Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Umer Khan and Sean Longoria

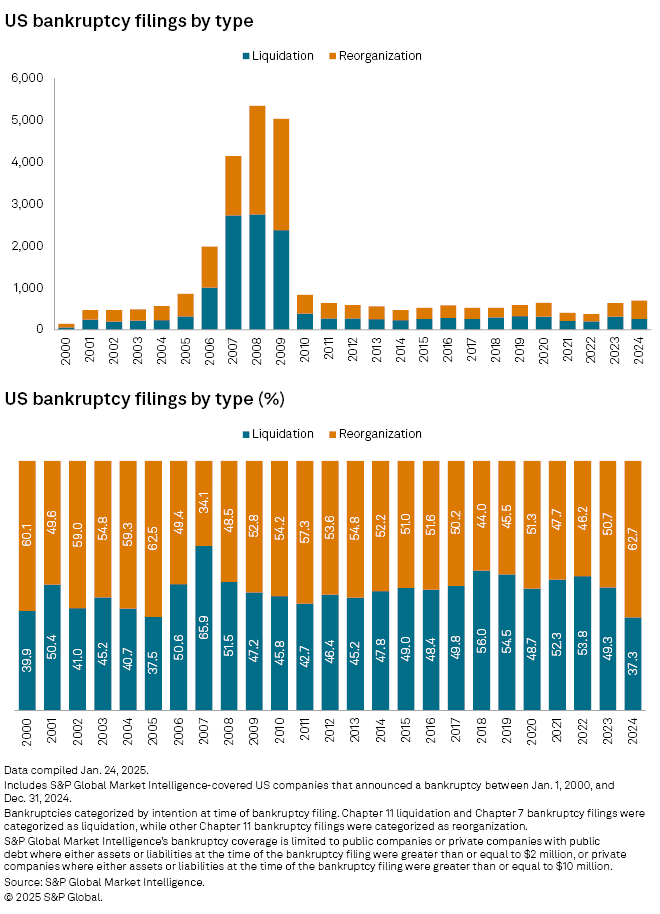

US companies that entered bankruptcy proceedings in 2024 seeking to restructure and continue their operations numbered nearly twice as many as those looking to sell off their assets at shutdown.

Of the 695 bankruptcy filings of public and certain private companies in 2024, 62.7%, or 436, sought reorganization, an increase of 12 percentage points over 2023 and the highest share since at least the start of the century, according to an analysis by S&P Global Market Intelligence.

Bankruptcy filings in 2024 hit their highest levels since 2010 as companies navigated higher-for-longer interest rates, the unwinding of COVID-19 support programs and strained consumer finances. Still, filings remain dramatically lower than the years surrounding the global financial crisis of 2007–2009.

Reorganizations regain popularity

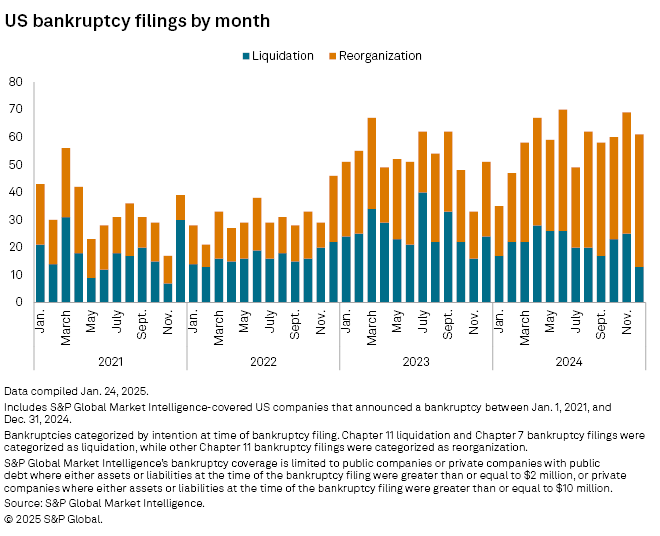

Recent filings show a wide preference for restructurings. In December 2024, 48 of the 61 filings sought reorganizations, while liquidations numbered 13, the lowest of any month since February 2022.

Historically, most businesses examined by Market Intelligence preferred to try to continue operations and restructure debt. While the balance of liquidations versus reorganizations tends to ebb and flow, bankrupt businesses tend to cease operations at higher rates during times of heightened financial stress.

Liquidations as a share of total bankruptcies spiked in the aftermath of the dot-com bubble bursting in the early 2000s, before and during the Great Recession, and in the years following the emergence of COVID-19.

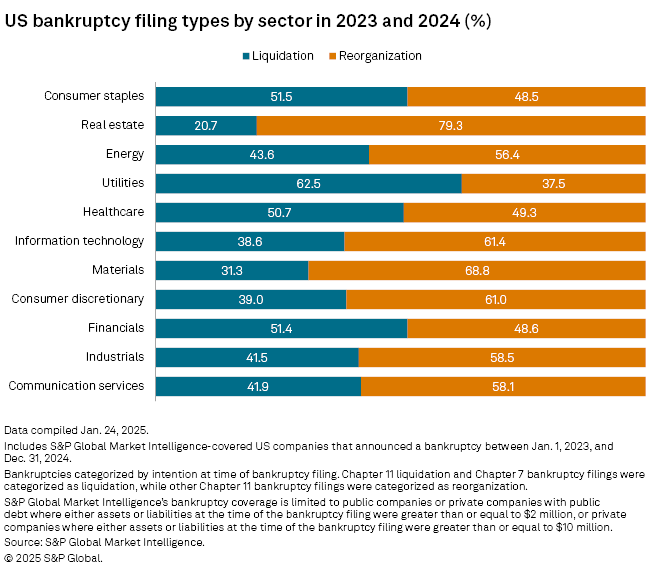

Sector breakdown

In 2023 and 2024, reorganization filings were dominant in seven of 11 sectors — real estate, energy, information technology, materials, consumer discretionary, industrials and communication services. The real estate sector had the largest percentage of reorganizations at 79.3%, and the utilities sector had the largest percentage of liquidations at 62.5%.

H-Food Holdings LLC, ViSalus Inc. and NEX SJ LLC were among the largest reorganizations of the fourth quarter of 2024, based on an analysis of total reported liabilities at initial bankruptcy filing.

H-Food and certain of its affiliates, which manufacture baked goods and snacks and provide food packaging services, entered bankruptcy proceedings in November 2024 to pursue a restructuring that would wipe out more than $1.9 billion in debt and secure $200 million in new capital, according to a news release. While the court case is proceeding, the company intends to exit bankruptcy during the first quarter of 2025.

Meanwhile, Invitae Corp. and SQRL Service Stations LLC filed the only bankruptcy petitions seeking to liquidate that reported more than $1 billion in liabilities in 2024.

Invitae, a medical genetics company that filed for voluntary Chapter 11 protection in February 2024, reached a deal in April the same year to sell substantially all of its assets to Labcorp Holdings Inc.

SQRL initially sought to reorganize in its bankruptcy petition in August 2024, but a bankruptcy trustee overseeing the case successfully urged the court to convert the case into a liquidation, according to filings.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.