Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Mar, 2025

By Yuvraj Singh and Beenish Bashir

Commonwealth Bank of Australia's shares are overvalued and could potentially decline by up to 23%, according to implied changes for Australia's biggest lenders based on analysts' price estimates compiled by S&P Global Market Intelligence.

National Australia Bank Ltd. and Westpac Banking Corp. could see a slight decrease in their share prices, while ANZ Group Holdings Ltd. is projected to have a potential upside of 4.7% to its price target, according to estimates from three or more analysts, as reported by Market Intelligence data.

"We note the market suggests that Commonwealth Bank of Australia (CBA)'s share prices are overvalued," said Nico De Lange, a banking analyst at S&P Global Ratings, in an email to Market Intelligence. Only 7.7% of analysts recommend a buy or overweight rating for CBA, Market Intelligence data showed.

Overpriced

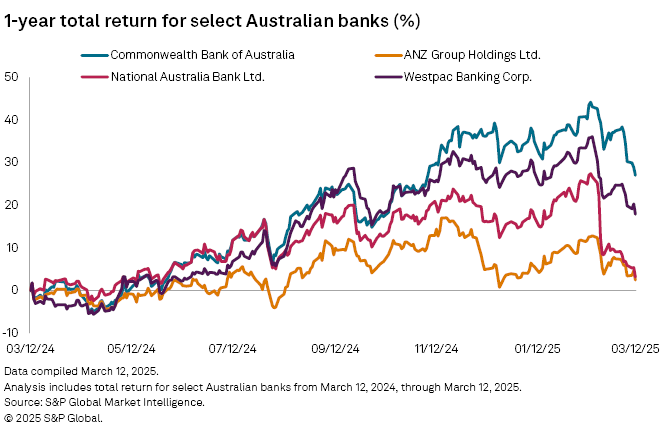

CBA, the country's biggest lender by assets, is one of the most expensive banks globally. The stock gives investors a 12-month total return of 27%, the highest among the big four Australian lenders.

CBA's total returns rose steadily in the past year to reach about 44% by mid-February before shares declined amid concerns that they were overpriced. The bank posted a modest 2% increase in its cash net profit to A$5.13 billion in the half year ended Dec. 31, 2024.

The bank's price-to-earnings ratio estimate for the next 12 months is the highest among peers at 23.4%. A higher P/E ratio suggests the stock is expensive compared to earnings.

Nothing fundamentally supports the premium valuation of CBA's shares, Matthew Wilson, an analyst at Jarden Research Division, told Market Intelligence in an email. "It is purely a function of passive flows into Australia."

Bearish outlook

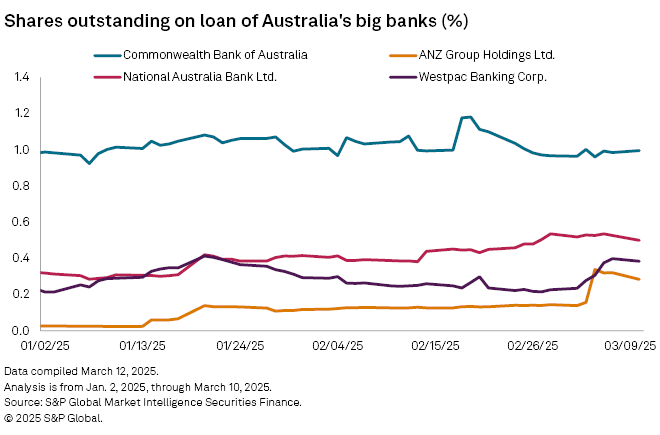

CBA remains the most-shorted bank among major Australian banks since the start of 2025, with about 1% of all its shares outstanding on loans, according to Market Intelligence data. Other major banks have less than 0.5% of their shares on loans, indicating a lower interest among short sellers.