S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Jan, 2025

By Karl Decena

| Nickel smelter operations in Indonesia's Konawe regency. The Indonesian government decreased its nickel ore mining quota for 2025. Source: Andry Denisah/AFP via Getty Images. |

Indonesia plans to limit nickel production in 2025 to influence prices and improve the performance of a sector

The Southeast Asian nation emerged as a major force in the nickel industry after prohibiting nickel ore exports in January 2020. The move helped attract predominantly Chinese-backed investments in local processing, driving up global nickel supply and

To prevent a further drop in nickel prices that are already squeezing revenue, the Indonesian government set a nickel ore mining quota of 200 million metric tons in 2025, decreasing from the 240 MMt quota set for 2024, Reuters reported Jan. 10. The country produced 215 MMt of nickel ore in 2024.

The government of President Prabowo Subianto is also facing pressure to reduce the pollution caused by nickel mining. Tri Winarno, director general of minerals and coal at Indonesia's Ministry of Energy and Mineral Resources, said the quota could further decrease if miners fail to comply with environmental rules and other regulations, according to the Reuters report.

"So all these issues are happening. And [the government] needed to temper this. They needed to deal with this," Alvin Camba, a research adviser on critical materials at the Associated Universities Inc. nonprofit group in Washington, DC, said in an interview. "The fact that they are [cutting the quota] right now means that it's a combination of ... economic logic and political logic."

Limited price support

The decision by Subianto, who took office in October 2024, to reduce nickel production marks a stark departure from the strategy of his predecessor, Joko Widodo. Indonesia's nickel industry flourished following the export ban imposed by the Widodo administration. The restriction helped attract China-based companies, including Zhejiang Huayou Cobalt Co. Ltd. and Tsingshan Holding Group Co. Ltd., which made large investments in new processing facilities in Indonesia.

Indonesia is expected to account for 60.2% of global nickel production in 2024, according to S&P Global Market Intelligence data. The Philippines ranked a far second at 10.2%.

The government aims to replicate its model for nickel, applying the idea to other commodities including bauxite, cobalt and tin. Bauxite is the most common ore of aluminum.

Price of success

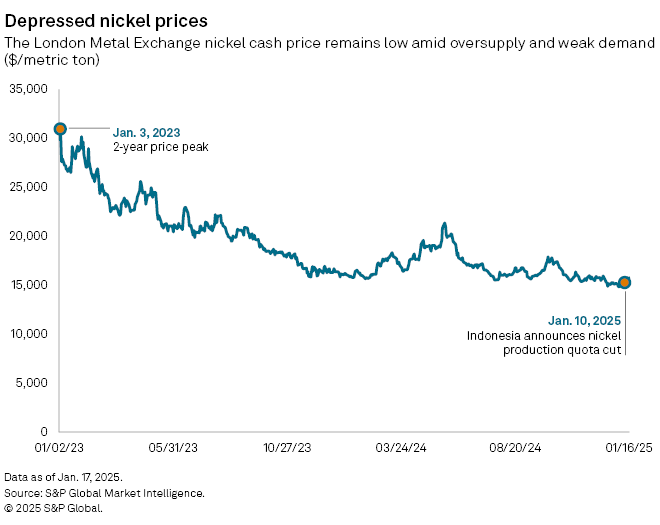

Indonesia's bans on nickel ore exports resulted in a flooded market and decreased prices. The London Metal Exchange (LME) nickel cash price dropped 48.7% to $15,885.58 per metric ton as of Jan. 17, compared to a two-year high of $30,958.00/t on Jan. 3, 2023.

The country's nickel policy could sway the market given its share of global production. Nickel markets responded immediately to Indonesia's Jan. 10 announcement of a decreased production quota, with the LME nickel cash price increasing by 4.02% as of Jan. 17, from $15,272.08/t on Jan. 10.

However, nickel prices were already expected to rise in the first quarter and the production cuts may not have a big impact, said Andrew Cole, principal analyst for base metals at London-based price reporting agency Fastmarkets.

"We have not adjusted our supply or price forecasts in response to the news," Cole said in an email.

Overall, Jakarta's nickel production cuts may not move the needle in prices, as alternative sources of ore are readily available.

"The domestic ore shortfall will be partially met by Indonesian companies importing material from the Philippines," Cole said. "But this comes at the expense of higher costs and lower grades."

Indonesian processors may also close the ore supply gap by focusing on extracting higher-grade nickel, according to Jorge Uzcategui, a senior analyst covering cobalt and nickel at Benchmark Mineral Intelligence.

"Based on our supply estimates, the quotas won't be enough to satiate smelter demand," Uzcategui said in an email. "However, there are factors that may come into play to meet some of this demand."

Raising standards

Indonesia's nickel profile has been tainted by environmental issues. Most of the Chinese-backed investments in local nickel processing comprise high-pressure acid leach facilities, which have higher emissions compared to traditional refining methods and risk contaminating drinking water.

By reducing production, Indonesia is hoping to improve the quality of its nickel industry. This would, in turn, help the country draw non-Chinese investors and especially those in the US, which is seeking to increase supplies of battery materials due to the ongoing clean energy transition.

"For American companies to get funding from the US government, they have to fulfill certain environmental and human rights standards," Associated Universities' Camba said. The environmental and social issues in Indonesia's nickel sector have worsened, Camba said, based on recent trips to the country.

Most Indonesian nickel is tied to China, which means that it does not qualify for electric vehicle tax credits under the strict sourcing requirements of the US Inflation Reduction Act. The law bans consumers from getting a $7,500 tax credit if the EV contains raw materials from a foreign entity of concern, defined as China, Iran, Russia and North Korea. Only a free trade agreement between Indonesia and the US would fix this issue.

Limiting nickel production would also help Indonesia manage its depleting reserves. Industry data shows that if the current pace of smelter processing continues, the country's nickel reserves may run out in four to five years, the Indonesia Business Post reported in October 2024.

"Indonesia's reserves of nickel are the largest in the world," Jason Sappor, a senior analyst on Commodity Insights' Metals and Mining Research team, said in an email. "Despite this, government officials have raised concerns in recent years that the nickel reserves are close to exhaustion."

The production quotas are already causing issues for miners. In late 2023, the government extended mining companies' quotas to three years from one year, in an effort to combat illegal mining. Sappor said the enhanced scrutiny under the new system slowed the quota approval process in 2024, forcing producers to import nickel ore.

The government's planned decrease in output may exacerbate the situation, Sappor said.

"Indonesia's government nevertheless must consider the potential impact that curbs on nickel production could have on the country's economic performance, given that such curbs could limit Indonesia's export of value-added nickel-containing products," Sappor said.