S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

06 Feb, 2025

By Garrett Hering, Nushin Huq, Noah Schwartz, and Susan Dlin

Gigawatts of clean power, billions of dollars of investment and thousands of jobs are in jeopardy after President Donald Trump sent shock waves across the nascent US offshore wind industry by halting federal leasing on the Outer Continental Shelf and pausing permits for both offshore and onshore wind.

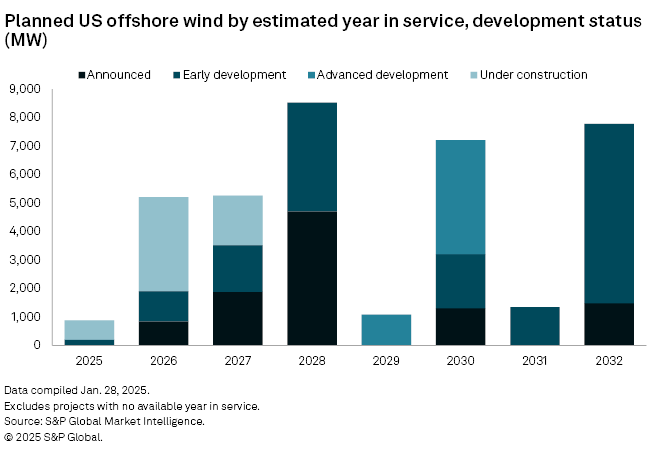

More than 37 GW of US offshore wind capacity is planned to come online by 2032, according to S&P Global Market Intelligence data. That includes nearly 5.7 GW under construction, 5.1 GW in advanced development, 16.3 GW in early development and another 10.2 GW of announced capacity.

The Biden administration had a goal of deploying 30 GW of offshore wind by 2030 and stoked broad private-sector interest, especially from European developers experienced with the technology, by opening up federal waters and offering valuable tax incentives in the 2022 Inflation Reduction Act. However, it is unclear how much development will remain afloat in the wake of Trump's Jan. 20 executive order to temporarily freeze leasing and new permits, pending a review by the secretary of the interior and the attorney general.

Even approved projects are in legal limbo, and some industry participants, including British oil major Shell PLC, are placing major investments on ice amid widespread uncertainty over the future of US offshore wind development.

"The ultimate scope and specific criteria of the planned review are not yet clear because there is some ambiguity regarding which offshore wind projects could be subject to additional federal review and scrutiny," Moody's analysts said in a Feb. 4 report.

Trump's order and his administration's "skeptical posture" toward offshore wind in general is "credit negative" for developers that have been most active building projects, the rating agency said, pointing to US utilities Dominion Energy Inc. and Eversource Energy, Denmark's Ørsted A/S, and Avangrid Inc., a subsidiary of Spain-based Iberdrola SA.

Those companies have "varying degrees of exposure" to the new risk landscape, Moody's said, adding that Eversource has the least risk among the four after divesting all of its offshore wind ownership interests in September 2024.

'Important source of electricity'

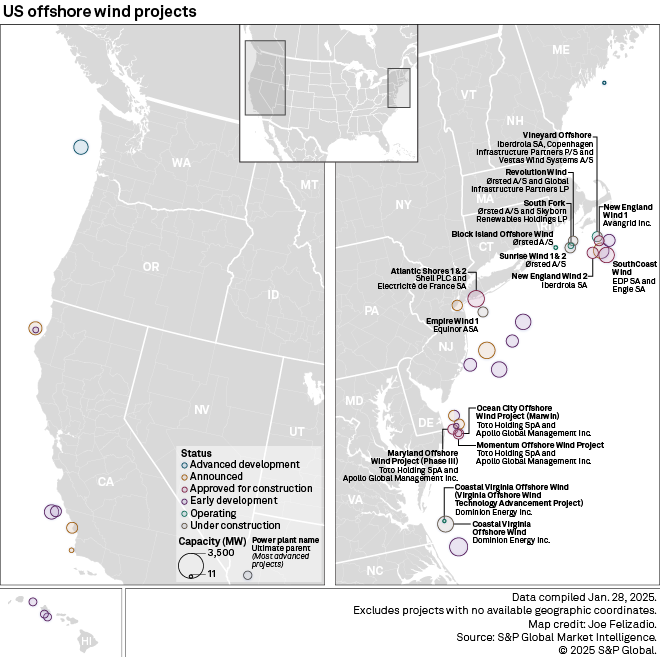

Dominion's nearly 2.6-GW Coastal Virginia Offshore Wind project is the largest such facility currently arising in US waters. A two-turbine 12-MW pilot project adjacent to the 176-turbine utility-scale facility, about 27 miles off the coast of Virginia Beach, Virginia, has been operational since 2020.

The utility on Feb. 3 raised the project's price tag by $900 million to $10.7 billion, citing higher grid upgrade costs. Private equity firm Stonepeak Partners LP, which in October 2024 agreed to purchase a 50% noncontrolling stake in the facility, will fund about $450 million of the cost increase.

Rising costs "will require incremental debt issuance and could increase political and regulatory scrutiny," Moody's said.

The project, which remains on track for completion in 2026, has enjoyed political support in Virginia, where it is providing about 1,000 jobs and "will be an important source of electricity for northern Virginia, the world's largest datacenter market," the ratings agency added.

Avangrid's 806-MW Vineyard Offshore Wind Project off the coast of Nantucket, Massachusetts, the first utility-scale offshore wind project to receive US federal approval, began delivering power to the grid in January 2024. However, in July 2024, an operational failure caused a turbine to shatter.

At the time, Rep. Jeff Van Drew (R-NJ) pointed to the incident as a reason to halt offshore wind development. Van Drew would later draft President Trump's executive order freezing offshore wind lease sales.

On Jan. 17, days before Trump took office, the US Bureau of Ocean Energy Management approved Vineyard Wind's revised construction and operations plan. The Bureau of Safety and Environmental Enforcement lifted its suspension order the same day.

The project has long-term power purchase agreements with several Massachusetts utilities starting in May.

Navigating turbulent waters

Also under construction are two Ørsted projects: the 704-MW Revolution Wind Offshore project off the coast of Rhode Island and the 924-MW Sunrise Wind project off the coast of New York. Both projects have experienced construction delays and cost overruns, resulting in major impairment charges.

Ørsted, however, remains "committed to the US market in the long term with its potential for renewables to meet the growing electricity demand and create thousands of industrial jobs across the US," former CEO Mads Nipper said Jan. 21 on a call with analysts. Nipper was replaced as Ørsted CEO on Feb. 1 by long-time insider Rasmus Errboe after four years in charge.

The Danish company has been a key player in kickstarting US offshore wind. In 2016, its 29-MW Block Island Offshore Wind off the coast of Rhode Island became the nation's first operational project. The developer's 132-MW South Fork Offshore Wind Project off the coast of Long Island, New York, began producing power in late 2023, touted as the first US utility-scale offshore wind farm.

Norwegian oil and gas giant Equinor ASA, which in January closed a $3 billion financing package for its 810-MW Empire Wind 1 project off the coast of New York, is committed to completing that facility despite "a challenging market with returns under pressure and uncertainty," CEO Anders Opedal told analysts Feb. 5.

However, some market participants believe Trump's executive order has closed the door to further development.

The US offshore wind market "has come to a stop, more or less with immediate effect," Vestas Wind Systems A/S CEO Henrik Andersen told investment analysts on a Feb. 5 earnings call.

Development was already facing headwinds before Trump returned to the White House, Andersen said, citing a lack of visibility on auctions on the East Coast.

Vestas is supplying turbines for Equinor's Empire Wind project and the 1.5-GW Atlantic Shores Project 1, part of a roughly 5-GW complex being developed off the New Jersey coast by Atlantic Shores Offshore Wind LLC, a joint venture of Shell and Electricité de France SA. Both the first phase and a 1.3-GW second phase were approved for construction in October 2024.

The Atlantic Shores development team said on Jan. 30 that they are "committed to New Jersey and delivering the Garden State's first offshore wind project," but state utility regulators on Feb. 3 decided not to award a contract in its latest solicitation.

"New Jersey's decision today to cancel its offshore wind procurement is a direct consequence of the uncertainty created by the recently issued executive order," Jason Grumet, CEO of the American Clean Power Association, said in response to the action. "Each offshore wind project represents a multibillion-dollar investment in American infrastructure."

Liz Burdock, CEO of nonprofit group Oceantic Network, said the decision was "not surprising given political headwinds and the uncertainty across the US economy driven by recent federal actions."

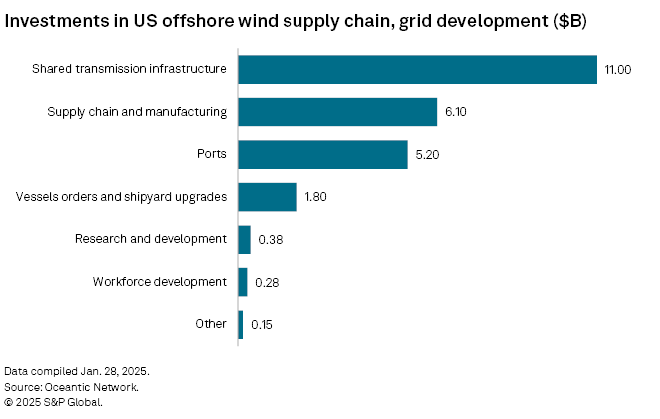

The group recently released a report highlighting $25 billion in supply chain and grid investments to support offshore wind, with nearly two-thirds of that flowing into Republican districts.

'California will continue to move forward'

Ocean Winds North America, a joint venture of French utility Engie SA and Portugal-based EDP SA, is developing the 2.4-GW SouthCoast Wind project off the coast of Massachusetts. The US Bureau of Ocean Energy Management (BOEM) approved a construction and operations plan for the project on Jan. 17.

Ocean Winds is also developing the 2.4-GW Bluepoint Offshore Wind Plant off the coast of New Jersey and the 2-GW Golden State Offshore Wind Project off the Central California coast.

"We're very much focused on quality growth and delivery and execution," Craig Windram, CEO of affiliate Ocean Winds SL, said in a recent interview with S&P Global Commodity Insights. "One of the things we don't tend to do is build up portfolio pipelines for the sake of capacity or gigawatts."

Adam Stern, executive director of industry group Offshore Wind California, says development of floating facilities in the Golden State will continue.

"As an industry, we're focused on what is advancing offshore wind in California," Stern told Commodity Insights. "And right now, most of that is happening at the state level."

After BOEM in 2023 executed leases for five areas in the deep coastal waters off California's coast, the California ISO last year approved a transmission plan that included $4.6 billion for infrastructure related to North Coast offshore wind development.

In addition, voters in November 2024 approved a $10 billion climate bond that included $475 million to upgrade ports for offshore wind. The California Energy Commission in July 2024 adopted a strategic plan, with goals of deploying up to 5 GW of offshore wind by 2030 and 25 GW by 2045.

"California will continue to move forward in developing offshore wind," Stern said.