S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Jan, 2025

By Tyler Hammel

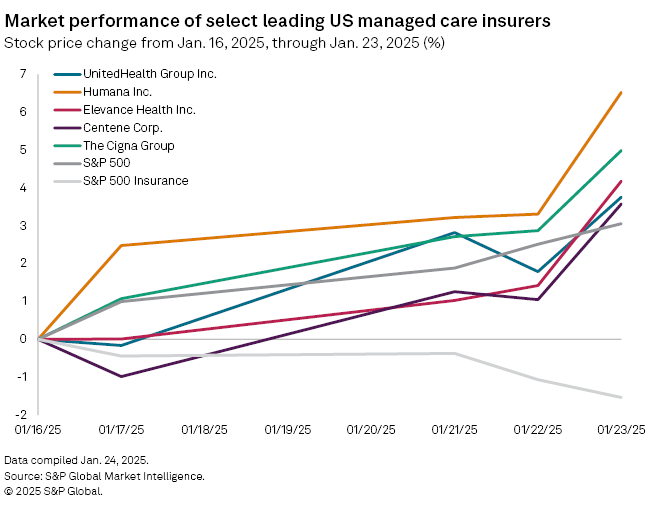

After a dip in the wake of the release of UnitedHealth Group Inc.'s fourth-quarter 2024 earnings figures, shares in the company and other managed care insurers have largely bounced back.

Healthcare giant UnitedHealth has been beset by the same issues other managed care insurers face, including high costs associated with government-subsidized plans such as Medicaid and Medicare Advantage, which have adversely affected earnings in recent quarters.

"America faces the same fundamental health care dynamic as the rest of the world. The resources available to pay for health care are limited, while demand for health care is unlimited," CEO Andrew Witty said during a Jan. 16 earnings call.

UnitedHealth's stock opened at $530.35 a share Jan. 16, the same day it released its fourth-quarter earnings, but fell to $510.59 a share by the close of trading. In the week since the company's earnings call, UnitedHealth stock has climbed 3.8%, closing at $529.77 by the close of trading Jan. 23. The health insurer remains up 5% from the start of the year.

The managed care giant's rise over the last week largely matches that of the S&P 500, which rose 3.05%, but it contrasts with the S&P Insurance index, which declined 1.53%.

Other managed care insurers saw their stocks rise during the same period, with The Cigna Group and Humana Inc. posting bumps of 5% and 6.5%, respectively, and Centene Corp. gaining 3.6%.

UnitedHealth weathers cost storm

Amid the recent rise in its stock value, UnitedHealth's fourth-quarter earnings were marked by scrutiny in the wake of the December 2024 killing of UnitedHealthcare CEO Brian Thompson.

While UnitedHealth leadership did not get into many of the specific pricing accusations that have arisen since Thompson's death, Witty did defend the company's partnership with pharmacy benefit managers (PBMs).

The drug middlemen, like UnitedHealth's Optum Inc., have been accused of raising prices by politicians and the Federal Trade Commission in recent months, which Witty pushed back against.

"Tackling that problem will require all parts of the system and policymakers to come together," Witty said. "Yet there are participants in the system who benefit from these high prices."

In a research note released prior to UnitedHealth's fourth-quarter results, J.P. Morgan analyst Lisa Gill described PBM regulatory efforts as "noise" that are unlikely to pass.

Gill and her fellow J.P. Morgan analysts rated UnitedHealth as "overweight" the week following its earnings call, pointing to expected improvements in its 2025 Medicaid business.

"We believe over time UnitedHealth should trade at a premium due to its attractive top- and bottom-line growth profiles coupled with reduced variability of its earnings vs. the [S&P 500 Index] and view the current discount to the [S&P 500 Index] as disconnected from the firm's fundamental performance and forward earnings outlook," Gill wrote.

Elevance sees earnings bump

Elevance Health Inc. was the second major managed care insurer to report fourth-quarter earnings, painting a similar picture as UnitedHealth on Jan. 23.

The Indianapolis-based insurer has been grappling with the same challenges facing the industry, CEO Gail Boudreaux said during an earnings call, pointing to rising costs, administrative complexity, disparities in access to care and inadequate Medicaid rates.

"While rates today remain insufficient to cover the elevated level of cost trend we are experiencing, we remain confident that rates will ultimately reflect the underlying acuity of our Medicaid membership over time," Boudreaux said.

Even with the challenges, Elevance met the expectations set in prior-quarter earnings calls and saw its stock rise to $401.36 a share on Jan. 23 from $390.73 a share at the close of trading on Jan. 22.

Although Elevance anticipates satisfactory operating revenue growth, the company only offered modest earnings-per-share growth estimates for 2025, wrote Stephens analyst Scott Fidel in a research note following the insurer's earnings call.

Fidel ranked Elevance as "equal-weight," acknowledging some cost pressures and pricing concerns.

"Elevance messaged a view that EPS guidance prudently accommodates for persistent medical cost pressures seen across commercial, Medicare, Medicaid," Fidel wrote. "However, we remain concerned that Elevance's pricing approach to 2025 could equally present downside EPS risk."