S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Jan, 2025

By Brian Scheid

The prospect of a trade war has had little impact on US financial markets so far, but expected tariffs on China and other trading partners could prove to be a hurdle to the market's ongoing bull run.

During his campaign, President Donald Trump pledged to impose 60% tariffs on China once he took office and threatened another 10% tariff on the first day of his second term. He has also threatened to levy 25% tariffs on all imports from Mexico and Canada. If applied, the duties would affect a wide range of goods such as electronics, automobile components and a broad range of consumer goods.

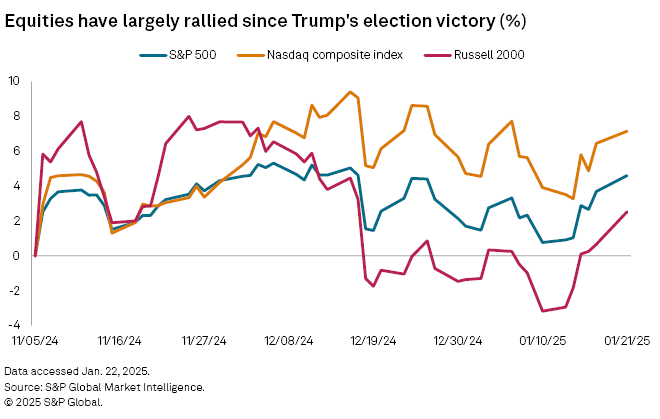

Equity markets have largely risen in the two-and-a-half months since Election Day, with the S&P 500 up 2.6% through Jan. 21.

The market impact of the potential tariffs will largely hinge on their specifics. And as investors have been reminded this week, when Trump is in the White House, policy details are often murky.

"It really depends on the type of tariffs, and right now there's a lot of uncertainty about what type of tariffs will be applied, on which countries, on which type of goods, and how much," said Sonu Varghese, vice president and global macro strategist with Carson Wealth.

Broad-based, universal tariffs would likely boost the strength of the US dollar, possibly muting the impact of tariffs on inflation but likely putting pressure on risk assets and hurting domestic manufacturing as the prices of US-made goods rise, Varghese said. Significant tariffs would also further pressure the Federal Reserve to delay interest rate cuts, increase volatility in cyclical areas of the market, and hurt mid- and small-cap stocks and some sectors, such as industrials, Varghese added.

"Markets have been pricing in the possibility of tariffs ever since the election outcome was in place," said Amol Dhargalkar, global head of corporates at Chatham Financial. "That said, markets expected tariffs to be employed through executive action, and that hasn't happened yet."

Instead, Trump directed his administration to investigate the US trade deficit and recommend some measures to remedy it. Trump said he would impose tariffs on imports from Mexico and Canada and an additional 10% on Chinese products starting Feb. 1 unless deals could be struck.

Even though those three countries account for more than one-third of US global trade, the market response has been relatively muted.

"The hourly missives from DC on tariffs are being taken by the markets in stride," said Andrew Brenner, head of international fixed-income at Natalliance Securities.

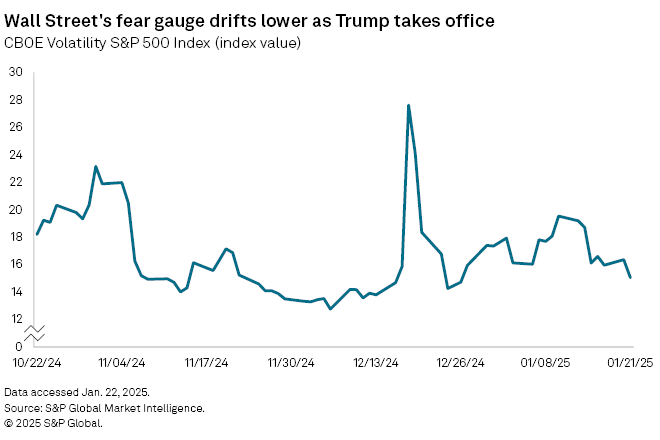

Investors are likely waiting on specifics before reacting, although the tariff threats could signal some forthcoming broad market volatility as new and fluid trade policies inject some uncertainty into the macroeconomic outlook, said Tyler Richey, a co-editor with Sevens Report Research.

"As forward-looking discounting mechanisms, equity markets in particular love stability and a clear consensus outlook for future growth trends," Richey said. "The implementation of new tariffs would derail the current Wall Street consensus that the Fed is in the process of nailing a soft economic landing that will result in strong, AI-amplified earnings growth in 2025 driving the broader stock market to new records."

Equities effect

The tariff tit-for-tats in 2018 and 2019 were a net negative for equity markets, according to a Jan. 21 note from Goldman Sachs economists. On the nine days that the first Trump administration announced tariffs, the S&P 500 fell 5% in total. Equities lost a combined 7% on days when foreign countries announced retaliatory tariffs.

Richey with Sevens Report believes that the upcoming tariffs will likely have a greater impact on equities than those in Trump's first term.

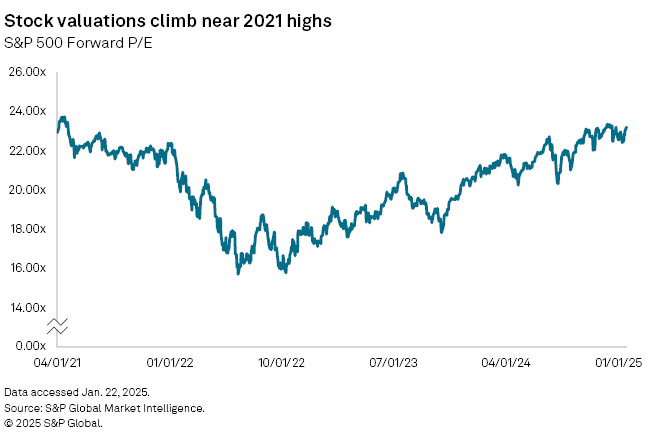

For one, the price-to-earnings ratio for the S&P 500 is above 2018 levels, and earnings expectations are now higher. With valuations higher, a correction would be more significant. Also, the long inversion of the yield curve, a leading recession signal, was not a factor in Trump's first term and could be evidence that the economy is more fragile at the moment.

In addition, the risks that tariffs posed to inflation were lower in 2018 simply because inflation was lower. The consumer price index, the market's preferred inflation measure, rose less than 2.2% from January 2017 to January 2018, when the first tariffs were imposed. The consumer price index saw an annual increase of 2.9% in December 2024, nearly a full percentage point above the Fed's target.

"Investors have very little appetite for a resurgence in inflation pressures and as such would likely sell first and ask questions later in this environment," Richey said.