S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

06 Feb, 2025

By Rica Dela Cruz

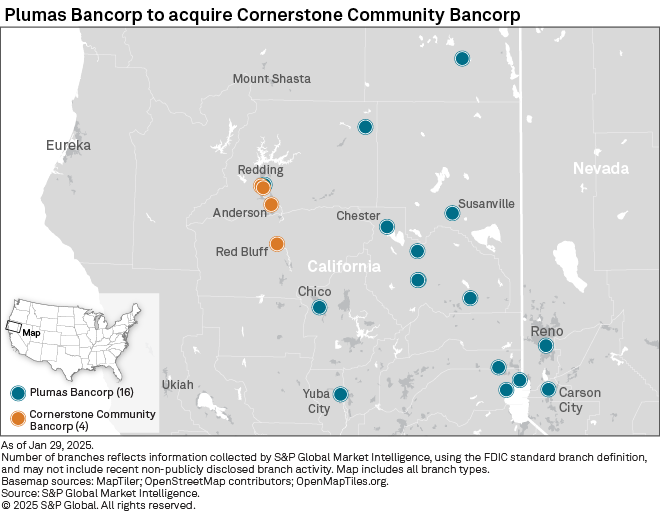

Plumas Bancorp is hoping to gain a stronger footprint in northern California, particularly in the north part of the Sacramento Valley, through its planned acquisition of Cornerstone Community Bancorp for $64.6 million.

California-based Cornerstone has its headquarters in Red Bluff, two banking offices in Redding and one branch in Anderson. Plumas also operates a branch in Redding and another in Chico, which is south of Red Bluff.

"As soon as the deal is approved and we close, it's going to really strengthen our footprint in the north part of the Sacramento Valley," President and CEO Andrew Ryback said in an interview. "[It] really kind of connects the dots for us."

Upon closing, the combined company will operate 19 branches across northern California and western Nevada, according to a news release. Plumas will expand in Shasta County, adding three branches that would rank the company fourth in deposit market share in the county on a pro forma basis, and enter Tehama County with one branch that ranks first in deposit market share in the county, S&P Global Market Intelligence data showed.

When asked if Plumas, based in Reno, Nevada, was specifically seeking a California-based bank, Ryback said the only community banks within the company's footprint are in the northern Sacramento Valley.

"There's only three banks that are potential combination partners in that similar geographic area, [with] Cornerstone being the best-performer of that group," Ryback said. "If there was a community bank in northern Nevada, sure, we'd definitely have an interest, but there isn't."

Deal rationale

One factor driving the deal was Ryback's long-standing familiarity and strong relationship with Cornerstone.

"I had always expressed an interest, and it ended up being the right time for them, right time for us," the executive said, adding that the companies had been close to reaching a deal in the past.

The deal announcement came on the same day Cornerstone reported a net loss for full year 2024, driven by a credit quality issue. In the third quarter of 2024, Cornerstone charged off three agricultural loans totaling $9.4 million because of the borrower's deteriorating financial condition. Despite the charge-off, Cornerstone said in its earnings release that it was well positioned to generate

Ryback sees opportunities to improve the Cornerstone franchise, noting its "strength has come more from the asset side" of the balance sheet, while it has struggled more on the funding side, Ryback said.

In the fourth quarter of 2024, Plumas' cost of interest-bearing deposits was 1.10%, well below those of its peers despite a 13-basis-point increase quarter over quarter. Interest-bearing deposits comprised about half of Plumas' total deposits and about 85% of Cornerstone's total deposits at year-end 2024, according to Market Intelligence data.

"[Cornerstone has] some brokered deposits and some other borrowings. We have a much stronger liability side of our balance sheet. So I think the combination of the two entities makes a lot of sense," Ryback said.

M&A outlook

The deal will result in Plumas having roughly $2.3 billion in assets, $2.0 billion in deposits and $1.5 billion in loans.

After completing the transaction, conversions and integration, Plumas will again consider growth opportunities, such as purchasing branches from other institutions, opening a branch in a new community or acquiring another bank, Ryback said. The attractive markets for Plumas, aside from Northern California, are Oregon and Nevada, he added.

Ryback hopes some regulatory burdens will be reduced under the new administration, making the M&A process smoother for small banks.

"Some of the new regulations that are flowing to banks will be curtailed or reduced, and those are all positives for the bank to continue to perform," he said.