Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Feb, 2025

By Karl Angelo Vidal and Shambhavi Gupta

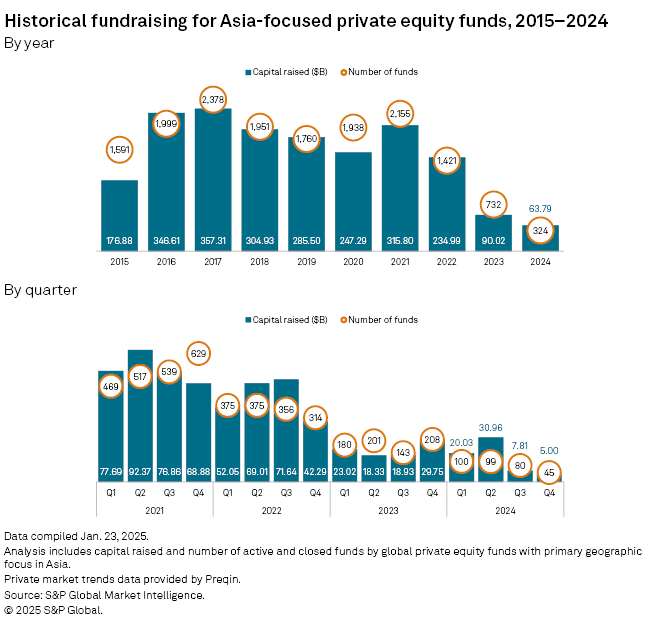

Asia-focused private equity and venture capital fundraising fell to a 12-year low in 2024 amid ongoing trade tensions between the US and China.

Funds targeting the region secured a combined $63.79 billion in 2024, the lowest total since 2012 and down 29% compared with the $90.02 billion raised in 2023, according to S&P Global Market Intelligence data.

Only $5 billion was raised in the final three months of 2024, a significant reduction from the $29.75 billion raised in the same quarter of 2023.

The number of Asia-focused funds in the market also dropped year over year to 324 from 732.

– Download a spreadsheet with data in this story.

– Read about global private equity fundraising in 2024.

– Explore more private equity coverage.

The China factor

Ongoing trade tensions between Washington and Beijing, the region's exit environment, and a US government executive order prohibiting outbound investments in sectors in China including AI and specific semiconductors, are dampening investor interest in Asia, said Siew Kam Boon, head of private equity practice in Asia-Pacific at Hogan Lovells.

Ricardo Felix, partner and head of Asia-Pacific at placement firm Asante Capital, said most of the capital previously intended for China has likely been redirected back to home bases, primarily in the US, while some has been allocated to other Asian markets such as India and Japan, where private equity deals are soaring.

US pension funds hesitate to invest in Asia-Pacific opportunities because the political or macroeconomic risk does not pay a satisfactory return premium, Felix said.

"I'm not seeing that [return premium] on a historic basis. Unless I have a defined bucket to deploy into Asia-Pacific, I might have to stay in my backyard."

Biggest funds

Broad macroeconomic uncertainty pushed investors to place their capital with large, familiar private equity names.

"People are still backing large managers like KKR, CVC and Bain," said Thomas Kim, partner at Hogan Lovells. "We are also seeing that first-time managers who are trying to raise the first PE fund are struggling a little bit just because of the general uncertainty in the market."

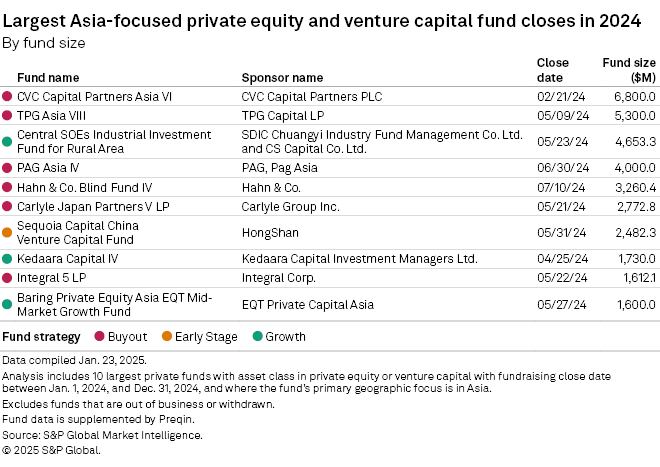

Fifteen Asia-focused private equity funds raised at least $1 billion at their final close, accounting for 63% of all capital raised by Asia-focused vehicles in 2024.

CVC Capital Partners Asia's CVC Capital Partners Asia VI was the largest fund to close in 2024, with $6.8 billion at the final close. TPG Asia Inc.'s TPG Asia VIII fund, which raised $5.3 billion, was the second largest.

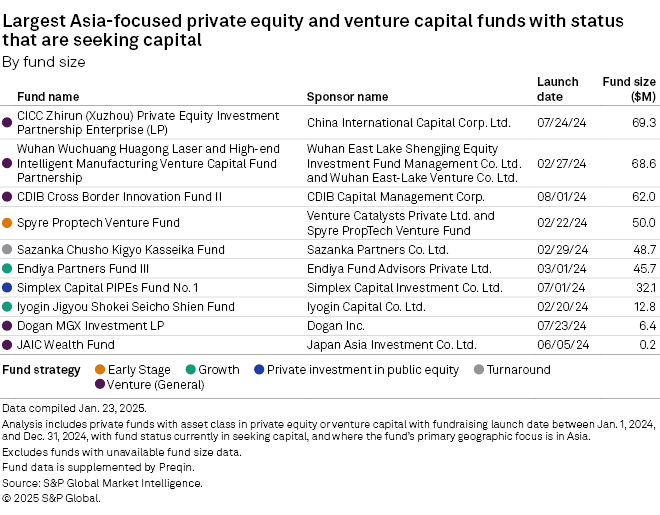

The largest fund in market is managed by China International Capital Corp. Ltd., which has pulled in $69.3 million for the CICC Zhirun (Xuzhou) Private Equity Investment Partnership Enterprise (LP) fund.

Fundraising recovery expected

Hogan Lovells' Boon expects Asia-focused private equity fundraising to recover in 2025.

"In the North Asia region, investors have been adapting to the environment in China in the last couple of years," Boon said. "On the investment level, they are looking at whether there are trends within the Chinese space, whether it be retail or technology, in response to the way the world is moving."

Asante's Felix said investors across Asia will likely support domestic or regional players raising capital.

"There's support in Thailand from institutions for Southeast Asia exposure. The same goes for Singapore and Malaysia. If anything, there's been a sort of a national surge in domestic institutions backing domestic players," Felix said.