S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Feb, 2025

By Karl Angelo Vidal and Neel Hiteshbhai Bharucha

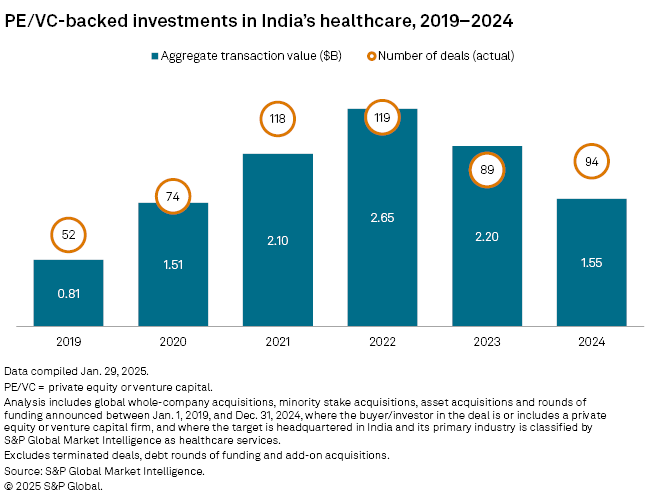

In 2024, the aggregate value of private equity and venture capital investment in India's healthcare sector fell to the lowest level since 2020.

Total transaction value in the sector stood at $1.55 billion, down 29.5% from $2.20 billion in 2023, according to S&P Global Market Intelligence data.

Total deal count was 94 for the year, up slightly from 89 in 2023.

Even with the decline in investment, India's healthcare companies remain attractive to investors due to the significant gap between the demand for healthcare and available facilities, said Sunil Thakur, partner at healthcare-focused private equity firm Quadria Capital Investment Management Pte Ltd. Quadria backs India-based healthcare companies Phasorz Technologies Private Ltd. and Nephrocare Health Services Pvt. Ltd.

Consumption of healthcare services is increasing for people who can afford them, while the government's universal healthcare program is supporting those who cannot, Thakur said.

"There is a shortage of healthcare infrastructure," Thakur told Market Intelligence. "The demand-supply gap is so huge that for the next decade, you will see this kind of growth and attraction both from strategic and financial sponsors."

Thakur forecasts investments in the sector to maintain momentum, with subsectors such as diagnostics, pharmaceutical outsourcing and medical devices standing out.

– Download a spreadsheet with data featured in this story.

– Read about global private equity entries in January.

– Catch up on private equity investment in advanced nuclear companies.

Healthcare investment down in Asia

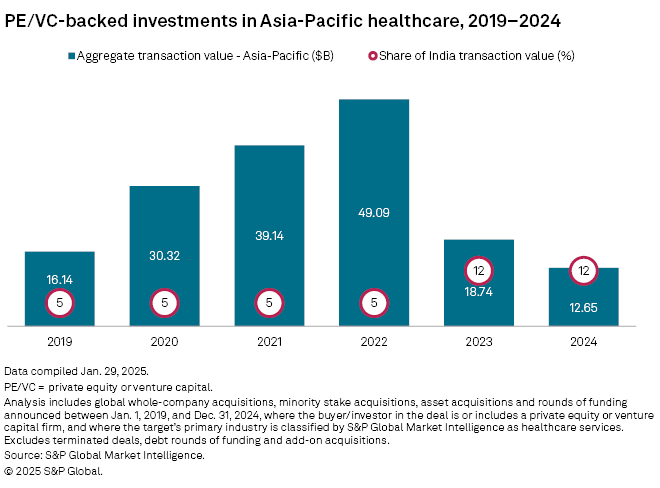

Private investment in India's healthcare market follows the general trend across Asia, which has also seen a two-year slide in deal value. In 2024, investment fell to $12.65 billion from $18.74 billion the previous year, driven by a 47% decrease in healthcare deals in China to $5.73 billion.

With its strong economic growth and expanding middle class fueling demand for healthcare, India is emerging as "a compelling alternative to China for dealmaking," according to a report from Bain & Co.

The report also cited India's dynamic capital markets and Advent International LP's $1.6 billion sale of Bharat Serums and Vaccines Ltd. to Mankind Pharma Ltd. in 2024 as an exit "with strong returns," underscoring the country's attraction to investors.

Largest healthcare deals in India

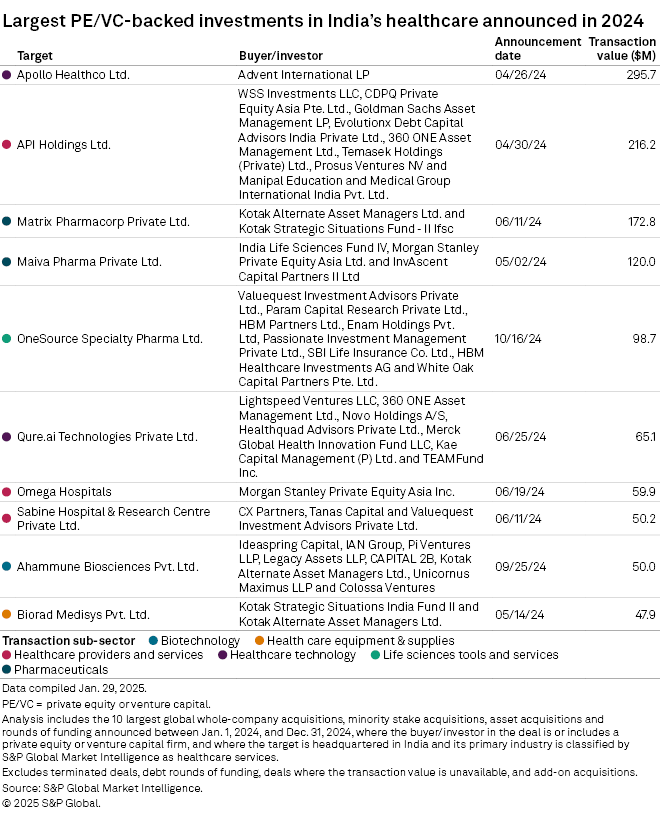

In the largest private equity-backed transaction in India's healthcare sector, Advent International LP invested $295.7 million in Apollo Hospitals Enterprise Ltd. subsidiary Apollo Healthco Ltd.

The second-largest deal was a $216.2 million funding round for pharmaceutical and cosmetic products distributor API Holdings Ltd. Prosus Ventures NV and Temasek Holdings (Pvt.) Ltd. participated in the round.

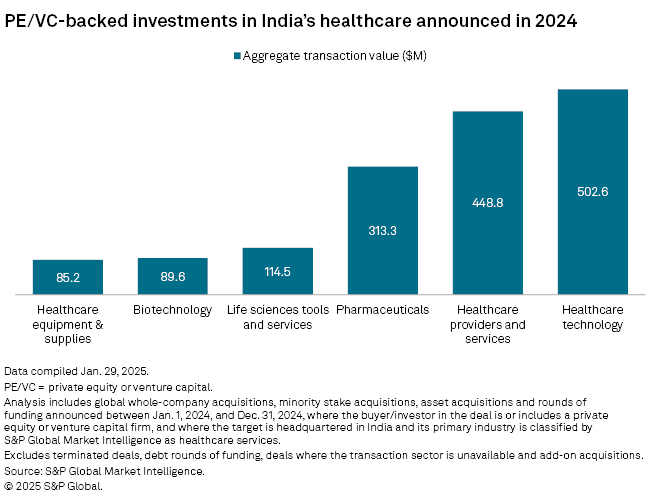

Within healthcare subsectors, healthcare technology secured the largest private equity-backed funding in 2024 with $502.6 million. Healthcare providers and services followed with $448.8 million.