S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Dec, 2024

By Alex Graf and Hussain Shah

US banks appear poised to expand their net interest margins and reduce their deposit costs in 2025 as the rate-cutting cycle is expected to continue.

Net interest margins (NIMs) of US banks began to expand in the second and third quarters as the Federal Reserve cut rates for the first time in four years. Banks should experience NIM expansion from both sides of the balance sheet in the fourth quarter and especially in 2025, said Kris Lazzaretti, president of data solutions at the payments and data firm, Deluxe.

"We start to see some benefits accruing from increased loan and security yields, met at the same time with lower interest-bearing deposit costs," Lazzaretti said in an interview. "We think that both of those will start to move in more favorable directions, which will yield higher net interest income across the industry."

NIM expansion ahead

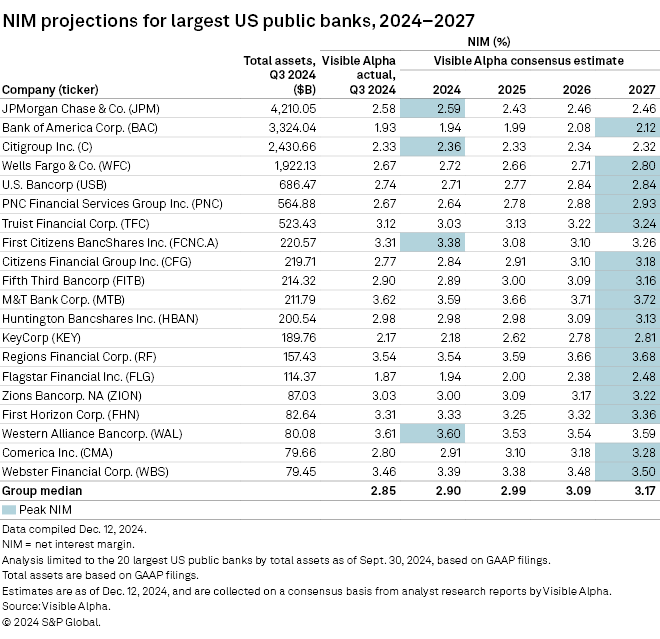

Analysts expect the NIMs of the 20 largest US banks to expand in 2025. Additionally, NIMs at most of these banks are not expected to peak again until 2027, according to an analysis of consensus estimates collected by Visible Alpha, a part of S&P Global Market Intelligence. The median of consensus NIM estimates for the group as of Dec. 12 was 2.90% for 2024, 2.99% for 2025 and 3.09% for 2026.

Now that the yield curve is steepening after over two years of inversion, bank NIMs should continue to expand in 2025, said Isaac Wheeler, managing director of balance sheet strategy at Derivative Path.

"That steeper curve should be beneficial overall from a net interest margin standpoint," Wheeler said. "Trump's election win and his likely potential nominees to the Fed in 2026 might also introduce some steepness into the curve as the market starts to price in more hawkish Fed positioning later on."

While larger banks are set to realize NIM expansion in 2025, smaller banks may have even more reason to be optimistic, Wheeler said. Balance sheet positioning at the 20 largest banks tends to be neutral or even asset-sensitive in terms of interest rate risk, and those institutions are therefore expected to benefit in a higher rate environment, Wheeler added.

"Rate cuts are not necessarily good for them," Wheeler said. "The small community banks that are out there that maybe skew a little bit more liability sensitive than the larger ones might be looking towards these rate cuts and expecting to benefit, especially if it's combined with a steeper curve."

Net interest income on the rise

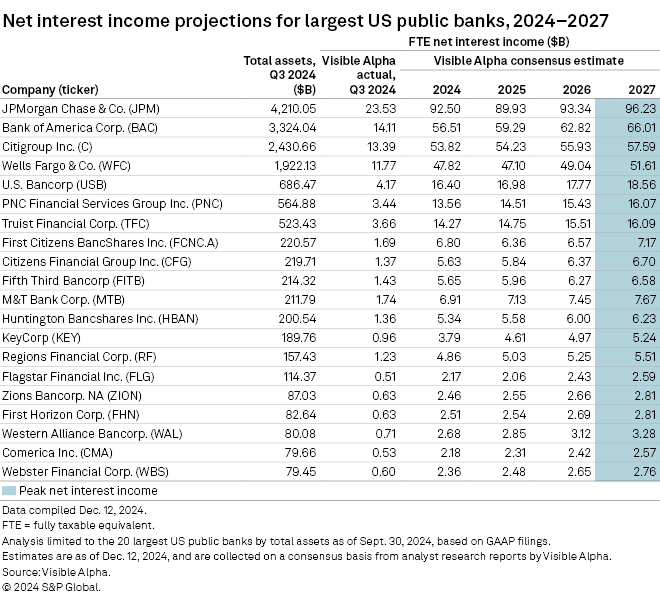

A major reason for the rosier NIM projections for 2025 is a significant expected increase in net interest income for all of the 20 largest banks. Net interest income at JPMorgan Chase & Co., the largest US bank, is expected to fall to $89.93 billion in 2025 from $92.50 billion in 2024, but is projected to rise to $96.23 billion by the end of 2027. Similarly, Bank of America Corp., the second-largest US bank, is expected to grow its net interest income to $66.01 billion by the end of 2027 from $56.51 billion in 2024.

While the Fed has cut interest rates in 2024, the market has tempered expectations for the extent of additional rate cuts in 2025 and the rate on the 5-year Treasury, a common investment for community banks, has increased as a result, Darling Consulting Group President and CEO Matt Pieniazek said in an interview. As such, bank loan and bond portfolios should benefit from additional interest income, the CEO added.

"The cash flow coming in from repricing, renewal and reinvestment is going to be reinvested at higher levels for a longer period of time," Pieniazek said. "The not so good news is that even though we're expected to see contraction in funding costs, they're not going to be to the extent or at the pace that everybody might have hoped."

Easing funding costs

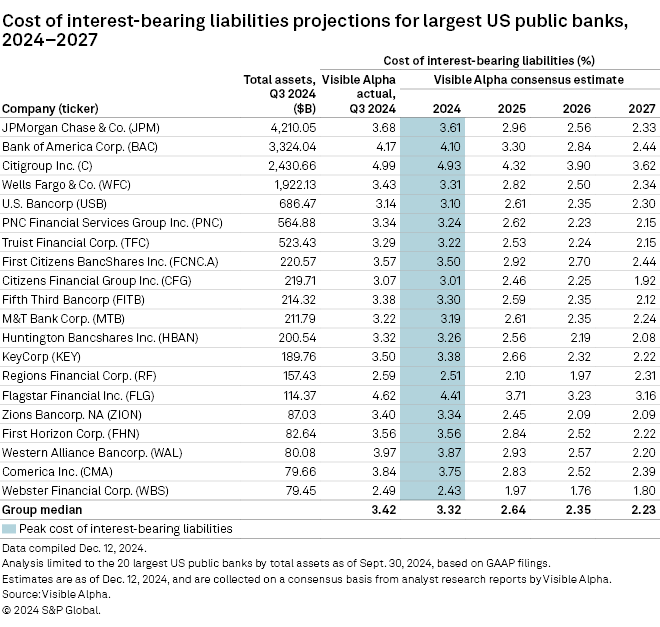

Analysts also expect the cost of interest-bearing liabilities to decline for all 20 of the largest banks in 2025, and continue on a downward trajectory in the following two years for most. The median of consensus estimates for the group as of Dec. 12 was 3.32% for 2024, 2.64% for 2025, 2.35% for 2026 and 2.23% for 2027.

Pressures on bank deposits are easing as deposit growth accelerates and deposit costs appear to have peaked, according to Lazzaretti of Deluxe. Deposit mix has become increasingly important, and banks are starting to shift toward noninterest-bearing deposits, Lazzaretti said.

Specifically, Deluxe, which serves more than half of the top 30 banks in deposit marketing strategies, is seeing its clients shift toward acquiring new-to-bank consumer and small business accounts, Lazzaretti said. As that shift plays out, deposit growth, mix and costs should all see improvements, Lazzaretti added.

"It's certainly intensified, particularly as they think about their plans for 2025," Lazzaretti said. "This all adds up to a really valuable formula for better NIMs."

Still, Darling Consulting Group's Pieniazek said he expects the Fed would need to cut rates at least one or two more times before any further acceleration of reductions in deposit costs. Many banks have been able to reduce rates on their certificate of deposit offerings at a faster pace than Fed rate cuts, but they can be reluctant to reduce those rates below 4%, Pieniazek said.

"There's a psychological effect here of like 4.05% sounds like a lot more than 3.95%," Pieniazek said. "When you get another easing or two, then you're going to start to see lesser and lesser rates out there with four handles, and that's when you're going to start to see banks more comfortable maybe sliding down rates."

Banks might be able to pivot away from more expensive funding sources as rates come down, according to Wheeler of Derivative Path. Wheeler expects deposit costs, in general, to decline. Even so, some banks are less optimistic and expect deposit pricing will be stickier than previously anticipated, Wheeler added.

Wheeler expects the future of deposit costs to depend in large part on the extent to which loan growth accelerates. If the economy remains robust, the Fed keeps cutting rates and loan growth picks up, deposit competition will likely be higher, Wheeler said.

"I feel like a recession is the last thing that anybody is talking about right now," Wheeler said. "That would maybe suggest continued deposit competition and maybe those deposit rates not coming down as much as people would have anticipated."