Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Published: September 1, 2019

Highlights

To read the full report, please download the article.

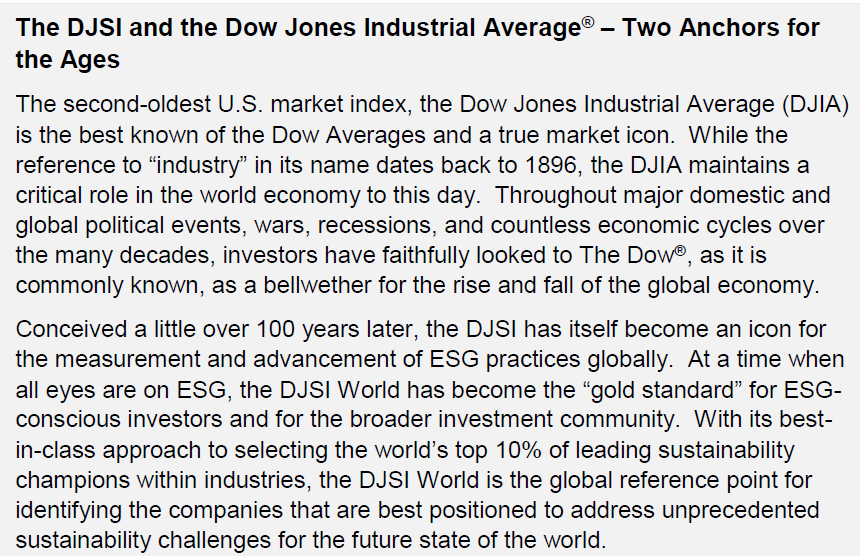

The year 1999 gave the world the euro, The Matrix, and the world’s first ever global sustainability benchmark—the Dow Jones Sustainability Index (DJSI). The product of a landmark collaboration between S&P Dow Jones Indices and SAM (now RobecoSAM), the DJSI pioneered sustainable indexing and has shaped corporate sustainability practices ever since. To commemorate the 20th anniversary of the DJSI in 2019, we reflect on its origins, its impact on the market, and the possible future of the sustainable investing landscape. Inclusion in the DJSI is seen as a badge of honor by sustainability champions around the world. Perhaps no other benchmark has had as profound an impact on the behavior of companies, as they seek to secure a coveted spot in the world-renowned DJSI World each year. Today, there are over 37,000 sustainable indices available worldwide, and with a 60% increase in the number between 2017 and 2018 alone, the industry is rapidly transforming. Amid this proliferation of environmental, social, and governance (ESG) benchmarking tools, the DJSI continues to make waves as the evolving global standard for benchmarking corporate sustainability performance, even two decades later.

The notion of responsible investing is practically as old as investing itself. Records date back to the 18th century, when faith-based groups such as the Quakers and the Methodists provided guidance on “sinful” investments to avoid. To this day, faith-based strategies like Shariah-compliant investing are offered within the broader sustainable investment framework. However, the modern socially responsible investing (SRI) movement, as we know it, took off in the 1960s and 1970s, for example, with the boycott, divestment, and sanctions against South African companies during the era of apartheid.

Similar measures were adopted during the Vietnam War, culminating in the establishment of the first ethical investment vehicle, the Pax World Balanced Fund, in 1971. The mutual fund, which avoided investments in the supply chains of the controversial tactical herbicide Agent Orange, offered a channel for values-driven investors seeking to redirect their investments on the basis of pacifist moral principles. Together, these movements paved the way for a generation of socially conscious investors seeking to affect social and political change, underscoring the ambition of the adage of “putting one’s money where one’s mouth is.”

By the 1980s, SRI had become fairly standardized in removing “sin stocks,” such as alcohol, tobacco, weapons, and nuclear energy, from investment portfolios. Fundamentally about values, SRI is driven by the desire to align one’s investments with one’s beliefs. But as modern portfolio theory suggests, excluding stocks from the opportunity set reduces potential returns. While popular with values-driven investors, SRI thus did not gain widespread traction among mainstream investors and was left relegated to those willing to put their beliefs before their returns. However, the idea that responsible companies are not only morally superior, but are also superior in terms of financial performance was slowly starting to surface. In the early 1970s, the New York-based journalist Milton Moskowitz published lists of “responsible” and “irresponsible” companies, tracking their performance against the stock market. In 1973, he wrote in the New York Times, “I do harbor the suspicion that socially insensitive management will eventually make enough mistakes to play havoc with the bottom line.” While his thinking underpinned many of the ideas behind corporate social responsibility (CSR), it would remain largely disconnected from the typical investment process until ESG investing later became widespread—in part, due to the launch of the DJSI.

In the belief that financial analysis is incomplete without extra-financial information, SAM was founded in 1995 as one of the world’s first asset managers focused exclusively on sustainable investing. At the time, few companies disclosed their exposure to ESG issues. SAM analysts began contacting companies directly, via phone calls or written requests. While hopeful, these initial attempts of calling individual companies to collect information on relatively undisclosed topics, such as company performance on greenhouse gases or human rights, proved challenging and difficult to scale. Building on this initial ad-hoc research, the annual SAM Corporate Sustainability Assessment (CSA) was later created, in what would soon become one of the most robust and well-established processes for measuring corporate sustainability performance in the world.6 However, to get to that point, the relatively young Zurich-based asset management company needed the industrial clout of a globally recognized brand to get the largest companies in the world to willingly share this information. It was for this reason that the founders of SAM pitched to Dow Jones Indexes (now S&P Dow Jones Indices) the idea of a global sustainability index built upon the rich ESG data that would emerge. The result was a powerful partnership to create a financial product that would radically transform the sustainable investment landscape– ultimately giving rise to the Dow Jones Sustainability Indices in 1999. SAM founder, Reto Ringger, recently said in a speech at the International University of Geneva about these early discussions with Dow Jones Indexes that, “it was an exciting time, as nobody had measured the sustainability performance of companies before.”

In the beginning, just 280 companies provided SAM with data, with 228 companies selected for inclusion in the first iteration of the index. At first, it was a small, self-selecting group of sustainability pioneers. Transparency was poor, and it was hard to imagine that it would develop into the leading benchmark for corporate sustainability that it is today. Twenty years later, nearly 1,200 companies actively participate in the SAM CSA, competing for one of the top spots in the world-renowned DJSI. Inclusion in the index is often regarded as a badge of honor and many companies make responding to the CSA—which can take hundreds of hours to complete—a priority for their business. The CSA, which has become synonymous with the DJSI, is seen as the most comprehensive assessment of extra-financial and sustainability indicators (commonly referred to as ESG today). It continues to provide a robust methodology for measuring corporate performance and preparedness on ESG issues. In 2019, the CSA was recognized for being the highest quality of 11 leading ratings providers in SustainAbility's Rate the Raters 2019: Expert Views on ESG Ratings.

In recent history, several infamous events—the Bhopal Disaster, the Exxon Valdez oil spill, and the Enron scandal, for example—sparked growing concerns about irresponsible business practices. Later, many would question the long-term viability of traditional assumptions around company value. Thus, the idea emerged that a company’s overall performance may be tied to extra-financial, but financially material, issues, which helped move the responsible investing landscape from an emphasis on “values” (as with SRI) to a broader set of relevant information than what is captured by traditional financial metrics (that is, ESG). Furthermore, as company value has been shown to be increasingly driven by intangible assets, such as reputation and goodwill, there is greater understanding that long-term economic value is driven by many forms of capital—including social, environmental, and human—as well as financial. There is also a growing body of evidence that sustainable companies are associated with superior stock market performance and investment returns. Thus, beginning with the DJSI in 1999, there have since been several initiatives to encourage corporate reporting on these issues.

From the establishment of the Carbon Disclosure Project (2000), UN Principles for Responsible Investment (2006), International Integrated Reporting Council (2010), Global Initiative for Sustainability Ratings (2011), Sustainability Accounting Standards Board (2012), Sustainable Stock Exchanges Initiative (2012), Montreal Carbon Pledge (2014), UN Sustainable Development Goals (2015), France’s Article 173 (2015), Task Force for Climate-related Financial Disclosures (2015), and the EU’s Sustainable Finance HLEG recommendations (2018)—to name but a few—companies have a decisive mandate to disclose their performance on sustainability criteria. Moreover, many public pension funds, particularly in Europe, have introduced mandates requiring managers to incorporate ESG into their investment processes. This is creating a trickle-down effect that is catalyzing an ecosystem of investors demanding greater transparency on sustainability topics from the companies they manage. The sustainable investing landscape has thus grown tremendously in recent years to what is now a multitrillion-dollar industry, covering multiple asset classes from infrastructure and microfinance to public equities and sovereign bonds. Remarkably, one-quarter of all assets under management now incorporate ESG considerations within the investment process.

With the evolution of the DJSI since 1999, sustainability topics, corporate responsibility, and public reporting have evolved, while investor expectations have also risen. In the early days of responsible investing, sustainability roles were typically a function of communications or marketing– largely disconnected from core business decisions in most companies. CSR teams were often understaffed and underfunded departments that much of the organization would ignore. But today, it is usually the investor relations professionals and other sustainability champions that drive not only sustainable practices but many strategic business decisions.

Many companies were also quick to realize that sustainable, long-term value creation would need to consider more than just short-term profit. As companies understood that societal needs, the regulatory environment, and expectations from the public were evolving, they found that they could indeed be more successful by being more sustainable—for instance, by preserving the natural resources their supply chains depend on, being more efficient in the management of their resources, attracting top talent whose expectations increasingly include a sense of corporate responsibility, and producing products sustainably to meet changing consumer preferences. It is perhaps for this reason that the Business Roundtable notably redefined its “Statement on the Purpose of a Corporation” in August 2019, signed by 181 CEOs, in a move away from the primacy of the shareholder and toward a commitment to all stakeholders.

Over the past two decades, the SAM CSA and the DJSI have been the best-known sustainability barometers for corporations around the world. They have helped companies to bridge the gap between their sustainability journeys and investor demands for transparency amid the rapidly evolving sustainability landscape. Each year, new CSA topics are added and the scoring methodology is enhanced to ensure it stays current and to push for advances in corporate behavior and industry standards on ESG.

To this end, SAM frequently challenges companies on emerging ESG topics that may become part of upcoming regulatory changes, reporting guidelines, or simply the broader conversation (see Exhibit 1). For instance, the CSA first explored company tax strategies in 2014, just as this matter was becoming a contentious issue in corporate responsibility circles and well before companies had started to disclose on it. Indeed, since its inception, the CSA is often the first time a company is asked to consider a sustainability topic, spurring a conversation within the company that may lead to a change in its sustainability policies, business practices, or public reporting.

For some companies, the CSA provided early support to help shape and develop internal sustainability practices. For others, it provided a framework within which to think about sustainability in regions where regulations, investors, and consumers often lagged behind in sustainability thinking. Meanwhile, the ongoing quest to identify and measure under-researched and underreported material ESG topics in the CSA has prompted consistent disclosure around current sustainability themes for all.

For investors, the DJSI provided one of the first opportunities to invest in a subset of global companies that are leading sustainability practices within their respective industries. Today, there are approximately USD 4.5 billion in assets in funds or other passive products tied to the DJSI (see Exhibit 2 for historical performance).

The impact of the DJSI on the behavior of companies and the sustainable investing landscape is widely acknowledged within sustainability circles. In August 2019, a group of academics from HEC Paris researched and confirmed the value of a company being included in the Dow Jones Sustainability Indices in a paper titled, Do Investors Actually Value Sustainability Indices?; The research concluded that companies that are added to or remain within the DJSI “attract more attention from financial analysts” and that this also “lead(s) to an increase in the percentage of shares held by long-term investors indicative of a trend that professional investors are paying more attention to CSR-visible firms over time.” Additional research conducted on the Dow Jones Sustainability North America Composite Index

America Index in 2018 also concluded that a company’s removal from or addition to the index has a statistically significant impact on its stock price, either negatively or positively, respectively.

Indeed, the idea that long-term investors would flow more capital into the leading sustainability performers within the DJSI was a key selling point from that initial pitch to create the world’s first sustainability benchmark more than 20 years ago. However, at that time, the concept of ESG investing did not even exist. As a groundbreaking and novel contribution to the financial markets, the DJSI has had a profound impact—not just on corporate sustainability performance but also, to some extent, on the way many investors think about and ultimately define company value.

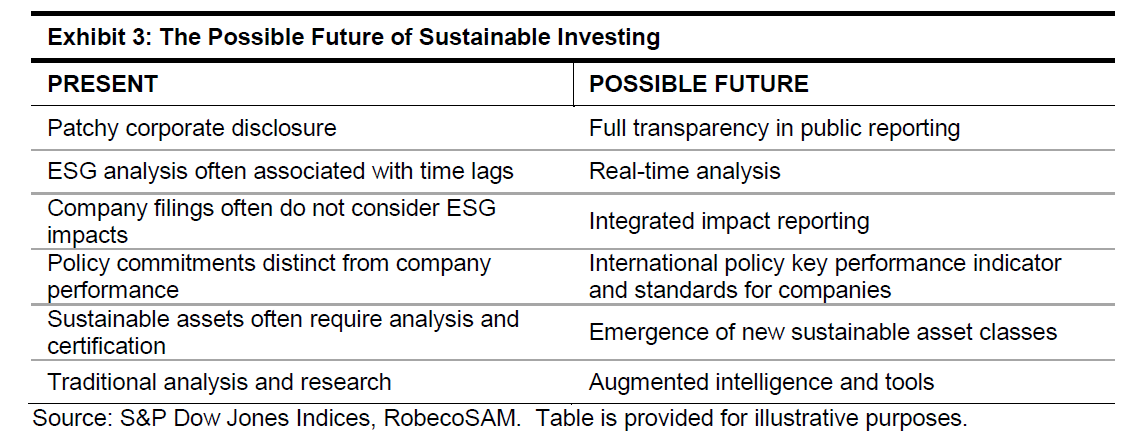

As we consider the impact of the DJSI, it’s important to understand not just how the landscape has changed over time, but how it may continue to evolve. The trend toward increased efficiency and transparency in an increasingly data-driven world has had a profound impact on all industries and professions—to which traditional financial analysis is by no means exempt. As a result, more and more investors are demanding real-time, immediate access to extra-financial, but financially material, information (i.e., ESG) beyond traditional channels. As evidence continues to build that sustainable companies are associated with better financial returns, there is generally greater conviction in the returns to sustainable investing. The emergence and greater transparency of corporate sustainability performance data has made it increasingly easier for analysts to expand the sources of information for their financial analysis.

There is also growing impetus for investors to demonstrate the real impacts of their investments and the contributions they have made toward achieving a range of international policy commitments, from the landmark Paris Agreement to the UN Sustainable Development Goals. Thus, since the early days of socially responsible investing, the landscape has developed, matured, and come almost full circle—as investors once again seek to not only integrate material non-financial information through ESG, but to also identify measurable and lasting positive contributions for both people and the planet, in line with scientific targets and global megatrends.

Yet ESG means different things to different investors. Thus, emerging topics, themes, and innovations will continue to forge the future path of sustainable investing in an unpredictable fashion. Disruptive technologies and new modes of business are contributing to an ever-shifting landscape, while innovative solution providers are responding to some of the world’s most pressing challenges. These solution providers operate in new thematic areas, such as digitization, robotics, battery storage, water, and agricultural technologies, thereby offering new investment possibilities with a much more visible social or environmental impact. Therefore, while the CSA (together with the influence of the DJSI) produced the first global sustainability scoring system, new sources of information, models, and tools—from big data, artificial intelligence, and satellite imagery—will continue to affect the evolving processes for determining company value.

Therefore, though it might seem paradoxical that the pioneers of sustainable indexing hope the term ESG one day disappears, we expect the notion to become redundant. As mainstream investment processes adapt to formalize the integration of these new and emerging sources of information, what was once reserved for sustainability-minded investors at the margins may soon become a key part of the standard investor framework. Perhaps even to the extent where ESG benchmarks need not be referred to as ESG at all.

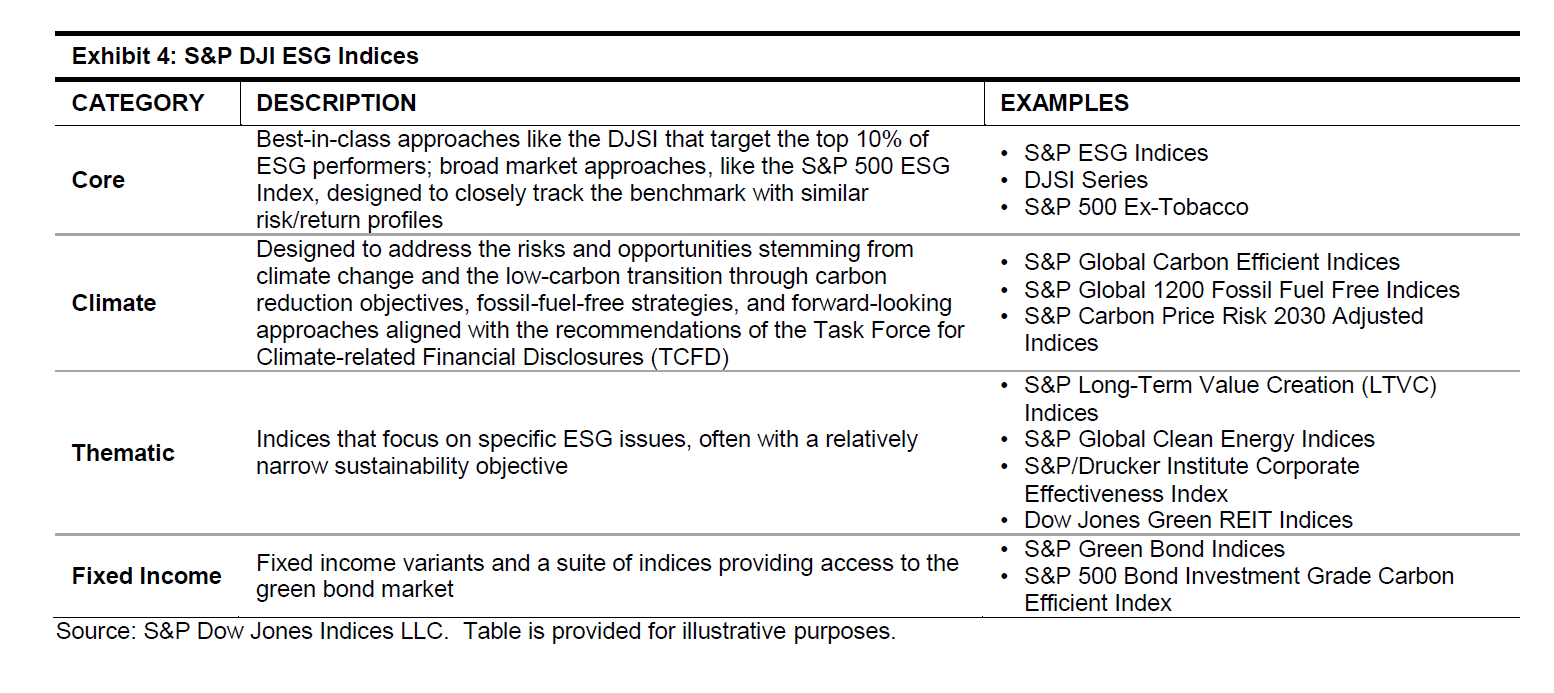

Since SAM and S&P Dow Jones Indices collaborated to launch the DJSI in 1999, S&P DJI continues to lead sustainable indexing solutions with a suite of more than 150 headline ESG benchmarks that continue to shape the sustainable investing landscape. From pioneering best-in-class approaches like the DJSI to mainstream strategies for integrating ESG across broad market benchmarks, S&P DJI offers a variety of ESG index solutions to accommodate the diverse ESG objectives for almost every type of investor, as highlighted by Exhibit 4.

Content Type

Language