Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Feb, 2025

By Nick Lazzaro

|

US President Donald Trump signed an executive order on potential reciprocal tariffs in the Oval Office at the White House on Feb. 13, 2025. The order is one of many signed in the early days of Trump's second term related to trade policy and potential tariffs that may be enforced this year. |

Tariff uncertainty and trade relationship volatility are pressing US companies to scrutinize their supply chain options and carefully examine M&A opportunities to mitigate risk.

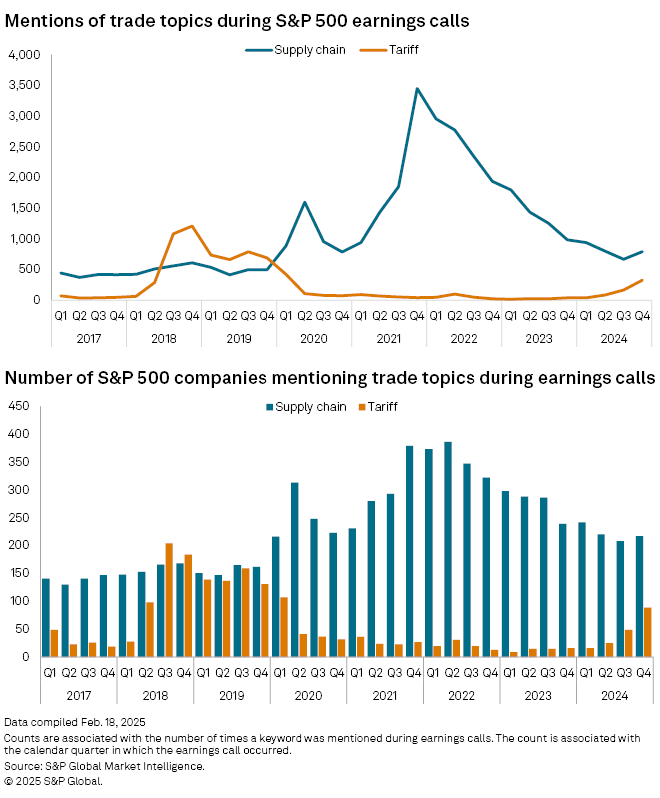

Discussion of tariffs during S&P 500 company earnings calls picked up in the fourth quarter of 2024 to 328 cumulative mentions by 89 companies from 165 mentions by 49 companies in the previous quarter, according to S&P Global Market Intelligence data. The chatter came as then-incoming President Donald Trump continued to reinforce his trade policy intentions. Trump has already moved to tax imports from China, Canada and Mexico; apply a universal duty on steel, aluminum, automotives, semiconductor chips and pharmaceuticals; and investigate reciprocal tariffs against countries with tariffs on US products.

Supply chain challenges more generally have elicited significantly greater attention from companies since the onset of the COVID-19 pandemic. S&P 500 companies mentioned supply chains over 3,000 times during earnings calls in the fourth quarter of 2021, and mentions have remained elevated compared to calls before 2020 as disruptions continue from shipping bottlenecks, geopolitical conflicts and extreme weather disruptions.

"One common theme that we're seeing with clients is that the preparation that predated any of these tariff announcements has been significant," said Robert Friedman, partner and co-head of the International Trade Practice at Holland & Knight, in an interview. "Many companies were caught more flat-footed during the first Trump administration when a lot of tariffs were rolled out. There wasn't the same level of focus on really understanding some of the basics."

Supply chain analysis tools, challenges

Supply chain analysis has become an immediate first-step strategy for companies with exposure to potential tariff policy. Stakeholders now have access to more refined software platforms and network design tools that enable advanced supply chain modeling, option and trade-off analysis, and detailed insights into the impact of price changes on demand, according to Scott Tillman, senior vice president of innovation at supply chain management solutions provider Logility.

"With COVID and other supply chain disruptions, companies have built resiliency into their supply chains more than what they have in the past because they realize the impact that external events can have … and we have better technology to deal with those types of incidents," Tillman said in an interview. "But I don't think we've ever seen tariffs at this scale either, so it's going to be interesting to see how the scale impacts what they're prepared for."

Careful analysis could assist companies with making difficult decisions in shifting product sourcing to other countries, onshoring operations within the US, or determining how costs should be absorbed or passed on to customers.

Specific solutions will be more feasible for some sectors than others. For instance, certain manufacturers may more readily be able to onshore operations in the US, while the agricultural sector may have limited options for domestically growing certain products in the US, Tillman said.

Even within sectors, companies have moved at varying paces since 2020 to adopt new strategies, which will affect their competitive positioning as they respond to new trade policy developments.

"[Companies will need to consider] how they are going to sustain cost competitiveness against somebody who might have already moved substantial operations to India or Southeast Asia," said Matt Lekstutis, director at procurement and supply chain consultancy Efficio, in an interview. "On the other hand, if you are one of those companies that's advantaged, how are you going to use that aggressively to try to take market share and go after market positioning?"

Companies with long-term business relationships in a country may also face unique hurdles, such as obtaining intellectual property rights, when considering options to move supply chains to other regions.

"If you have outsourced or moved a fair amount of your production to one of these regions, say in China, do they do the design and engineering of the products or subcomponents that are coming to you? Are they investing in the tooling that's used? If they are, that limits your optionality," Lekstutis said. "Getting control of that intellectual property has been one of the keys to creating second supply options to create more flexibility."

Tariff-influenced M&A

Rather than shuffle supply chains, foreign stakeholders may view potential M&A opportunities with US-based targets as a more efficient approach.

The automotive, energy and manufacturing industries may be most likely to view M&A as an effective strategy, said Mark Williams, Americas chief revenue officer for dealmaking platform Datasite, in an email.

Furthermore, interest in M&A could be initiated by either US or foreign companies, although companies from countries that are considered geopolitical adversaries, such as China, may face political and regulatory roadblocks if their US acquisition targets are involved in technology, defense, energy, healthcare or other sensitive industries, Williams said.

"Some global firms will look to establish or purchase domestic operations to avoid tariffs, potentially spurring cross- border M&A activity," Williams said. " Additionally, to mitigate risks from tariffs and geopolitical tensions, some US businesses might acquire foreign suppliers or manufacturers in tariff-exempt regions, ensuring more stable and cost-effective supply chains."

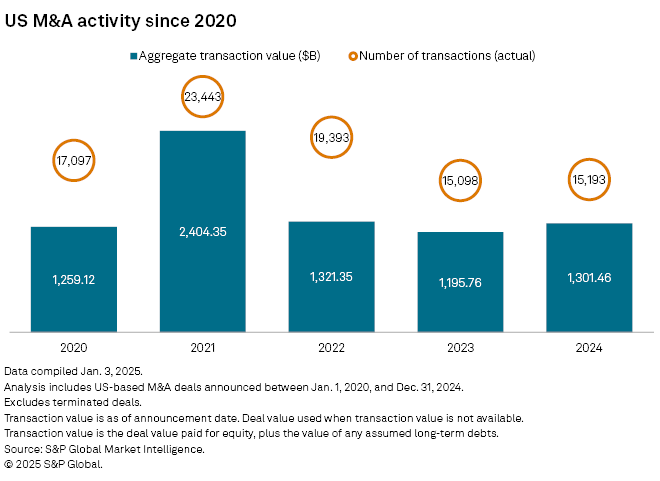

US M&A activity improved by the end of 2024 after a slowdown that began in 2022. There were nearly 15,200 M&A transactions in the US with an aggregate value of $1.301 trillion in 2024. While transactions were up slightly from 2023, aggregate value rose almost 9% on the year.

"If you were on the fence about doing a joint venture between one of your key suppliers and a US company to onshore some manufacturing or some aspects of the supply chain, I think those conversations have been accelerated," Friedman with Holland & Knight said.