Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Feb, 2025

By Robert Clark and Xylex Mangulabnan

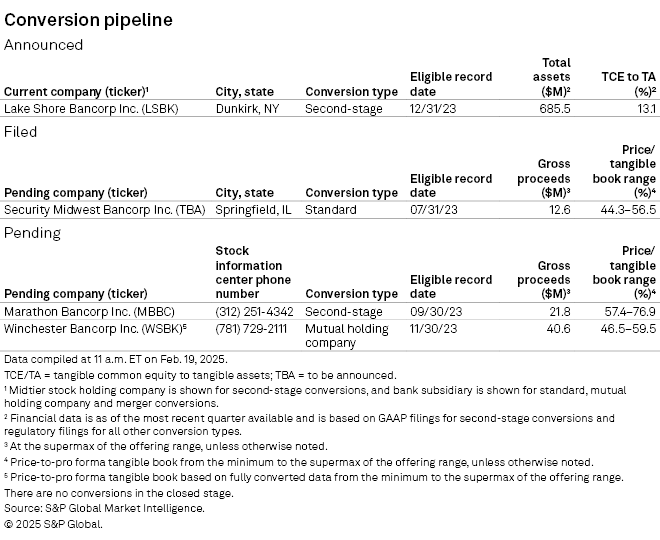

This feature has the latest news from the mutual bank conversion sector. As of Feb. 19, four conversions were in the pipeline.

Dunkirk, New York-based Lake Shore MHC adopted a plan of second-stage conversion. Lake Shore Bancorp Inc. is the midtier stock holding company, and Lake Shore Savings Bank is the subsidiary banking institution in the corporate structure. The Tier 1 date for depositors is Dec. 31, 2023.

Metairie, Louisiana-based Magnolia Bancorp Inc. priced its mutual-to-stock conversion at the maximum of the offering range. Shares began trading Jan. 15, closing up 11.2% from the $10 offering price.

The SEC approved the registration statements for Winchester, Massachusetts-based Winchester Bancorp Inc. and Wausau, Wisconsin-based Marathon Bancorp Inc. Winchester's mutual holding company conversion offering expires March 18, while Marathon's second-stage conversion offering closes March 21.

On Sept. 12, 2024, Security Midwest Bancorp Inc., the proposed holding company for Springfield, Illinois-based Security Bank SB, filed a registration statement for a standard conversion.

In the filing, the company said it implemented a cannabis-related business (CRB) program in 2018, offering deposit and cash-management services to licensed cannabis-related businesses, adding that it currently offers depository accounts to customers operating licensed cannabis businesses in Illinois, Michigan and Ohio. In December 2022, Security Bank initiated lending to cannabis organizations and their associated real estate entities.

As of June 30, 2024, Security Bank held $54.8 million of deposits from CRB customers, representing roughly 27% of total deposits, as well as $20.3 million of loans to CRB customers and associated real estate entities, comprising about 19% of total loans. One individual customer accounted for just over half of the CRB deposits. Additionally, fee income related to CRB deposit accounts made up more than 50% of total noninterest income during the 18 months ended June 30.

The company said in the filing that it intends to grow the CRB program "modestly."

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

Titan Bank tops 2024 best deposit franchises among small US community banks

OCC gives 2 banks 'needs to improve' Community Reinvestment Act ratings

Massachusetts-based Cornerstone Bank merges with PeoplesBank

NSTS Bancorp receives noncompliance confirmation from Nasdaq

Eastern Bankshares to reposition $1.2B investment portfolio at a loss

William Penn picked Mid Penn's deal proposal despite higher competing offer

Failed Illinois-based bank attracted 4 in-state peers

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.