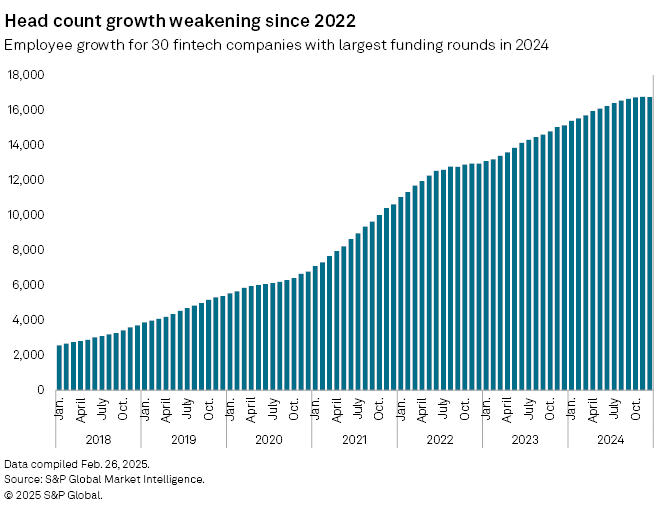

The 30 fintech companies that saw the largest funding rounds in 2024 also experienced stagnation in head count growth between late 2022 and early 2023. While growth resumed its upward trajectory in mid-2023, the median year-over-year growth rate continued to fall, down to 10% in December 2024 from 82% in December 2021, according to data from Market Intelligence.

"Young companies are under pressure to demonstrate leaner operating costs and a clear path to profitability," said Sophia Furber, a fintech analyst at 451 Research, a technology research group within Market Intelligence.

|

|

Headcount Analytics data is now available for over 4.3 million private companies in Capital IQ Pro, accessible through the Corporate Profile and People Summary pages, as well as Screener. To learn more, email support.capiqpro@spglobal.com. |

Valuations dropping

Fintech valuations have failed to recover and remain below the peak levels seen during the pandemic. Stripe cut its 2020 valuation of $100 billion to $50 billion in its latest round in 2023. Press reports have indicated that Stripe shares are now privately changing hands at a valuation of about $70 billion.

Melio Payments Inc. raised $150 million in 2024 at half the $4 billion valuation it achieved in 2021, according to Market Intelligence data. Most publicly listed fintechs have not participated in the market recovery, with companies like Block Inc. and PayPal Holdings Inc. still trading more than 70% below their peak levels.

"Fintech had an explosive run in previous years, but valuations got ahead of the businesses. Now, investors are pricing companies more realistically, leading to fewer deals and more scrutiny around the future growth prospects of companies," said Royal Park's Clark.

Many venture capital investors are also discovering that scaling fintech companies often takes time. In an environment that prioritizes profitability over growth, this is a poor fit for a venture capital investor looking for quicker returns.

"It's not uncommon for neobanks to take close to a decade to turn a profit. This is probably just too long for a lot of VCs," Furber said.

That is especially true when new technology subsectors — such as generative AI — offer the possibility of greater returns.

"A lot of money is getting sucked into native AI and out of traditional tech sectors, most notably fintech," Victor Basta, managing partner at investment bank Artis Partners, told Market Intelligence.

While venture capital funding is down, the fintech sector is reaching a level of maturity that makes it better suited for M&A. Clark noted that M&A activity in fintech is booming.

"Startups that can't raise new funding are looking for acquisitions as a lifeline," Clark said.

Market Intelligence data shows the value of fintech deals nearly doubled in 2024 compared with 2023.