Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Feb, 2025

By Nick Lazzaro

|

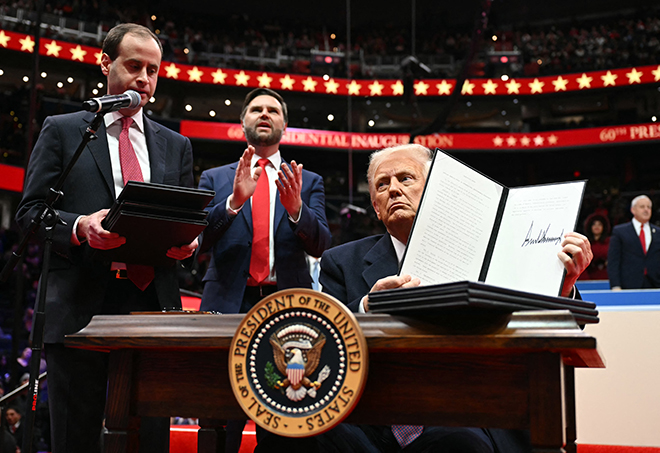

US President Donald Trump holds an executive order announcing the US withdrawal from the Paris Agreement on climate change during an inauguration event Jan. 20, 2025. |

Companies and their investors are persisting with net-zero and other climate targets despite mounting political opposition, though they are quieter about it.

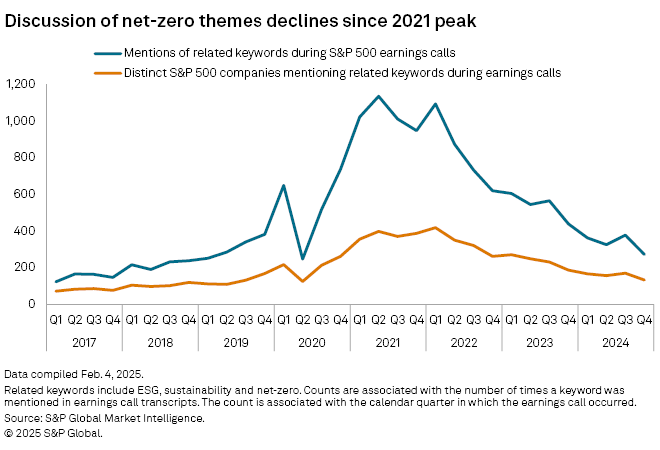

Mentions of climate-related topics during S&P 500 earnings calls hit a four-year low in 2024 after spiking during former President Joe Biden's administration, according to S&P Global Market Intelligence data. During the peak in the second quarter of 2021, 400 companies mentioned terms including environmental, social and governance, sustainability and net-zero a total of over 1,100 times. That dropped to 272 mentions by 133 companies in the fourth quarter of 2024.

While the run-up came as businesses anticipated new climate-focused legislation from Biden, the recent dip coincided with growing pushback against climate-friendly investing and legislation at the US state level and by President Donald Trump. Still, while corporate talk of sustainability has dropped considerably, this likely does not signal companies' lack of commitment to their sustainability goals.

"In 2022, we started to see individual states discourage the private sector from prioritizing anything other than financial returns for state pension funds and the like," Megan Ridley-Kaye, a partner in the corporate and finance practice at Hogan Lovells, said in an interview. "By 2024, ESG had become a less prominent part of the US corporate discourse, even though many of its principles remain important to the identity of US companies. Often these are rebranded as 'sustainability,' or something less charged than those three letters."

US political shifts

In January, Trump signed a slew of executive orders intended to undermine or reverse climate- and energy-related mandates from the Biden administration. Meanwhile, lawmakers in 18 US states have either introduced or pre-filed nearly 50 bills targeting ESG investment criteria since the 2025 legislative session began, according to the consulting firm Pleiades Strategy.

These moves reflect an ideological shift that could sway popular opinion on issues such as climate and energy transition, similar to companies backing out of diversity, equity and inclusion initiatives alongside Trump's moves to eliminate DEI programs in the federal workforce. Some analysts believe, for instance, that the US' withdrawal from the United Nations Paris Agreement on climate change under Trump may slow green bond sales in the US.

But for climate policy, there may be a disconnect between a company's public posturing and actual commitment toward targets and coalitions.

"There is perhaps a mixed bag even within the same company or sector," Jamison Friedland, sustainability analyst at AXA Investment Managers, said in an email. "For example, even after the major US and Canadian banks decided to leave the Net-Zero Banking Alliance, most reiterated statements emphasizing their continued dedication to achieving net-zero targets or supporting customers' transitions to a low-carbon economy."

Refining climate investment approach

Initial enthusiasm for ambitious corporate climate agendas has likely shifted to strategy recalibrations with more realistic targets since 2022.

"While initial targets may have been overly broad and sometimes didn't have a visible pathway for achievement, as companies continue to get better data, and recognize what data still relies primarily on broad estimates, this has allowed entities to be more precise in steps available based on existing technology and measurement capabilities," Friedland said.

Investor sentiment is following a similar path as engagement with climate-conscious finance becomes more nuanced and balanced with overall investment strategy, according to Ruth Knox, a partner and global co-chair of the ESG and sustainable finance practice at Paul Hastings LLP.

"There has been phenomenal ambition and energy around this topic, but often, when you are advising general partners ... the level of ambition isn't always matched by deep thought on what is possible and what is practically achievable for general partners that are having to juggle different objectives simultaneously," Knox said. "I would expect that in this new environment we're entering, there will be significantly more analysis done at the investor level about how to achieve good outcomes and also how to define what good looks like."

Many companies have sought to modify net-zero programs to align with international standards set by bodies such as the multiorganization-backed Science Based Targets initiative, which in 2021 established a framework to achieve the Paris Agreement's goals of reducing emissions and limiting global temperature increases by 2050. More than 7,000 global companies have Science Based Targets initiative-approved climate plans, and over 3,700 companies have validated net-zero commitments.

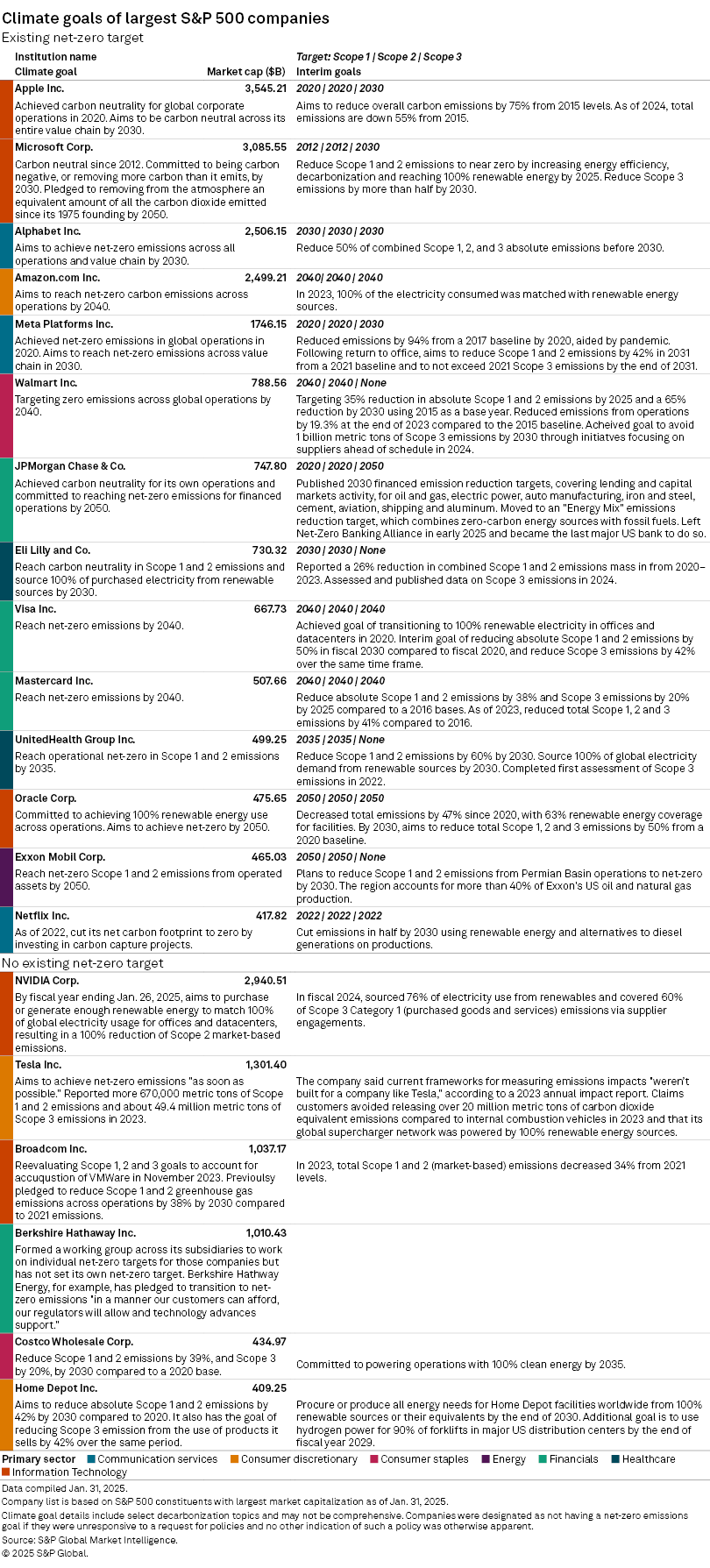

Some of the S&P 500's largest companies — such as Apple Inc., Microsoft Corp. and Meta Platforms Inc. — have already achieved net-zero status for their Scope 1 and 2 emissions, while companies such as Alphabet Inc. and Walmart Inc. have plans to reach this milestone at different points over the next 15 years. Meanwhile, NVIDIA Corp. and others have climate plans in place but have not yet set net-zero targets.

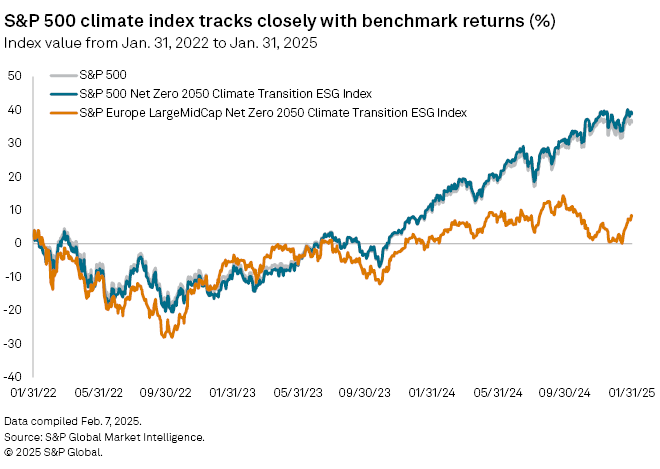

The S&P 500 and one of its climate-oriented counterparts, the S&P 500 Net Zero 2050 Climate Transition ESG Index, have posted similar returns, with respective 36.30% and 38.79% gains over a three-year period to Jan. 31, 2025. The net-zero index includes 352 of the S&P 500's constituents that have climate transition plans aligned with the Paris Agreement.

Climate ingrained in investment strategy

Regardless of political influence, climate considerations continue to play a role in financing strategy as investors acknowledge climate's impact on asset values, infrastructure, supply chains and economic productivity, thus holding corporations accountable for maintaining quality sustainability programs.

"There is high likelihood that prolonged ignorance of physical climate risks can translate into a financial shock type of black swan event. Investors and risk managers must swiftly act in tandem to factor in such risks," Achin Bhati, head of ESG and associate director of investment research at Acuity Knowledge Partners, said in an email.

The awareness for climate risk mitigation has only increased with the rising frequency of extreme climate events — such as the Southern California wildfires in January and flooding in southeastern US states caused by Hurricane Helene in 2024 — that could trigger asset value erosion and economic disruptions, Bhati said.

Investors are also monitoring long-term trends, such as the electrification of the power grid to support AI and datacenter investments, that transcend shorter-term politics.

"Investors are still keen on energy transition assets on the basis that, in the long term, that's where the world is heading," said Ridley-Kaye of Hogan Lovells. "Even though there might be some additional regulatory obstacles in the next few years, many investors still consider energy transition a good long-term investment because of the strong fundamentals supporting it."