Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2021

The pandemic year 2020 saw significant shake-ups in media-industry executive pay as some companies thrived under the new quarantine dynamics and others sought to survive and retain key leaders.

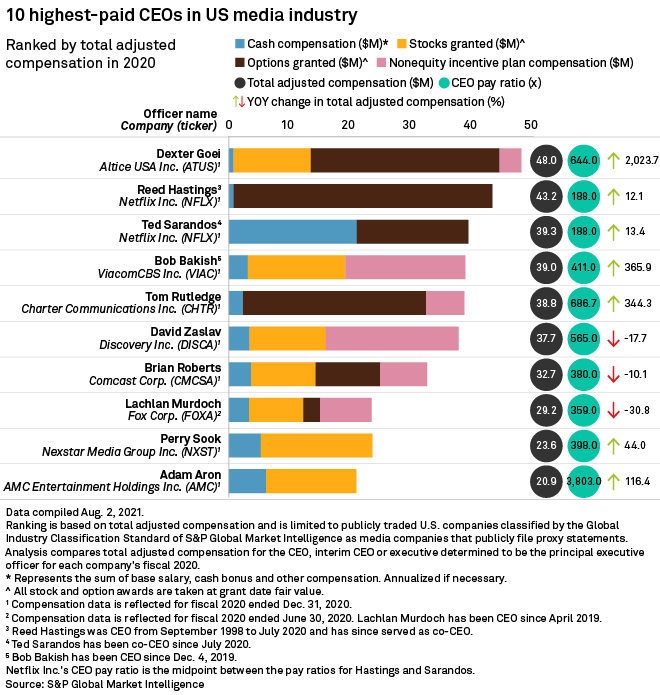

Netflix Inc. enjoyed an unexpected boom in user growth through the pandemic year as consumers turned to streaming media under widely imposed shelter-at-home orders. The company beat its guidance on membership additions for three quarters in 2020, and in turn, its CEO Reed Hastings and co-CEO Ted Sarandos registered as the second- and third-highest-paid media CEOs for the year, according to data compiled by S&P Global Market Intelligence.

Hastings saw $43.2 million in total adjusted compensation, up 12.1%, and Sarandos' compensation jumped 13.4% to $39.3 million, Market Intelligence data shows. Netflix saw its total revenue climb 24% year over year in 2020 to $25.00 billion.

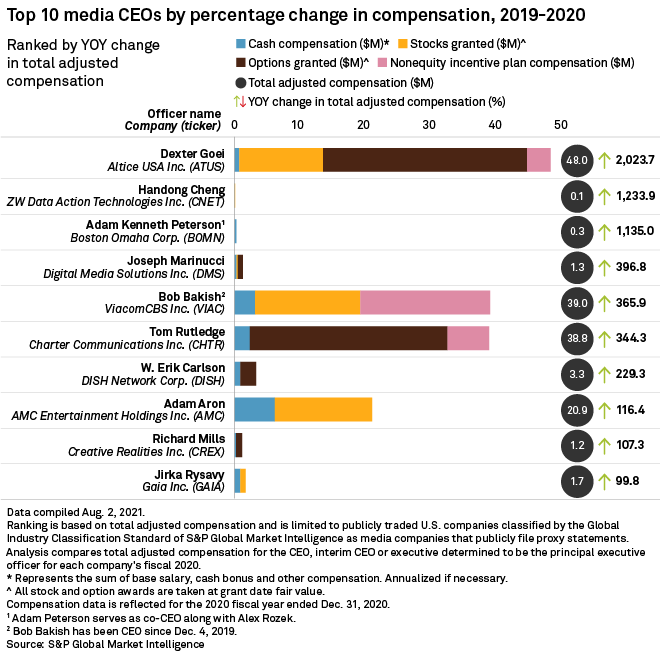

However, the highest-paid media CEO of the year was Dexter Goei of Altice USA Inc., as the executive saw a massive jump in stock and options compensation.

Goei's 2020 total adjusted compensation was up over 2,000% year over year to $48.0 million, against a base salary of just $778,846. Goei's 2019 base salary was $750,000.

The Altice CEO's pay was boosted by $31.0 million in options and $12.7 million in stock granted during the year. The massive jump in stock and options was due to the four-year rollover of the company's Long Term Incentive Plan, which it launched in 2017.

Theater operator AMC Entertainment Holdings Inc. had a very difficult year, as theater closures related to pandemic lockdowns drove the company to nearly zero revenue. That led to furloughs or layoffs for 26,000 theater employees, as well as furloughs for 600 of its corporate employees, including CEO Adam Aron.

Unable to operate the company's 100-year-old cinema business, executives focused on engineering AMC's balance sheet to weather the storm, issuing equity and debt and striking agreements with lenders to restructure its outstanding obligations.

AMC's board decided to reward Aron for the effort and also provide him the incentive to continue with the company at a time that much of AMC's leadership was resigning under the operational pressure.

"The COVID-19 pandemic and the public health response to it had a catastrophic impact on the company's business and made previously established short and long-term performance targets extraneous to our core objective — the company's survival," AMC said in recent company filings. "The compensation committee made a number of strategic and extraordinary decisions during 2020. We believe that our exercises of discretion were reasonable and necessary in light of our executive officers' actions in circumventing potentially catastrophic outcomes for stockholders."

In the end, AMC did not increase the base salary for its key executives, including its CEO, but it altered its stock incentive program to focus on adjusted EBITDA growth for the years following 2020, and it launched a special stock compensation program.

The result was an $8.3 million jump in stock and options awarded during 2020 compared to 2019 and a 116.4% jump in total adjusted compensation for Aron, who exited the year with $20.9 million in total adjusted compensation.