S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Mar, 2023

By Adrian Jimenea and Mohammad Taqi

Swiss banks Credit Suisse Group AG and UBS Group AG and Germany's Deutsche Bank AG were the least cost-efficient banks among major European lenders in the fourth quarter of 2022, S&P Global Market Intelligence data shows.

Credit Suisse, which is now merging with UBS, recorded a cost-to-income ratio of 127.58% in the quarter. The bank reported a quarterly loss of CHF1.39 billion. Meanwhile, UBS reported a cost-to-income ratio of 77.23%, the third highest in the sample.

Deutsche Bank, Germany's biggest bank by assets, reported the second-highest cost-to-income ratio of 81.09%. This was down 10.64 percentage points year over year but up 9.48 percentage points versus the prior quarter. Deutsche Bank aims to reduce its cost-to-income ratio to below 62.5% by 2025.

In contrast, Nordic banks were among the most cost efficient in the sample, with Sweden-based Swedbank AB (publ) and Skandinaviska Enskilda Banken AB (publ) reporting ratios at 37.88% and 38.96%, respectively. Norway-based DNB Bank ASA also booked a relatively low ratio of 40.58%.

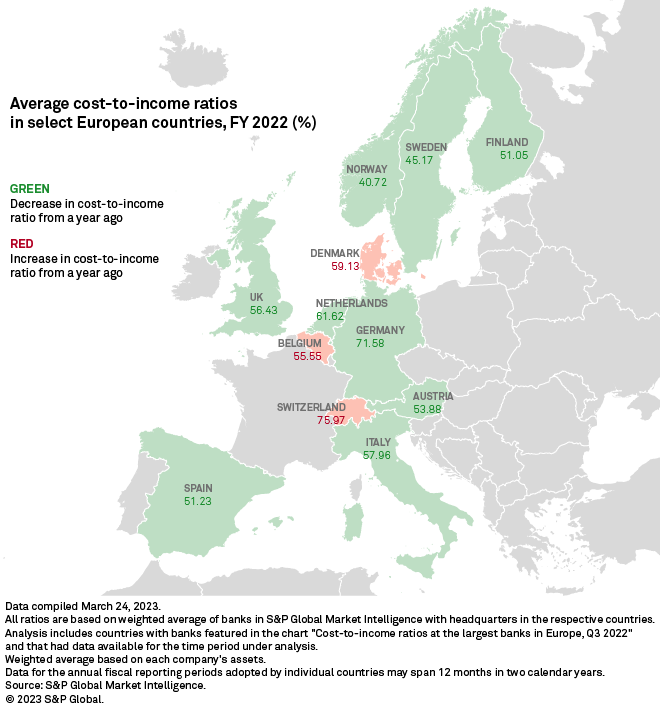

Full-year cost-to-income ratios improved on an aggregate basis in most major Western European countries, Market Intelligence data shows. Only Switzerland, Belgium and Denmark had higher aggregate ratios in 2022 than in 2021 among the sample.