S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jan, 2025

By Nick Lazzaro and Umer Khan

Global fourth-quarter initial public offerings reached the highest level in more than a year as a slowdown from 2022 and 2023 stretched into 2024.

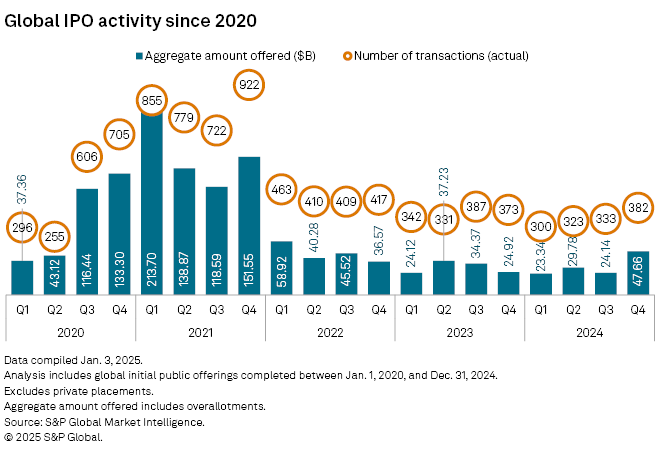

In the fourth quarter, 382 IPOs were launched worldwide with an aggregate offering amount of $47.66 billion, up about 15% in volume and 97% in value on the quarter, according to the latest S&P Global Market Intelligence data. This was the highest number of transactions since the third quarter of 2023 and the largest aggregate amount offered since the first quarter of 2022.

IPO transactions fell to 1,338 in 2024 from 1,433 in 2023, while the aggregate amount offered rose to $124.92 billion from $120.64 billion over that period. Activity in both years lagged the 3,278 global IPOs with a cumulative $622.71 billion offering amount recorded in 2021, when interest rates declined following the COVID-19 pandemic.

US IPOs

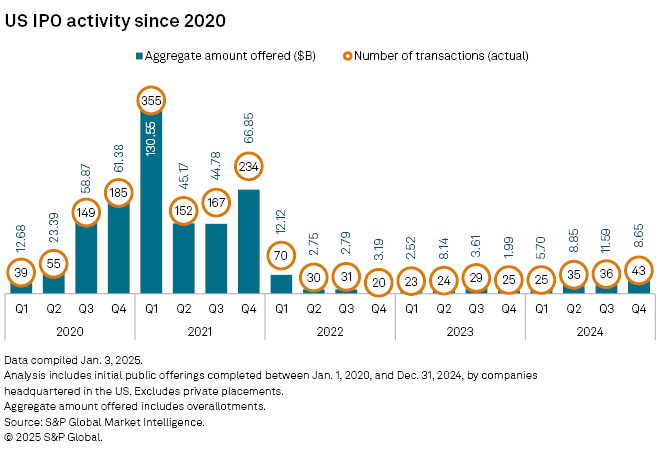

US IPO transactions increased modestly in the fourth quarter, after rising in each of the last three quarters. However, the total transaction value retreated to $8.65 billion from the third quarter's recent peak of $11.59 billion. Still, the fourth-quarter numbers were up from 25 transactions and $1.99 billion offered in the year-prior quarter.

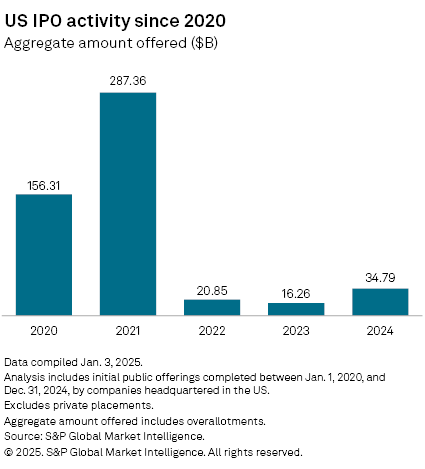

US IPO activity also accelerated annually, with 139 transactions and $34.79 billion offered in 2024, up from 101 transactions and $16.26 billion in 2023.

Due to elevated interest rates and economic uncertainty, the amount of equity issued in US IPOs remained subdued in 2024 compared with 2020 and 2021. A total of $71.9 billion in cumulative equity was issued through US IPOs from 2022 to 2024, compared with $287.36 billion in 2021 alone.

StandardAero Inc. — an aerospace engine maintenance, repair and overhaul services provider — held the largest US IPO in the fourth quarter with a $1.66 billion offering. The largest US IPO in 2024 was a $5.1 billion offering in July by Lineage Inc., a real estate investment trust for temperature-controlled warehouses.

European IPOs

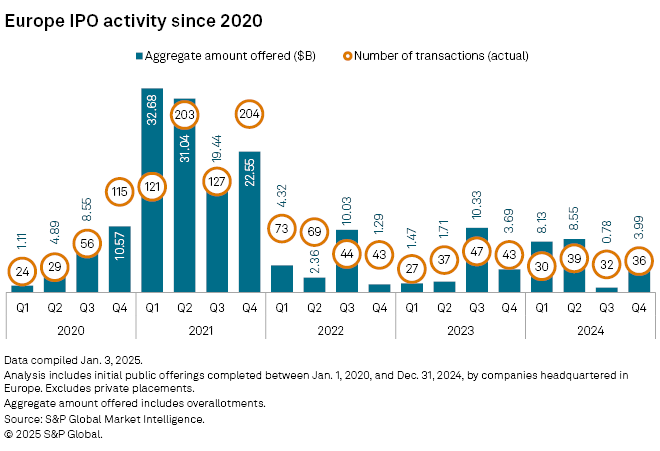

European IPO activity increased in the fourth quarter with 36 transactions and nearly $4 billion in total offerings, compared with 32 IPO launches and $780 million in the third quarter.

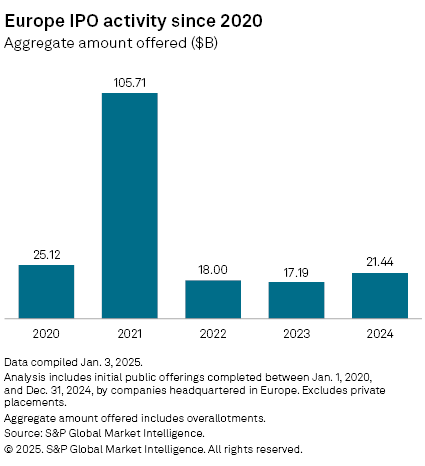

However, the 36 IPOs in the fourth quarter represented the fourth-lowest quarterly total over the last three years. For the full year, European IPO transactions decreased to 137 in 2024 from 154 in 2023.

European IPOs offered $21.44 billion in 2024, higher than the total offerings of $17.19 billion in 2023 and $18 billion in 2022. The combined aggregate amount offered through European IPOs from 2022 to 2024 represented only about 54% of the $105.71 billion offered in 2021.