Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Mar, 2025

By Iuri Struta

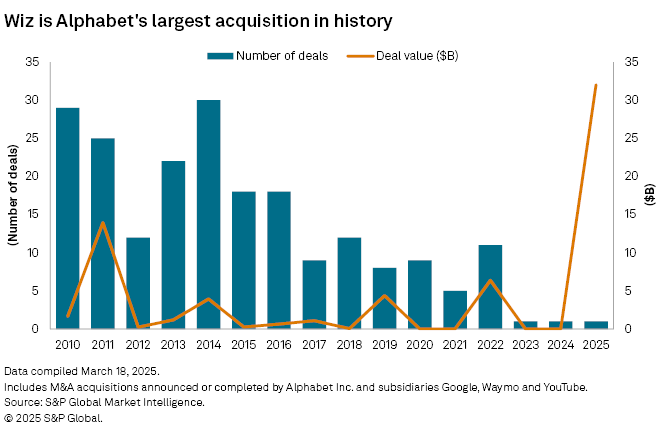

Alphabet Inc.'s $32 billion all-cash acquisition of cybersecurity startup Wiz Inc. is the first major Big Tech deal in more than three years, providing a key test of the current regulatory environment.

The acquisition, set to close in 2026, will integrate Wiz into Google Cloud. Alphabet said the deal will "accelerate two large and growing trends in the AI era: improved cloud security and the ability to use multiple clouds."

Alphabet previously tried and failed to buy Wiz in 2024 for about $23 billion. The higher valuation underscores the company's cybersecurity and cloud ambitions and signals a potential rebound in Big Tech M&A after years of muted activity due to high interest rates and regulatory scrutiny.

"We believe that this acquisition will open the door to a massive wave of M&A across the tech landscape … especially within cybersecurity, as more cloud operators look to secure their cloud portfolios," Wedbush Securities analyst Dan Ives said in a note.

By the numbers

If completed, Alphabet's acquisition of Wiz would be its largest deal, surpassing its $13.21 billion purchase of Motorola Mobility Holdings Inc. in 2011.

The deal would also expand Alphabet’s cybersecurity portfolio following its $5.54 billion acquisition of Mandiant Inc. in 2022.

"At a stroke, the largest deal ever in cybersecurity, assuming that this time it closes, elevates Google from an interesting also-ran in security operations. It moves from being augmented by one of the most respected names in incident response, Mandiant, to becoming a significant player in security for cloud-native applications,” said Scott Crawford, a cybersecurity analyst at S&P Global Market Intelligence 451 Research.

Google Cloud CEO Thomas Kurian said Wiz provides a cloud security platform that connects to all major clouds.

"With Wiz, we believe we will vastly improve how security is designed, operated and automated, providing an end-to-end security platform for customers to prevent, detect and respond to incidents across all major clouds and code environments," Kurian said during a March 18 call.

More clouds, more problems?

Wiz's multicloud approach is a key factor in its appeal but could create friction with Alphabet's cloud rivals, including Amazon.com Inc.'s AWS and Microsoft Corp.'s Azure. Much of the telemetry Wiz relies on originates from Amazon and Microsoft clouds, said Crawford.

"So what does that aspect of 'multicloud' mean not only for Google but for competitors — especially when this data has tangible value not lost on those contenders?" Crawford wrote.

Kurian sought to address those concerns, saying Wiz will remain independent until the deal closes. "After close, Wiz will maintain full support as a multicloud solution, continuing to partner with all major clouds, including AWS, Azure, Oracle and others," the Google Cloud CEO said.

Key test

Alphabet must first secure regulatory approval. Investment bankers have predicted that tech M&A is going to take off in 2025, citing a more lenient antitrust stance under the Trump administration.

Alphabet's dealmaking slowed in 2023 and 2024 as the Federal Trade Commission, led by Lina Khan, challenged acquisitions by major technology firms including Microsoft, Meta Platforms Inc. and NVIDIA Corp.

"In our view, with Lina Khan gone at the FTC … the M&A engines are back underway in Big Tech after a dark period," Wedbush's Dan Ives wrote.

However, FTC Chair Andrew Ferguson has signaled continued scrutiny of Big Tech.

"President Trump has taken … the big tech issue very seriously, dating back to his first administration," Ferguson said in a Bloomberg Technology interview posted March 17. He cited FTC cases against Google's search business and Meta that began during Trump's first term.

"We don't intend to take our foot off the gas," Ferguson added. "If you're a big tech company, you should be getting your lawyers to give you great advice on complying with our competition and consumer protection laws."