Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Dec, 2024

By Taylor Kuykendall and Susan Dlin

The cost of producing gold rose in the third quarter, according to an S&P Global Market Intelligence analysis, as mining companies worked to preserve wider margins generated by an elevated gold price.

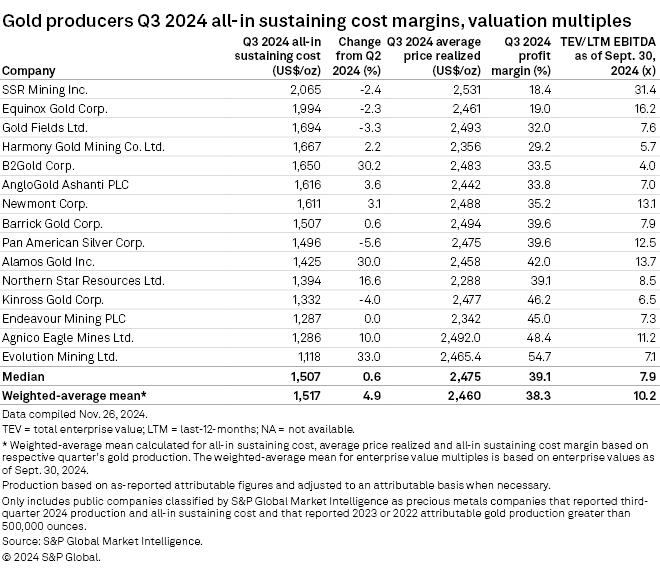

The weighted-average mean of the miners' all-in sustaining costs (AISC) was $1,517 per ounce in the third quarter, increasing 4.9% compared to the prior quarter. As part of their commentary during third-quarter earnings calls, miners pointed to labor as a major driver of rising costs.

The price of gold continued to set records in the third quarter, and the weighted-average mean of the companies' realized price was $2,460/oz for the period, increasing 11.8% from the second quarter.

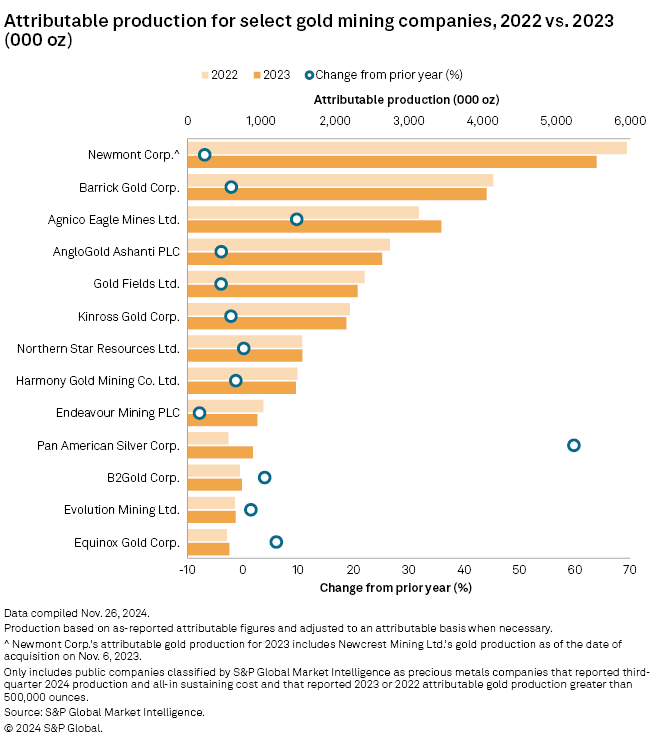

The weighted-average mean profit margin for the analyzed miners was 38.3% in the third quarter. The analysis covered companies with attributable production exceeding 500,000 ounces in 2023 or 2022.

On a percentage basis, Pan American Silver Corp. recorded the greatest decrease in costs, with its AISC down 5.6% quarter over quarter to $1,496/oz in the September period.

"We are focused on achieving our production targets and managing costs to deliver margin expansion," Michael Steinmann, Pan American president and CEO, told investors on a Nov. 6 earnings call. "Current metal prices are improving profitability, and we are expecting a strong finish to the year from a back-end loaded production profile."

|

– Learn more about the gold market from its Commodity Profile. – |

SSR Mining Inc. reported the highest AISC for the September quarter at $2,065/oz, decreasing 2.4% compared to the June period. Third-quarter AISC included the cash component of care and maintenance at the Copler

The company halted operations at the Copler mine in Turkey in February due to a landslide, and it suspended the Seabee operations in Canada in August due to nearby forest fires.

SSR Mining also reported steeper royalty costs associated with the increased gold price and higher-than-expected maintenance costs for the September quarter. However, the company recorded a profit margin of 18.4% with an average realized price of $2,531/oz for the quarter.

Evolution Mining Ltd.

Newmont Corp., the largest gold company by attributable production, reported AISC of $1,611/oz, netting a 35.2% profit margin. The company expects its AISC to fall 8% to $1,475/oz in the fourth quarter, CFO Karyn Ovelmen said on an Oct. 24 earnings call.

"This favorable decline is expected to be driven by higher gold production volumes and will be slightly offset by higher sustaining capital reinvestment," Ovelman said.