S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Feb, 2022

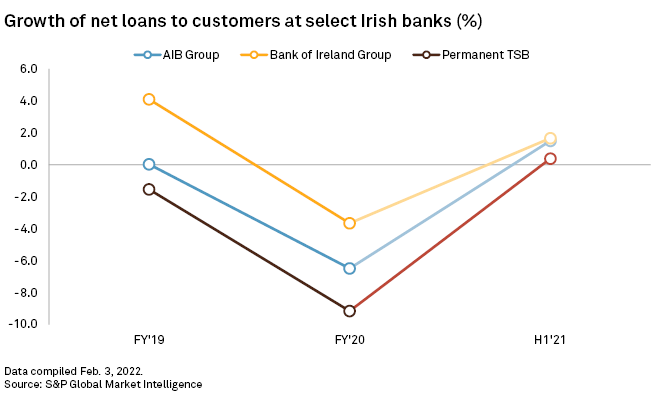

Net loans at Ireland's largest banks are poised to return to or even exceed 2019 levels as economic activity continues to recover from the effects of the COVID-19 pandemic and loans they acquired recently are due to come on their balance sheets in 2022.

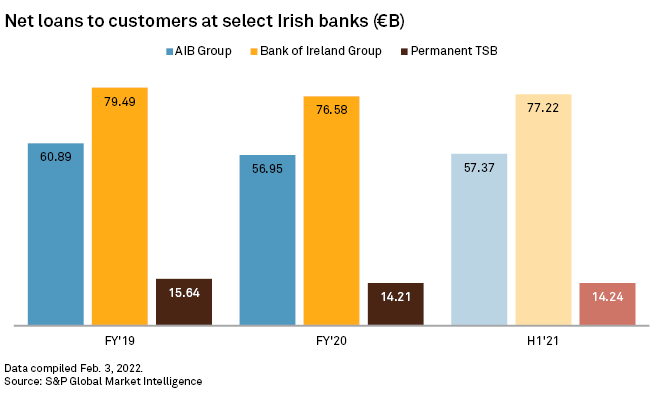

Net loans to customers at Bank of Ireland Group PLC, AIB Group PLC and Permanent TSB Group Holdings PLC totaled roughly €148.83 billion in the first half of 2021, compared to €147.74 billion in full year 2020 and €156.02 billion in full year 2019, S&P Global Market Intelligence data shows.

Bank of Ireland, the country's largest lender by total assets, saw net loans to customers rise to €77.22 billion at the end of June 2021 from €76.58 billion in full year 2020 and €79.49 billion in full year 2019. In a third-quarter 2021 trading update, Bank of Ireland said new lending on a constant currency basis increased 7% year over year in the nine months to September, while customer loan volumes were stable at €76.7 billion.

The bank is also set to see a material expansion in its loan book in full year 2022 from its acquisition of a portfolio of loan assets from KBC Bank Ireland PLC, Goodbody said in a Jan. 25 report. The lender signed a roughly €5.0 billion deal with the KBC Group NV unit in October 2021 involving €9.2 billion of loans and €4.4 billion of deposits.

The loan growth outlook will also be favorable to AIB Group — Ireland's second-largest bank by assets — in 2022, bolstered by strong organic growth in new lending in the Republic of Ireland, mortgages, corporate and small and medium-sized enterprises, and property, Goodbody said.

As of the end of June 2021, AIB's net loans to customers stood at €57.37 billion, compared to €56.95 billion in full year 2020 and €60.89 billion in full year 2019, Market Intelligence data shows. The lender said in its third-quarter 2021 trading update that new lending amounted to €7.2 billion for the nine months to September, representing a 7% growth versus the equivalent prior-year period with a pickup in momentum in the third quarter to €2.7 billion, compared to €2.2 billion in the second quarter. The trend is expected to continue in the fourth quarter as new lending in the second half is on course to outperform the first half.

The Irish mortgage market also continued to perform strongly in the third quarter of 2021, resulting in a 17% year-over-year increase in Republic of Ireland new mortgage lending for the nine months ended Sept. 30, 2021.

AIB's acquisition of roughly €4.2 billion of corporate and commercial loans from Ulster Bank Ireland DAC, which is pending approval from Ireland's competition regulator, is also projected to contribute to its loan book growth, which Goodbody estimates will start to come on to AIB's balance sheet from later in 2022.

Permanent TSB Group Holdings, which agreed in December 2021 to acquire certain elements of Ulster Bank's retail, SME and asset finance business in Ireland, also reported strong growth in loan originations in the nine months ended Sept. 30, 2021, with new lending of €1.4 billion, up 50% year over year.

PTSB said when it announced the deal that the assets being acquired will increase its mortgage book by about 40% from its 2020-end level and its branch network by approximately 30%. PTSB's business lending will also triple in size relative to its level at the end of 2020 when incorporating the micro-SME loans and the established asset finance business being acquired. Completion of the first step in the transaction is expected to take place in the fourth quarter of 2022.

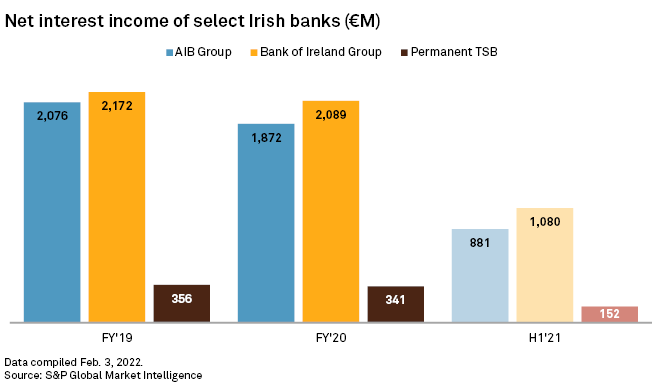

Higher net interest income

Bank of Ireland's net interest income, or NII, was 2% higher in the nine months ended Sept. 30, 2021, compared to the same period in 2020, the bank said, and Goodbody expects the lender to benefit materially from its acquisition of Irish stockbroking firm J & E Davy. Davy's consolidation is forecast to strengthen the group's other operating income line in 2022, assuming the transaction completes July 1 and as business income and fees and commissions recover, according to Goodbody.

AIB's NII is also projected to grow in 2022 on the back of loan growth and net interest margin enhancement, according to Goodbody. For full year 2021, the lender expects to see a moderate decline in NII

Permanent TSB Group, which reported losses in full year 2020 and the first half of 2021, is expected to continue to report losses in the near term, Goodbody said. However, the lender's business is on an improving trajectory and profitability is projected to recover on the back of its deal with Ulster Bank, it added.

Bank of Ireland and AIB are scheduled to report their full year 2021 results on Feb. 28 and March 3, respectively, while PTSB is set to release its results March 2.