Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Research & Insights

Who We Serve

Research & Insights

Who We Serve

In Person

The National Gallery Singapore

The speed and scale of biodiversity loss and ecosystem degradation are the highest in history. Research from S&P Global Sustainable1 shows that 54% of companies in the S&P Global BMI have a significant dependency on nature across their direct operations, with 16% of companies having at least one asset located in a Key Biodiversity Area (KBA) that could be exposed to future reputational and regulatory risks.1

Analysis from Singapore Sustainable Finance Association (SSFA)’s recently published practical guide for FIs getting started on nature financing2 similarly highlights that investors and banks in the region may face material nature-related risks through their investments and lending and that the next step is for financial institutions to examine specific areas of risk in sectors of economic importance to the region such as agriculture, mining, manufacturing and real estate through a materiality and risk assessment.

Over the course of lunch, we will look to cover:

We would like to extend an invitation for you to join us at the Sustainable1 Summit – Unlocking Transition Opportunities, taking place the same afternoon, also at the National Gallery. Indicate your interest by checking the box in the registration form.

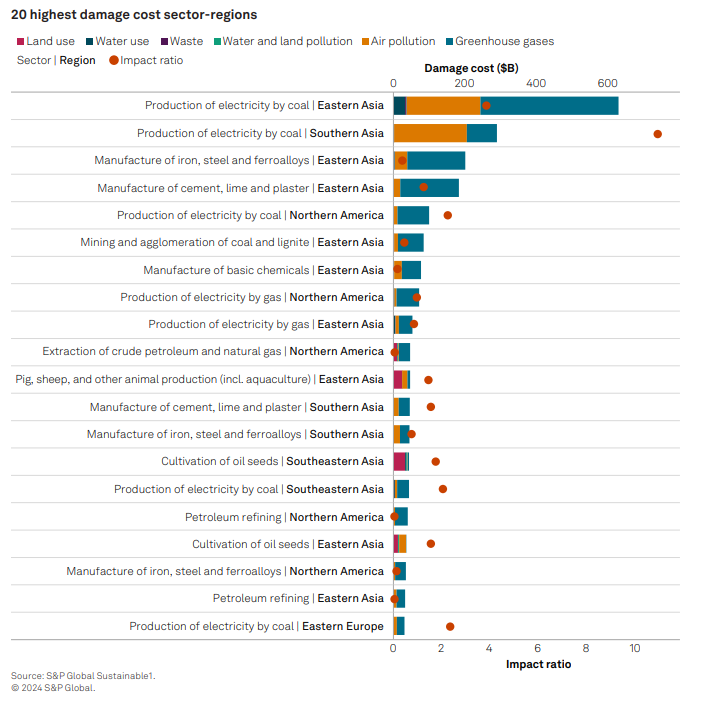

Related Publications1: Unpriced Environmental Costs: The Top Externalities of the Global Market

Related Publications2: Financing our Natural Capital: A practical guide for Fis getting started on nature financing

*This is strictly an invitation only event with limited capacity. Please RSVP via the registration link above

S&P Global Sustainable1

Global Head of Thought Leadership

Lindsey Hall is Global Head of Thought Leadership at S&P Global Horizons, where she hosts the All Things Sustainable podcast. The show interviews leaders around the globe and has been downloaded more than 2 million times by an audience on six continents. Lindsey also leads the S&P Global Sustainability Research Lab, which produces the Sustainability Quarterly Research Journal, S&P Global's flagship sustainability publication.

She got her start in financial journalism writing for various Financial Times publications in London before joining SNL Financial in 2010, where she spent a decade covering financial news and regulation as a reporter and editor.

Lindsey holds a Masters from the London School of Economics.

S&P Global Sustainable1

Head of Nature Research and Methodology

Gautier Desme is Head of Nature Research and Methodology at Horizons, leading the development of new datasets on environmental and climate issues, such as the development of analytics that allow investors and businesses to quantify the nature-related risks in their portfolios and operations.

Gautier Desme is Head of Nature Research and Methodology at Horizons, leading the development of new datasets on environmental and climate issues, such as the development of analytics that allow investors and businesses to quantify the nature-related risks in their portfolios and operations. Prior to that, Gautier served in other leadership roles, leading on sovereign carbon risk, green bonds analytics and positive impact.

Gautier started his career at Crédit Agricole Corporate & Investment Bank in London, first as a credit structurer, then in commodities derivatives structuring, where he designed investment strategies and products across energy, metals and agriculture markets. He developed and issued the first EUTS carbon note in 2010, allowing investors to benefit from arbitrage opportunities in the EU Carbon Allowance market.

Gautier holds a master’s degree in Financial Markets from University Paris Dauphine, and a master’s degree in Environmental Technology from Imperial College London.

S&P Global Sustainable1

Manager, Corporate Sustainability Solutions,

If you have more questions, please feel free to contact our team.