Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2021

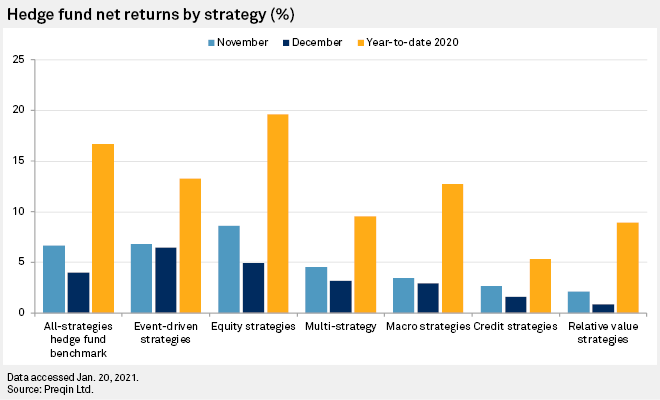

Global hedge funds extended their full-year gains in December, with funds employing equity strategies emerging as the year's top performers, according to the alternative assets data provider Preqin.

Preqin's All-Strategies Hedge Fund benchmark returned 3.99% last month, pushing the gains for 2020 to 16.69%. "This marked a drastic turnaround from the ill effects brought by COVID-19 earlier in the year," Preqin said.

Equity strategies led all hedge fund strategies in 2020, returning 19.59%, following a gain of 4.95% in December. The S&P 500 index gained 16.3% in 2020, or 18.4% on a total-return basis.

Event-driven strategies outperformed other hedge fund strategies in December, gaining 6.45%. Event-driven strategies were the second-biggest winners in 2020, returning 13.28% for the full year.

Relative value strategies were the weakest performers in December, with a gain of 0.89%, while credit strategies recorded the lowest returns for the full year, with 5.32%.

By currency, hedge funds denominated in U.S. dollars were the best performers in December and in the full year, with gains of 4.68% and 20.60%, respectively.

Hedge funds denominated in pound Sterling recorded the second-highest returns in 2020, with 9.91%. Funds denominated in Japanese yen performed the weakest in December and in the full year, with gains of 1.55% and 4.32%, respectively.