Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Jan, 2025

By Nick Lazzaro

|

Specialty retailer Williams-Sonoma Inc. is one of the largest companies by market capitalization currently included in the S&P MidCap 400, a benchmark index for midsize companies. Investments in midcap stocks could increasingly provide hedging and diversification opportunities in 2025 amid concerns over historically high large-cap and megacap stock valuations. |

Midcap stocks may attract more attention in 2025 as investors seek hedges and diversification against high valuations among large-cap equities.

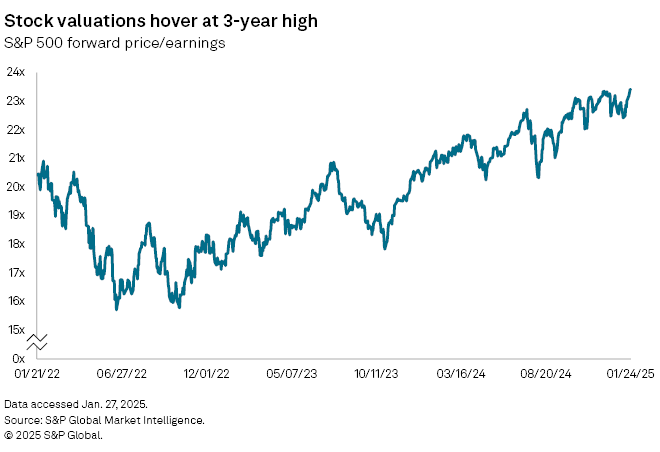

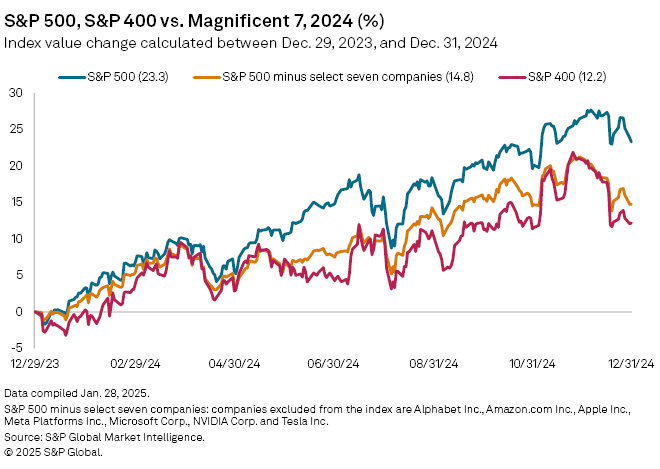

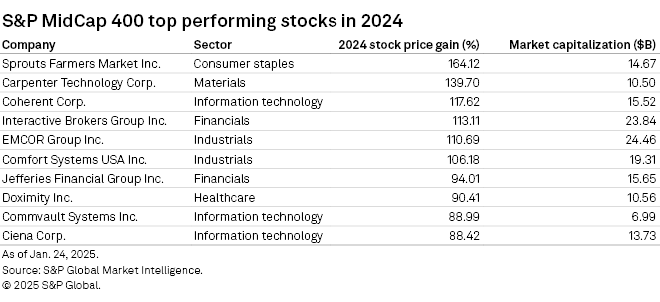

Driven by AI-focused optimism, the large-cap S&P 500 surged 23.3% in 2024, outpacing the 12.2% gain in the S&P MidCap 400, a benchmark stock index for midsize companies with an average market capitalization of about $7.71 billion. The S&P 500's price at the end of 2024 was valued at 22.6 times forward earnings, compared to just over 17 for the S&P 400. These forward price-to-earnings ratios, a key measure of valuation, have since risen to 23.41 and 17.97, respectively, as of Jan. 24.

These historically high valuations, especially for the market-driving, megacap "Magnificent Seven" stocks within the S&P 500, are casting some concern over otherwise optimistic views of another big year for large-cap equities. In contrast, the lower relative valuations of midcap stocks may offer more stability if high-valuation stocks stumble and cause market volatility.

"People want to be part of this AI boom and the growth rates that we're seeing in these megacap companies, but they're also exposing themselves to a significant amount of risk if they're not diversifying portfolios and including exposure to midcap or small-cap companies," Tyra Pratt, portfolio manager for Jensen Investment Management, said in an interview.

AI optimism exposed to market overreaction

After over two years of bullish returns for the Magnificent Seven— Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp., NVIDIA Corp. and Tesla Inc.— and other companies exposed to AI trends, many analysts believe high-valuation stocks are now priced to perfection.

At the current prices, even small setbacks could slow growth for these companies or trigger an exaggerated bearish market reaction. This was evident when technology stocks plunged Jan. 27 after China-based DeepSeek launched a free AI assistant, allegedly at a fraction of the cost of other existing models, to rival those offered by US companies. Leading AI chipmaker NVIDIA fell nearly 17% on the day alongside a nearly 1.5% drawdown in the S&P 500.

"The growth may still be great, but if it's slowing even a little bit, or even in an earnings call if you get a hint that something is not perfect — because right now they're priced for perfection — it's bad news about good news that would undo a lot of perfection and could bring things down quite rapidly," Steve Dean, chief investment officer at Compound Planning, said in an interview.

The situation echoes the dot-com bubble of 2000. However, unlike the companies at that time, the Magnificent Seven companies are generating earnings to somewhat justify the valuations, Dean said.

If large-cap stock valuations are nearing a ceiling, this could present an opportunity for midcap and small-cap stocks to gain ground.

"For the past decade, small- and mid-cap companies have significantly underperformed their large-cap counterparts," Arun Bharath, partner and chief investment officer for Bel Air Investment Advisors, said in an email. "Going forward, we expect the valuation gap of large-cap companies to narrow versus that of the small- and mid-cap sectors."

Midcaps amid slower rate cuts

Still, midcap and small-cap companies have been less insulated than large-cap companies from the impact of elevated interest rates.

"[Smaller companies] tend to rely on variable rate debt, while larger companies have greater access to capital and can get those fixed coupon bonds, and so that alone can increase cost for them for paying that debt down," Jensen's Pratt said.

Companies with more restricted cashflows or higher debt loads have struggled over the past few years as the US Federal Reserve lifted its benchmark interest rate to a 20-year high during a hawkish rate hiking cycle from 2022 to 2023. The elevated interest rates played a contributing factor that sent US corporate bankruptcies to a 14-year high in 2024.

Some relief came in the final four months of 2024 when the Fed lowered its benchmark rate by a full percentage point over three monetary policy meetings. However, further cuts are expected to slow in 2025 amid persistent inflation and a resilient job market.

"Mid- and small-cap stocks tend to be more sensitive to economic conditions, so rising rates and a weakening potential economic outlook or uncertainty about the economic outlook would tend to make investors more cautious about mid- and small-cap stocks … that would present a challenge to this reconciliation of the valuation gap [among stocks in different market capitalizations]," Compound Planning's Dean said.

Risk of tariffs

US President Donald Trump's expected slate of tariffs has also clouded market outlook for 2025. Larger companies with both international supply chains and global customer bases are more exposed to the risks that could be aggravated by such trade actions.

However, the prospect of tariffs tends to pose less risk for midcap and smaller companies.

"With 76% of their revenues coming from the US, mid-cap stocks are somewhat insulated from tariff exposure and are expected to see strong earnings growth, around 13% in 2025, with attractive valuations, which could be the desired equity market sweet spot," according to a Jan. 2 note from Raymond James.

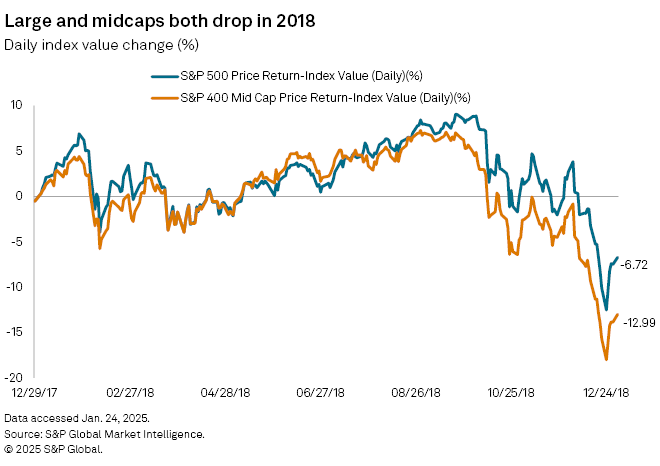

Equities largely took a hit when Trump imposed multiple rounds of tariffs in 2018, especially against imports from China. The S&P 500 and the S&P 400 lost 6.72% and 12.99%, respectively, during the year from the end of 2017. The tariffs from Trump's previous term, as well as geopolitical conflicts, led many companies to juggle and diversify their supply chains over the ensuing years.

"Midcaps in a more general sense may not be quite as globally diversified as larger-cap companies," Jensen's Pratt said. "They might have a few suppliers overseas, but back from when this originally happened, they have already diversified so that if it happened again, they weren't so reliant on just China."