Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

By Cristina Polizu, Miguel de la Mata, Sharon Liebowitz, Giorgio Baldassarri, Alexandre Birry, Andrew O'Neill, Davis Chu, and Victoria Schumacher

Highlights

Cryptocurrencies (excluding selected stablecoins) exhibit high volatility relative to traditional financial assets (such as equities or bonds), with sharp drops in value but also high returns.

Cryptocurrencies (excluding selected stablecoins) show a notable historical return correlation among themselves, although they started at different times and independent of each other.

Cryptocurrencies have generally shown low return correlation with traditional financial assets.

Bitcoin does not store value as gold does, but this is an evolving ecosystem, and the future may prove differently.

Stablecoins are cryptocurrencies with a market value tied to an external indicator such as a fiat currency, but there are significant differences between their performance and design. Some may not live up to their promise (note the recent collapse of TerraUSD).

Nicholas Weaver, senior staff researcher at the International Computer Science Institute, chief mad scientist at Skerry Technologies and known cryptocurrency skeptic, joins the Essential Podcast to discuss the recent news surrounding FTX and today's cryptocurrency landscape.

While it's been more than a decade since the introduction of cryptocurrencies and the disruptive technology that enables them, cryptocurrencies and the broader ecosystem remain a relatively small segment of the financial market. As of August 2022, the total market capitalization of cryptocurrencies stood at $1.1 trillion (down from its all-time high of $3 trillion), or about 2.5% of the U.S. equity market capitalization. Nevertheless, we believe that crypto assets and blockchain technology are here to stay.

There are still challenges in understanding crypto assets' performance and their relationship with traditional financial assets. Crypto assets and blockchain define an ecosystem that exhibits significant differences from the existing financial system (although the demise of TerraUSD illustrates that the basic laws of finance continue to apply to this ecosystem). Market participants still debate as to whether they behave like currencies, commodities, or financial securities, or are something else, such as synthetic financial instruments backed by a new technology and an algorithmic trading protocol. The feedback from all market participants, however, is that the crypto world is volatile.

To better understand this asset class, its valuation, and the varying volatilities of the diverse crypto markets, we are doing a deep dive into the crypto ecosystem by performing a study that compares various crypto assets among themselves and with more traditional assets (such as equity markets, bond indices, gold, and fiat-pegged currencies) using data through August 2022. Of note, understanding volatility risk is paramount to appropriately assessing capital and margin requirements when crypto assets are included in portfolios and in trading and lending protocols.

Chart 1 below juxtaposes key performance drivers for crypto markets and for traditional financial assets. Traditional markets comply with government-enforced regulations, and tend to be more transparent and to abide by basic economic laws. The crypto ecosystem, on the other hand, is driven more by market adoption and technology.

Chart 1

Cryptocurrencies are a digital transfer of value that function on a blockchain public ledger. A blockchain’s core building blocks are hash cryptography (including digital signatures), immutable ledgers, a peer-to-peer network, mining or staking, and a consensus protocol to allow new blocks (see chart 2).

Chart 2

To analyze characteristics and performance drivers for this new asset class and compare the crypto ecosystem with traditional financial data in terms of market valuation and liquidity risk, our study focuses on four cryptocurrencies with a large market cap (Bitcoin, Ether, XRP, and Binance coin) and three stablecoins (Tether, USD Coin, and multi-collateral Dai).

The following are details on the four cryptocurrencies with a large market cap:

Bitcoin (BTC): BTC was created in 2009 by a programmer or group of programmers under the pseudonym of Satoshi Nakamoto and is described as a peer-to-peer electronic cash system that facilitates payments without a financial intermediary. Today it is the largest crypto asset, and it operates on its own Bitcoin blockchain.

Ether (ETH): ETH is the second-largest crypto asset by market cap and was launched in 2015. Its blockchain, Ethereum expands the use case to "programmable money," smart contracts, tokens, and ICOs.

XRP: XRP is another popular cryptocurrency. Together with its blockchain, it is designed to support payment use cases and process transactions at a fast speed. Ripple Labs controls almost half of the supply of the asset, albeit stored in vaults that release up to one billion XRP tokens a month, and 15% of the unique node list validators, which makes XRP a bit different from Bitcoin and Ether.

Binance coin (BNB): BNB, along with the Binance Exchange, (one of the world’s largest exchanges), was launched in 2017 and has many use cases on the Binance blockchain.

Cryptocurrencies have been an attractive investment opportunity due to high positive returns, but they also exhibit high volatility and significant negative-return periods. For example, Bitcoin lost in 2014 almost 59% of its value and, in 2018, almost 73% of its value. Since November 2021, when Bitcoin was at its peak of almost $68,000 USD, the cryptocurrency lost more than half of its value in the following six months. The speculative nature of cryptocurrencies and their high volatility led to the creation of stablecoins, which act as a bridge between the crypto ecosystem and the traditional financial world. Stablecoins are designed to hold a stable value by pegging to a reference asset such as fiat currency (for example, USD). They create a more stable cryptocurrency and are typically backed by fiat assets, crypto assets, or an algorithm. Stablecoins play an essential role in decentralized finance (DeFi) protocols. One reason for their high popularity is due to them being used as a medium of exchange by decentralized finance trading protocols. Stablecoins are used to ease transactions with other cryptocurrencies and replace fiat currencies (see [1]). Yet, there are significant differences between the performance of stablecoins based on the type of collateral or lack thereof.

We looked at the following three stablecoins:

Tether (USDT): USDT is the largest stablecoin by market capitalization ($67.5 billion) and is pegged to the U.S. dollar.

USD Coin (USDC): USDC is the second-largest stablecoin ($51.7 billion). Tether and USD Coin are centralized fiat-collateralized stablecoins, meaning that each token is backed by one dollar in reserve assets. They are backed by cash and cash equivalents and financial assets, including certificates of deposits, U.S. Treasuries, commercial paper, and certain bonds.

Multi-collateral Dai (DAI): DAI is a decentralized cryptocurrency pegged to the U.S. dollar ($6.9 billion in market cap). Unlike USDT and USDC, DAI is backed by crypto collateral and uses an algorithm based on margin trading to govern and maintain its peg. DAI coins aim to protect their peg by being overcollateralized.

The aforementioned stablecoins have relatively successfully maintained a value close to their peg over their limited history.

TerraUSD (UST): UST was a decentralized stablecoin and was not backed by U.S. dollars in a bank account. Instead, it used an algorithmic trading based on another token (LUNA) to manage its peg. To mint one UST token, $1 worth of TerraUSD's reserve asset (LUNA) had to be burned. Since May 9, 2022, the price of LUNA and UST collapsed, and so did their market capitalization.

While the centralized stablecoins and DAI managed to weather the shockwave caused by the collapse of UST, as shown in chart 3, the collapse of TerraUSD in May 2022 underlined the volatility risk of a stablecoin that was not fully backed by reserve assets, and instead relied on an algorithm to maintain a peg.

Contagion effects and market uncertainty have contributed to the lowest price since November 2021 of Bitcoin of below $20,000 and to the reduction of more than 50% in size for the crypto markets.

Chart 3

The crypto market trades 24/7. For the purpose of our study, we focused on the universal coordinated time (UTC) daily price of a selected sample of cryptocurrencies that dominate the markets. Typically, the start price at the inception of the coin is close to zero, but during their lifetime, they achieve various levels (see tables 1 and 2 below). Notably, Bitcoin achieved the highest price to date in November 2021. It has since dropped more than 60% in value.

The market capitalization of any given coin is calculated by multiplying the value of one unit with the supply in circulation. Chart 4 below shows the market cap for the cryptocurrencies in our study in March and May 2022. By far, Bitcoin and Ether dominate the market cap in the crypto markets.

Despite considerable high returns, crypto assets have seen significant drops in value. The daily largest drop in price for Bitcoin and Ether was recorded around March 11, 2020, the date when WHO declared the COVID-19 crisis a pandemic. Table 3 below summarizes the largest price decline for the studied sample.

The highest 24-hour positive returns are also notable, and we show them in chart 5 below together with the largest drops in value.

Chart 5

We then looked at return correlation among the cryptocurrencies to better understand the interaction within their ecosystem. Despite the fact that the genesis of each coin is independent of each other and the fact that they were created on different platforms using different protocols and at different points in time, our analysis shows (since 2018) moderate-to-high correlation among the cryptocurrencies, excluding stablecoins. The stablecoins exhibit insignificant correlation with the other cryptocurrencies (table 4), which is somewhat expected.

Table 4

Next, we took a closer look at the 100-day correlation between Bitcoin and Ether and between Tether and USDC to break down the historical data into shorter periods. Chart 6 shows that the interconnectivity between BTC and ETH is consistently high, as is the overall historical correlation. As a comparison, we added on the same graph the rolling correlation between the two largest holdings in S&P 500, which are for Apple (AAPL) and for Microsoft (MSFT). The two largest stocks exhibit medium-to-high correlation, as do the two largest cryptocurrencies (BTC and ETH) (see chart 6).

Chart 6

The comparison of crypto markets with the equity markets provides more insight into the crypto ecosystem. Our analysis shows high volatility, high returns, and, to date, low correlation with equities. We performed a comparative study with the top three holdings in the S&P 500 (SPX): Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). In terms of market cap, each of these three equities dwarfs even the largest cryptocurrencies, as illustrated in chart 7 below. We looked at the top three holdings to provide meaningful comparison with the cryptocurrencies that exhibit the highest market cap.

Chart 7

From chart 8 below, we see that cryptocurrencies, excluding stablecoins, generally, exhibited wider dispersion for their daily returns (on both positive and negative sides) compared to the stock returns. This shows the highly speculative nature of cryptocurrencies and reinforces that these two asset classes are potentially driven by different factors. In chart 8, we show the box-plots for daily percentage changes for cryptocurrencies, excluding stablecoins, for SPX and the top single stocks (AAPL, MSFT, and AMZN).

Chart 8

Chart 9 shows a plot of the quarterly returns for Bitcoin since 2014 shows "bull" and "bear" periods in its short lifetime, a potential to outweigh other financial assets' returns and attract investors for longer investment periods. While traditional markets have a long track history and established performance cycles, the nascent crypto market is rapidly evolving, and its "bull" and "bear" periods may be driven by idiosyncratic factors.

Chart 9

In the past few years, crypto assets exhibited significantly more volatility than equities. Chart 10 below shows the rolling annualized volatility for crypto assets, SPX and the top three SPX holdings. The volatility stays above 60% for the cryptos, excluding stablecoins, while the top three SPX holdings exhibited less volatility. Stablecoins’ volatility is generally low, although the track record of stability remains uncertain for some of them.

Chart 10

The drivers for cryptocurrency valuation are different from those of traditional financial data; thus, a low correlation is not surprising. For example, the equity of a firm increases in value due to increased earnings, higher operating profits, interest rates, tax laws, and monetary policies. Cryptocurrency valuation, on the other hand, is driven by market confidence and adoption, liquidity, supply and demand, market sentiment, and regulatory landscape. As such, we do expect that crypto assets may not exhibit a systemic correlation with traditional financial data, although some degrees of interconnection between the two markets do exist. For example, favorable market conditions such as a strong GDP and low unemployment contribute to an increase in investors’ confidence. Due to their short history and speculative nature, we acknowledge that new trends might add more transparency in how cryptocurrencies and equities relate to each other, as more retail and institutional investors have positions in both equity and crypto markets.

As seen in table 5 below, the historical correlation since 2018 between the daily returns of the crypto assets, SPX and the largest three stocks is less than 0.3.

Table 5

A deeper dive into 100-day rolling correlations for Bitcoin and the top three largest holdings shows that the return correlations increased during the COVID-19 March 2020 period and during the first quarter of 2022, but otherwise remained low (chart 11).

Chart 11

Chart 12 shows a spike in correlation between USDC and SPX at the beginning of 2020, followed by a shift to negative correlation in the second quarter of 2020. Stablecoins may not follow the downward trend in the stock market as they are designed to hold their peg.

Chart 12

Some market participants attribute to cryptocurrencies a behavior closer to technology stocks, rather than to a currency, a commodity, or a large cap equity index: high risk, high reward, and speculative in nature. By the same token, cryptocurrencies often don’t have corporate management and people like tech stocks have. As the top three holdings from S&P 500 are also top holdings in NASDAQ (NDX), we limit our study to the composite index. Notably, the technology sector accounts for more than half of the index.

To date, the crypto markets (excluding stablecoins) have generally displayed wider returns dispersion as shown in the box-plot graph in chart 13.

Chart 13

Cryptocurrencies have also consistently maintained a higher volatility than the tech index, as shown in chart 14 below where we plot the rolling volatility.

Chart 14

While the 100-day return correlation for NASDAQ and cryptos follows a similar pattern to the one exhibited by S&P 500 and Bitcoin (shown in chart 11), there is an upward trend in the past months with levels exceeding 0.5.

Chart 15

As the crypto markets are powered by technology and innovative protocols, rather than by economic growth, it remains to be seen how the interconnectivity between crypto and financial markets evolves through time. Absolute inferences on the interaction between crypto markets and traditional financial data are difficult to make; they may hold for short periods of time, but more data is needed to study long term trends.

We repeated this historical analysis for a bond index (S&P 500 bond index total return), and as expected, we found that the bond index aligns closer with the stablecoins in terms of volatility, while maintaining a low correlation with cryptocurrencies throughout most of the historical study period, as shown in charts 16 and 17 below.

Chart 16

For thousands of years, gold has been and still is the oldest store of value and hedge against market downturns. Central banks use it as a reserve asset and as an inflation hedge. When Bitcoin was launched, it was often referred to as "digital gold." The market rallied expectations that Bitcoin may play a similar role as gold in a portfolio: store value and weather economic downturns. To live up to this promise, Bitcoin’s correlation with gold is expected to be significant especially if the market adopts Bitcoin as an investment asset during stress periods. Our study shows that this expectation has not been fulfilled so far. Starting with the volatility of gold in the 1970s, which was one of the periods of high volatility for gold, we see little resemblance with the initial period of volatility for Bitcoin, as shown in charts 18a and 18b below.

Chart 18a and Chart 18b

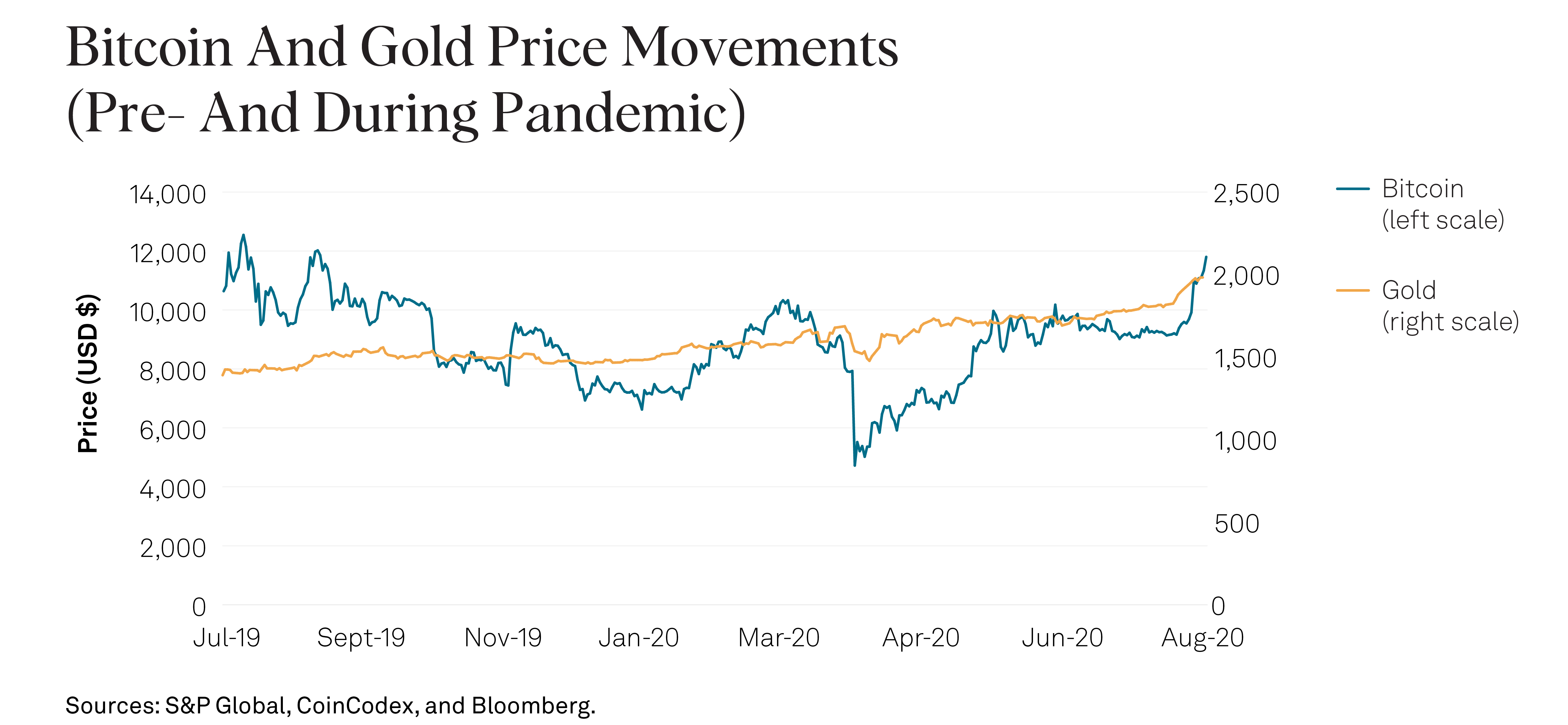

During the pandemic, many investors transitioned to gold, and, as a result, the price of gold increased by more than 40% from mid-2019 to mid-2020. Bitcoin over the same period did not exhibit a clear trend of an asset that holds value and protects against market downturns, as shown in chart 19.

Chart 19

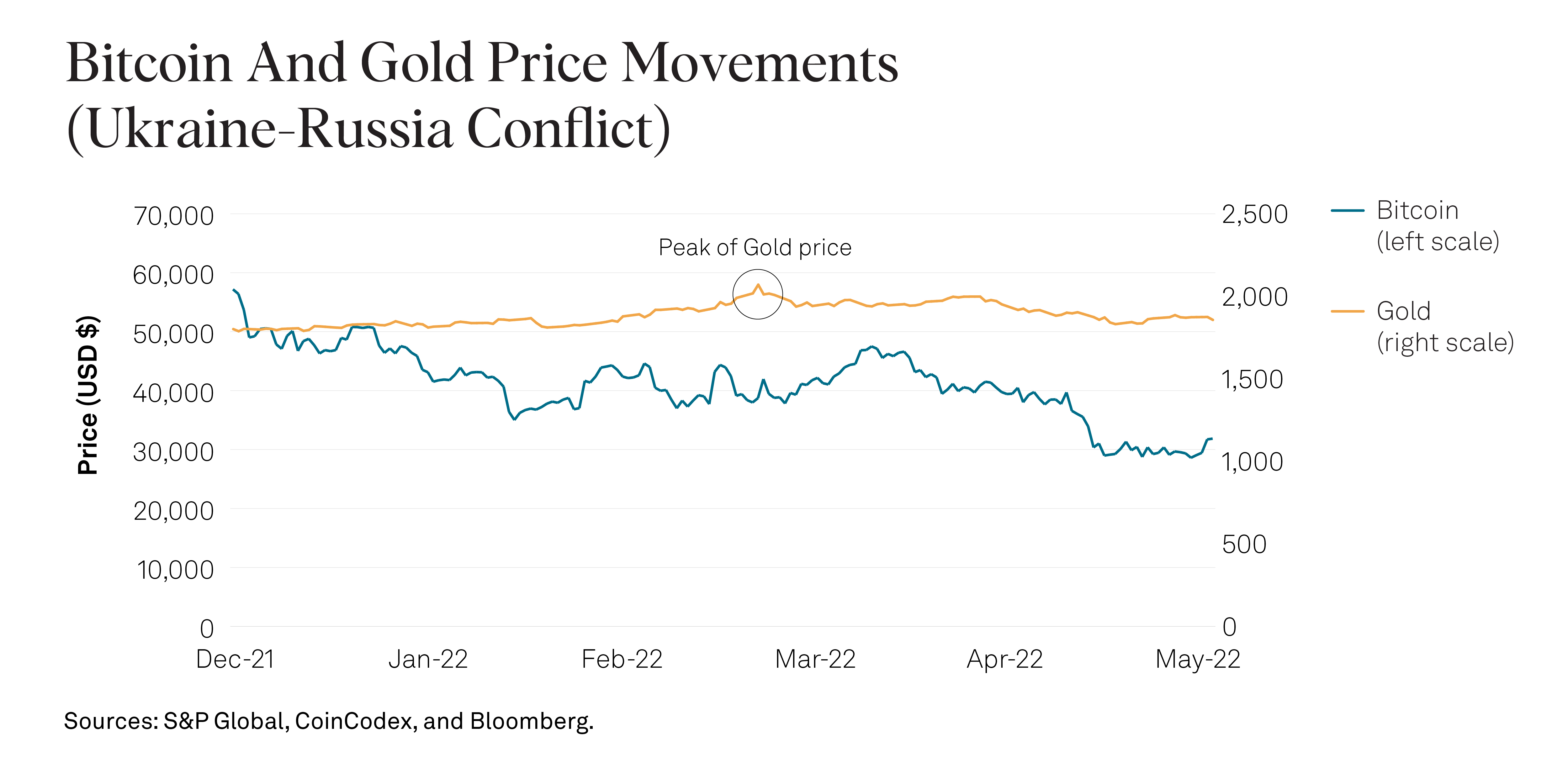

Additionally, in the recent Ukraine-Russia conflict-dominated months, while gold price trended upward, there was no obvious flight to quality for Bitcoin, as illustrated in chart 20 below.

Chart 20

Moreover, as inflation fears intensify and inflation indices trend undoubtedly upward, and as supply chain shortages, energy concerns, and war uncertainty continue to grow, Bitcoin’s price fell to its lowest level since November 2021, while gold, after a rally during the first quarter, averaged higher than pre-pandemic levels (e.g., July 2019).

Noticeably, the high returns for crypto assets have exceeded the ones for gold, which distinguishes them as high reward assets rather than value storage assets, see chart 21 below.

Chart 21

A rolling volatility analysis shows that gold’s performance as a commodity lines up closer with that of the stablecoins, and exhibits significantly lower volatility than the other crypto assets.

Chart 22

To date, gold exhibits low return correlation with the cryptomarket, but this may change in the future if markets will adopt crypto assets as a store of value; although, to date, there are no significant signals to point in that direction (see table 6 below).

Table 6

A deeper dive into the return correlation over 100-day windows shows generally low levels of correlation between gold and Bitcoin, with a modest spike in the pandemic's first months. The same low correlation levels hold for gold and USDC. In the first quarter of 2022, when the market has been dominated by fears of inflation and war uncertainty in Europe, we did not see increased trends in correlation for gold and the crypto assets. Going into the third quarter we see though a positive slope in rolling correlation (see chart 23 and chart 24).

Chart 23 and Chart 24

Regulation, utility, and liquidity are other variables that are relevant for both markets. While gold is highly regulated, the regulatory framework for cryptos is still evolving and country dependent. With newly emerged technologies and decentralized finance, cryptos expanded their use cases to lending, borrowing, and other financial transactions, but it is too early to assess whether cryptos will be perceived as a utility in the traditional sense.

In terms of liquidity, gold has a cost related to the physical commodity (storage and transportation), while crypto assets exhibit a different type of cost related to mining and cold wallet storage.

Pegged fiat currencies are a legal tender whose value is backed by governments and precede the recent expansion of stablecoins. A natural question to ask is whether stablecoins and traditional fiat pegged currencies exhibit similarities in terms of volatility. To do that, we studied the last few years of exchange rates for Hong Kong dollar (HKD) to USD and compared it with the performance of stablecoins. We chose the HKD because its pegging system has been set up for decades and is implemented in a predictable and disciplined way. Pegged fiat currencies typically require large amounts of capital reserves and rely on government and central bank support for maintaining the peg. This process is quite different for the stablecoins ecosystem, where some coins rely on cash and traditional assets as collateral and others use crypto collateral and algorithms.

The daily returns dispersion is markedly higher for the three stablecoins than for the fiat exchange rates, with DAI showing the largest dispersion (see box-plot graph in chart 25).

Chart 25

Rolling annual volatilities support a similar conclusion (see chart 26). However, the volatility of the stablecoins has trended downward in the past couple of years, though without a complete convergence to the volatility of the HKD peg.

Chart 26

Historically, daily return correlations for stablecoins and the HKD/USD exchange rates are low as shown in Table 7.

Table 7

Similarly, chart 27 shows that the 100-day rolling correlation consistently remains on the low side.

Chart 27

We find that key to understanding cryptocurrencies is the comprehension of the fundamental principles of blockchain and decentralized finance, as well as the performance drivers of this new asset class. Our study of the volatility of cryptocurrencies and their correlation to traditional financial assets provides more insight into this new ecosystem, as it enters its second decade. As more data become available and regulatory frameworks continue to develop, we believe that questions about future patterns in cryptomarkets will be at the center of many research studies.

Exploring Crypto And DeFi Risks In Credit Ratings, June 30, 2022

Stablecoins Common Promises, Diverging Outcome, June 15, 2022

This report does not constitute a rating action.