Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jan, 2025

| Tantalum from Pilbara Minerals' Pilgangoora lithium-tantalum project in Western Australia. |

Australia could capitalize on having the world's largest reserves and resources of tantalum as demand from the electronics sector increases and African supply faces challenges, executives said.

Tantalum has a relatively small but important market and is on the critical minerals lists of several countries including the US, the UK, India and Australia. The metal is used on circuit boards, in capacitors and sputtering targets for semiconductors. Tantalum is also a key component in superalloys used in aircraft and gas turbines, and is used to manufacture lenses with a high refractive index.

"The future of the tantalum market is expected to continue to grow steadily, driven by continued demand in the electronics, aerospace and medical sectors," Dale Henderson, managing director and CEO of major Australian lithium producer Pilbara Minerals Ltd., said in an email interview.

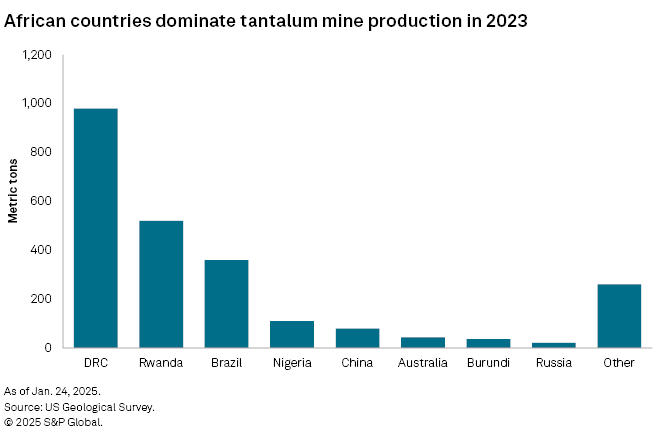

The largest source of tantalum is central Africa, but supply from the region "oscillates with market dynamics, tending to flow into oversupply when prices surge," Nils Backeberg, founder and director of critical minerals consultancy Project Blue, said in an email interview.

Political instability in the Democratic Republic of Congo's Kivu region has disrupted the country's supply, but "this limited supply availability is somewhat offset by diversified sourcing from other countries," Henderson said.

This provides an opportunity for Australia, from which the US sourced 54% of its tantalum ores and concentrates in 2023, according to the US Geological Survey.

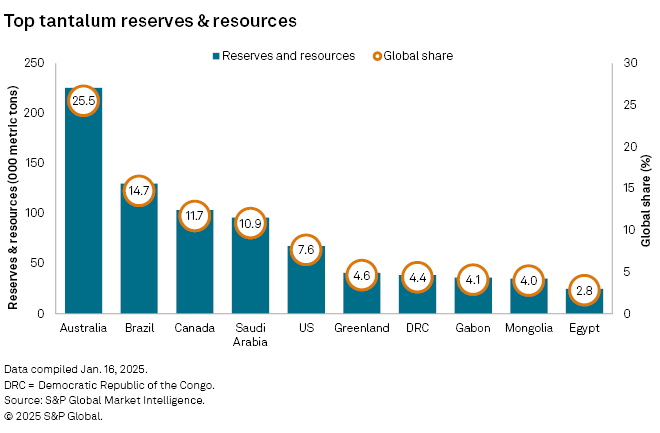

About 25.5% of tantalum's global reserves and resources are in Australia, according to S&P Global Market Intelligence data. However, the country only ranked sixth in global production in 2023, behind the Democratic Republic of Congo, Rwanda, Brazil, Nigeria and China, according to the US Geological Survey.

That production profile could shift in time.

"Australian tantalum producers can play a pivotal role in diversifying the global supply of tantalum via high-quality deposits, ethically-sourced tantalum products and strong processing capabilities," Henderson said.

"While production is currently driven primarily by lithium and rare earths markets, Australia's significant tantalum resources position us well to capitalize on growing global demand for this critical mineral."

Tantalum supply from lithium-pegmatite mines

Australia's tantalum output in 2023 comes entirely out of Western Australia, which also hosts the world's biggest hard rock lithium mines.

Tantalum resources in pegmatites have "mostly been reported for the Australian deposits on the back of the recent expansions for lithium mining, making the country a key reserve base for tantalum," Backeberg said. Thus, supply of tantalum is linked "closely to the successful development of spodumene mines," the Project Blue executive said.

The massive Greenbushes pegmatite mine, for example, "has been a prominent supplier of tantalum," Backeberg said.

Tantalum, tin and more recently lithium have been mined at Greenbushes, and Talison Lithium Pty. Ltd. produces two mineral concentrate streams from the mine: spodumene concentrates of varying grades, and tin-tantalite mineral concentrates.

Talison, which is co-owned by Tianqi Lithium Corp. and Albemarle Corp., holds the mineral rights to the spodumene at Greenbushes, while Global Advanced Metals Pty. Ltd holds the mineral rights to the tin-tantalite minerals at the mine, a Talison spokesperson said in an email.

Global Advanced Metals also owns the tantalum at Pilgangoora and Wodgina in Western Australia, and has built multiple tantalum treatment units to meet growing demand.

"The question remains if tantalum — a smaller byproduct revenue stream ... [of a] pegmatite mine — can support the development of lithium projects by leveraging [environmental, social and governance] concerns around [conflict mineral] supply out of central Africa," Backeberg said.