This piece is produced by S&P Global Sustainable1, S&P Global's single source of essential sustainability intelligence to navigate the transition to a low carbon, sustainable and equitable future.

Lately, we’ve been hearing from firms outside the EU asking whether the Sustainable Finance Disclosure Regulation (SFDR) applies to them. Until recently, European legislation may not have been at the top of the agenda for financial services firms in the U.S., or anywhere outside the European Union.

But two factors might have you suddenly realizing that it’s worth paying attention to EU sustainable investment regulation, regardless of where you’re based. This is, especially true since some of this regulation is already in effect.

First, in order to market investment funds in the EU, firms often set up a local legal entity that could potentially expose the parent company to EU regulation. Second, the EU put new regulation in place mandating sustainability disclosure from certain types of financial firms. Let’s examine this further.

Demand for environmental, social and governance (ESG) investment products has grown substantially, with a 10-fold increase1 in inflows to ESG funds from 2018 to 2020 just in the U.S. The SFDR is an EU regulation that seeks greater transparency from firms marketing investment products in the EU that have an explicit sustainable investment objective, an environmental or social characteristic and even products that do not consider ESG (as mentioned in this SFDR primer2). The SFDR seeks disclosure from such firms on how their funds perform related to certain ESG factors, or Principle Adverse Impacts (PAIs). It focuses on “Financial Market Participants” (FMPs) — an umbrella term for firms that fall within several financial services industries3.

Will parent companies outside the EU be impacted by SFDR? Which non-EU country’s financial firms have the greatest exposure? Does it matter if the subsidiary FMP or parent is a private company? We looked at these questions leveraging S&P Global Market Intelligence data.

First, we identified the largest FMPs that are likely subject to the SFDR, focusing on FMPs based in the EU with more than 500 employees. We then narrowed this list to those FMPs with parent companies outside the EU that are also in financial services industries. Finally, we consolidated the list of parent companies as some had more than one EU FMP subsidiary.

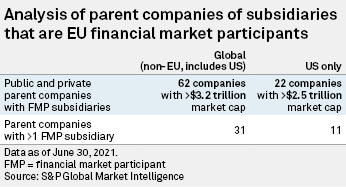

Starting with the parent companies, we identified 62 operating in financial services as their primary sector. About half of that group — 31 companies has more than one FMP subsidiary in the EU. If a parent company has more than one FMP subsidiary, will it be more inclined to implement ESG measuring and monitoring of its products at the enterprise level, or just at the EU FMP subsidiary level?

Market cap associated with only the publicly listed parent companies totals over $3.2 trillion. If we were able to add in the value of private companies, that number would be far higher.

Parent companies headquartered in the U.S. account for more than $2.5 trillion of that $3.2 trillion figure, though in terms of numbers, only about one third of the companies are U.S.-based. With this in mind, U.S. parent companies will want to understand the evolving EU SFDR requirements.

To put these parent companies in context among financial services players globally, we looked at whether they are the constituents of the S&P 500 and S&P Global BMI as proxy lenses for large caps in the U.S. and globally. A majority of the U.S. companies are constituents of the S&P 500 and more than half of the 62 global companies are constituents of the S&P Global BMI. This list includes some of the largest, most well-known financial firms.

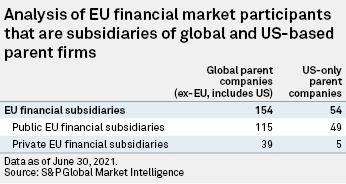

We identified 154 subsidiaries in the EU that had a parent company located outside the EU, suggesting that many firms will be discussing SFDR requirements for their businesses with headquarters beyond EU borders.

Private company dilemma

As seen above, there are both public and private financial firms that have EU FMP subsidiaries, and the expectation to disclose in line with the EU SFDR applies to both. This presents a shift for firms based in regions where disclosure requirements for private equity funds are lower than for public equity funds, and where such requirements do not consider sustainability factors.

Learn more about how SFDR will impact private companies in this episode of ESG Insider, a podcast hosted by S&P Global Sustainable1

Expectations of asset managers related to ESG disclosure are a major topic globally. More than $3 trillion worth of parent firms based outside the EU will be considering how their EU subsidiaries can begin to measure, monitor and disclose on ESG performance of investment products in line with the SFDR. These firms are both public and private, representing a shift from the historic focus on just publicly listed companies and funds. Will this raise the bar for fund-level ESG disclosure to investors beyond the EU?

Navigate the regulatory landscape with essential intelligence Align with SFDR

SPEAK TO A SPECIALIST1“ESG funds beat out S&P 500 in 1st year of COVID-19; how 1 fund shot to the top”: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/esg-funds-beat-out-s-p-500-in-1st-year-of-covid-19-how-1-fund-shot-to-the-top-63224550

2 “What is the Impact of the EU Sustainable Finance Disclosure Regulation (SFDR)?”: https://www.spglobal.com/marketintelligence/en/news-insights/blog/what-is-the-impact-of-the-eu-sustainable-finance-disclosure-regulation-sfdr

3Article 2 of the SFDR text defines “Financial market participants”: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32019R2088&from=EN