S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Jan, 2025

By Arpita Banerjee and Xylex Mangulabnan

About two-thirds of US regional banks have reported year-over-year earnings gains in the 2024 fourth quarter.

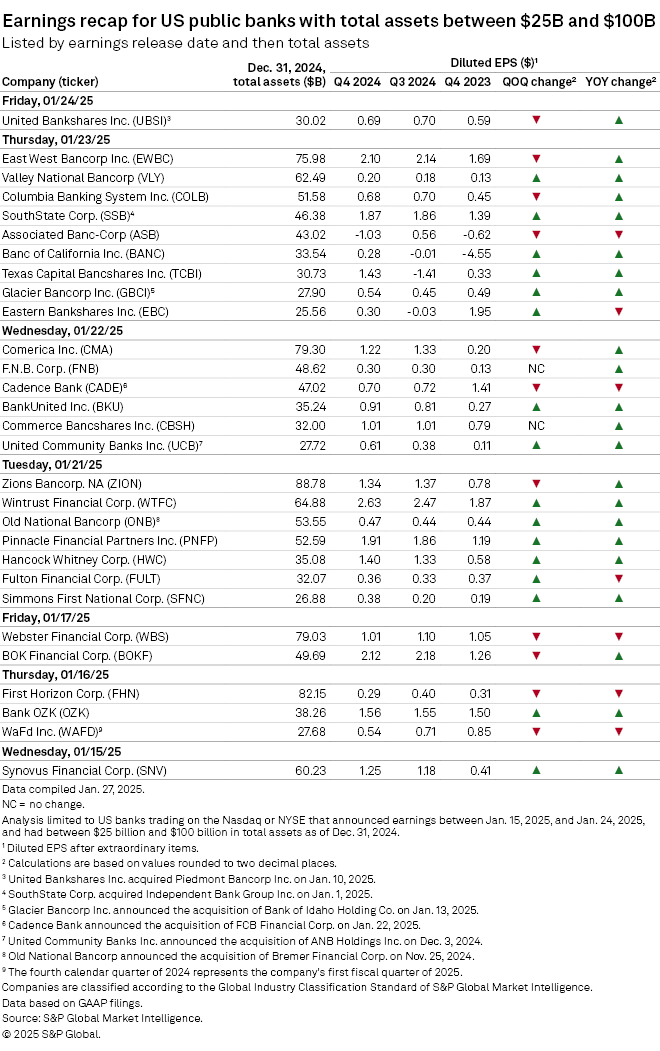

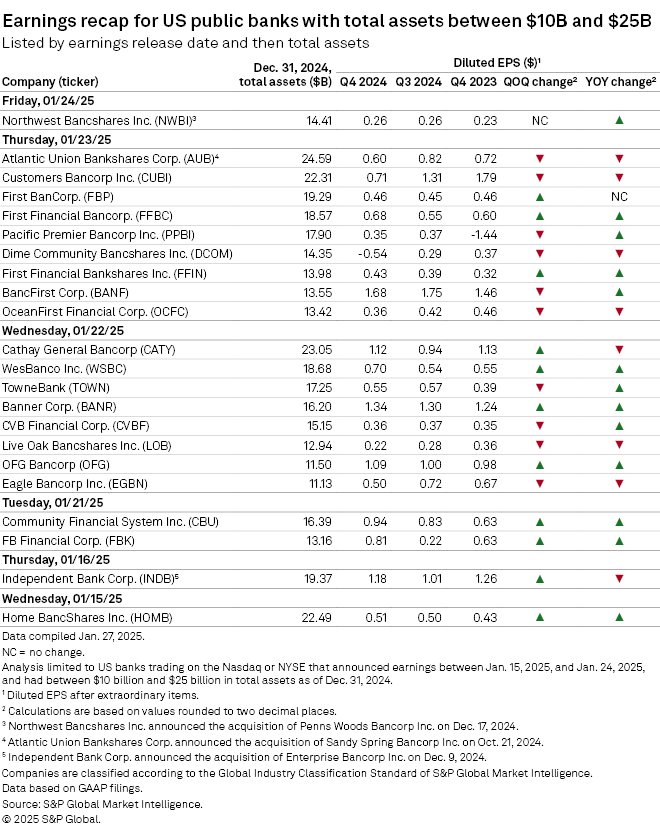

Of the 51 banks with assets ranging from $10 billion to $100 billion that disclosed 2024 fourth-quarter financial results between Jan. 13 and Jan. 24, 35 reported higher earnings per share compared to the same period a year earlier, according to S&P Global Market Intelligence data.

Twenty-seven regional banks logged improved results on a quarter-over-quarter basis, while 22 recorded both quarterly and yearly EPS increases. Only 11 regional banks recorded EPS declines on both sequential and yearly bases.

Banks with $10B to $25B in assets

There were 22 banks with $10 billion-$25 billion in assets included in this analysis, of which 13 posted year-over-year EPS increases. Eight logged higher EPS on both a quarter-over-quarter and year-over-year basis.

Nashville, Tennessee-based FB Financial Corp. reported the strongest sequential EPS growth in the group with a 268.2% increase to 81 cents. Earnings were up 28.6% year over year in the quarter.

On a full-year basis, FB Financial reported adjusted EPS of $3.40, for a year-over-year increase of 13%. The company attributed the growth to an annualized increase in deposits, noninterest income, net interest income and loans held for investment.

Wheeling, West Virginia-based WesBanco Inc. logged a 29.6% sequential increase and a 27.3% yearly increase in EPS. For full year 2024, the company recorded EPS of $2.34 on an adjusted basis, compared to $2.56 in 2023.

WesBanco posted 29% year-over-year growth in pretax pre-provision earnings in the final quarter of the year, driven by a $1 billion increase in loans, supported by deposit growth and an improved net interest margin, CFO Daniel Weiss said on a conference call. The company recorded a 21% rise in fee income, while operating expenses ticked up just 1% compared to both the previous quarter and the same period a year earlier.

Six banks recorded EPS declines on both a quarterly and yearly basis: Atlantic Union Bankshares Corp., Customers Bancorp Inc., OceanFirst Financial Corp., Dime Community Bancshares Inc., Eagle Bancorp Inc. and Live Oak Bancshares Inc.

Hauppauge, New York-based Dime Community's EPS decline in the fourth quarter was attributed to a $42.8 million pretax loss on sale of securities, $1.3 million of pretax severance expense and $1.2 million of pretax expense related to the termination of a legacy pension plan. Income tax expenses related to taxable gains on the surrender of legacy Bank Owned Life Insurance assets contributed to overall losses for the quarter.

"Excluding the impact of these two transactions as well as severance and costs associated with pension termination and other onetime items, adjusted EPS increased by 45% versus the prior quarter," Dime CFO Avinash Reddy said during the earnings call.

Cathay General Bancorp and Independent Bank Corp. logged higher EPS compared to the third quarter, but lower EPS year over year.

Banks with $25B to $100B in assets

Of the 29 banks with $25 billion to $100 billion in assets, 22 reported year-over-year EPS increases. Fourteen banks logged higher EPS on both yearly and quarterly bases.

Blairsville, Georgia-based United Community Banks Inc.'s fourth-quarter EPS of 61 cents was up 60.5% from the previous quarter and up 454.5% from the year-ago period. For the full year, the company's EPS was $2.04, up from $1.54 in 2023.

Loan growth returned to historical levels, with loans increasing $212 million, or 5% on an annualized basis, Chairman and CEO Lynn Harton said on an earnings call. The bank funded the new loans with customer deposits, which grew $213 million from the third quarter. That growth allowed the bank to increase net interest income while experiencing some minor expected net interest margin compression, Harton said.

United Community expects similar loan growth in the first quarter of this year, with strong business owner confidence and a robust pipeline for new loans, President Richard Bradshaw said.

Los Angeles-based Banc of California Inc.'s fourth-quarter EPS stood at 28 cents per share, a 2,900% quarter-over-quarter increase and a 106.2% year-over-year increase. Net interest income for the quarter was $235 million, an increase of 1% from the prior quarter, attributed to expansion in net interest margin by 11 basis points to 3.04%.

"While our 2025 outlook for our net interest margin for the entire year is currently targeting a range of 3.20% to 3.30%, that assumes no further Fed rate cuts in 2025," Banc of California CFO Joseph Kauder said in an earnings call.

Other banks that recorded higher EPS sequentially and annually include Texas Capital Bancshares Inc., Simmons First National Corp. and Glacier Bancorp Inc.

Eleven banks posted quarter-over-quarter EPS declines, but only five posted lower EPS compared to both the previous quarter and year-ago period: Associated Banc-Corp, Cadence Bank, Webster Financial Corp., First Horizon Corp. and WaFd Inc.

Eastern Bankshares Inc. and Fulton Financial Corp. posted higher quarterly EPS but lower EPS year over year in the fourth quarter of 2024.