Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Feb, 2021

By Komal Nadeem

Chubb Ltd.'s shares were among the week's biggest winners after the company reported year-over-year income gains and fewer catastrophe losses for the fourth quarter of 2020 and said it would increase its stock repurchase program.

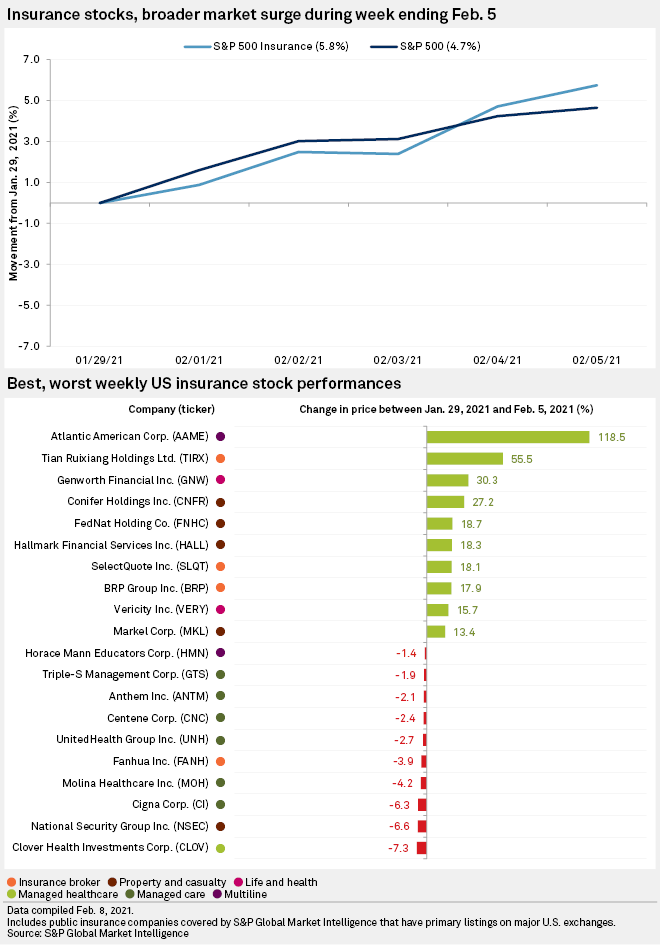

The insurance sector underperformed the broader market for the week ending Feb. 5 but still made solid gains. The SNL U.S. Insurance Index rose 2.19% to 1,187.10, while the S&P 500 climbed 4.65% to 3,886.83.

Chubb reported fourth-quarter 2020 core operating income and more than doubled net income to $2.42 billion, or $5.34 per share, from $1.17 billion, or $2.57 per share, in the fourth quarter of 2019.

The insurer's first quarter is off to a very good start and market conditions remain similar to that fourth quarter of 2020, Wells Fargo analyst Elyse Greenspan said in a research note. The commercial market has "legs," Greenspan said. She is confident in Chubb's ability to grow its business and expand its margin moving forward.

Piper Sandler analyst Paul Newsome said Chubb should continue to post strong margin expansion in 2021, as it has a better balance sheet compared to its peers. If Chubb continues to be careful with its reserve condition, the company will be in an "excellent position" to capitalize on growth opportunities as the hard market matures, Newsome said in a note.

In addition to disclosing its financial results, Chubb also said its board boosted the company's stock buyback authorization by $1 billion to $2.5 billion.

The insurer's shares finished the week higher by 11.59%.

Argo Group International Holdings Ltd. released loss estimates for the fourth quarter of 2020 and said losses related to natural catastrophe events and the continued impact of the COVID-19 pandemic are expected to affect its fourth-quarter 2020 results. The company anticipates cat losses of about $38 million in the quarter, mainly connected to hurricanes Delta and Zeta and about $13 million of pandemic-related losses.

Argo's shares finished the week up 2.38%.

A few heavy hitters in the life insurance space also announced their fourth-quarter 2020 results. MetLife Inc. moved strongly higher, rising 9.20%, while Prudential Financial Inc. added 2.40%. Aflac Inc. logged a more modest increase of 0.60%.

Managed care company Cigna Corp. was among the worst performers as it reported lower fourth-quarter 2020 adjusted income. The company attributed the decline to pandemic-related impacts and the return of the health insurance tax. COVID-19 impacts included the direct costs of virus testing and treatment, as well as the costs of actions taken to support customers, providers and employees, and decreased specialty contributions.

Cigna's adjusted income from operations fell to $1.27 billion, or $3.51 per share, from $1.62 billion, or $4.31 per share, a year earlier.

The stock finished the week down 6.28%.

Health insurance broker eHealth Inc., which saw its stock plunge late last week after revealing preliminary earnings and cutting its full-year 2020 outlook, posted one of the biggest increases as its stock soared 20.65%.