S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Sep, 2022

By Ranina Sanglap, Marissa Ramos, and Zia Khan

State Bank of India emerged as the least efficient among the largest banks in Asia-Pacific in the June quarter, as notional losses on investments dragged on Indian lenders' income.

The biggest Indian lender by assets sat atop a sample of banks in Asia-Pacific with the highest cost-to-income ratios, which S&P Global Market Intelligence calculates by dividing operating costs by operating income. The ratio is a primary gauge of profitability: the lower the ratio, the more profitable the bank is.

The cost-to-income ratio of State Bank of India, or SBI, swelled 9.11 percentage points year over year to 71.06% in the June quarter, the steepest rise among banks in the sample, according to data compiled by Market Intelligence.

HDFC Bank Ltd. saw its cost-to-income ratio rise to 40.78% from 35.23%, as market weakness led to mark-to-market losses on the investments of most Indian lenders.

Market losses

"My assessment is that on account of the mark-to-market impact on their investment book because of interest rates firming up in the first quarter of fiscal 2023, the non-interest income of a number of banks, including SBI and HDFC Bank, has been affected," said Krishnan Sitaraman, senior director and deputy chief ratings officer at CRISIL Ratings, a subsidiary of S&P Global.

The difference in the degree of mark-to-market losses broadly corresponds with the variation in the cost-to-income ratios at Indian banks, Krishnan said.

Mark-to-market losses, or unrealized losses on investments, occur when the value of financial assets held by companies falls. Indian banks, which are major buyers of government bonds, reported a surge in mark-to-market losses in the June quarter after rate hikes by the Reserve Bank of India pushed bond prices lower. India's 10-year benchmark bond yield stood at 7.294% as of 5:44 p.m. Hong Kong time on Sept. 20, up from 7.277% a day earlier. Bond yields move inversely to their prices.

Pressures remain

The pressure on bond prices is likely to continue as analysts expect the Reserve Bank of India to hike benchmark rates again on Sept. 30 to control inflation, Reuters reported Sept. 20, citing banks and brokerages. However, the quantum of the rate hikes may ease later this year, easing the pressure on banks' mark-to-market losses.

SBI reported a 6.7% year-over-year decline in stand-alone net profit in the June quarter to 60.68 billion rupees, primarily due to mark-to-market losses on its investment book of 65.49 billion rupees. The bank did not respond to queries sent via email through its external communications agency.

ICICI Bank Ltd., the third largest Indian bank by assets, improved its cost-to-income ratio to 60.01% from 62.45% in the year-ago quarter.

Japanese banks

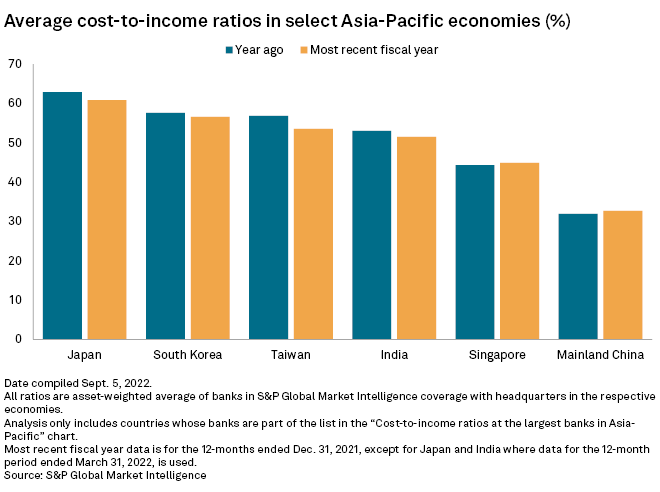

Japanese banks were among the least efficient in Asia-Pacific, as the Bank of Japan's record low rates keep a lid on their revenue and earnings growth. On the other hand, banks in mainland China remain the most efficient, although some have seen their cost-to-income ratios rise during the quarter.

While Japanese banks continue to cut costs, they are not expected to bring their efficiency to the level of their regional peers soon, said Michael Makdad, an equity analyst at Morningstar.

"The main reason that cost-to-income ratios rose in the 10 years after the global financial crisis is not that expenses are out of control, but rather that revenue growth was lacking, particularly since early 2016 when the Bank of Japan adopted its negative interest rate policy," Makdad said. "The banks are working to bring costs down in line with revenues, but they won't be able to improve efficiency to the level of peers in the region within just a few years."

As of Sept. 21, US$1 was equivalent to 79.97 Indian rupees.