Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

From challenges to global trade, concerns in the energy sector, and upheaval in retail industry, corporations and investors are navigating the pandemic's disruptions to global supply chains.

Listen and subscribe on Apple Podcasts, Spotify, and our Podcast Page.

This report considers the ways in which Panjiva’s global supply chain data may be useful for credit risk analysis before taking a look at evolution of supply chain risks from trade policy uncertainty through to the COVID-19 pandemic before taking a deep dive into three sectors.

Broadly speaking, credit analysis can be defined as the assessment of: the credit health of counterparties and investments; the probability of a firm’s default; and the creditworthiness of unrated companies.

Gauging Supply Chain Risk in Volatile Times

It is clear from the past few weeks that COVID-19 continues to disrupt global supply chains in unprecedented ways. The impact on supply chains has been widespread with autos, electronics, capital goods, commodities and apparel firms all facing headwinds from reduced availability of parts. A review of over 6,000 company conference calls from January 20 to March 4, 2020 shows 42.3% of firms mentioned coronavirus.

The imminent impact of these supply chain bottlenecks on the credit standing of corporates is already visible in Asia Pacific with S&P Global Ratings taking 47 ratings actions related to COVID-19 as of March 26, 2020 as it expects borrowers and issuers with weaker credit profiles to find conditions increasingly difficult, even with monetary easing.

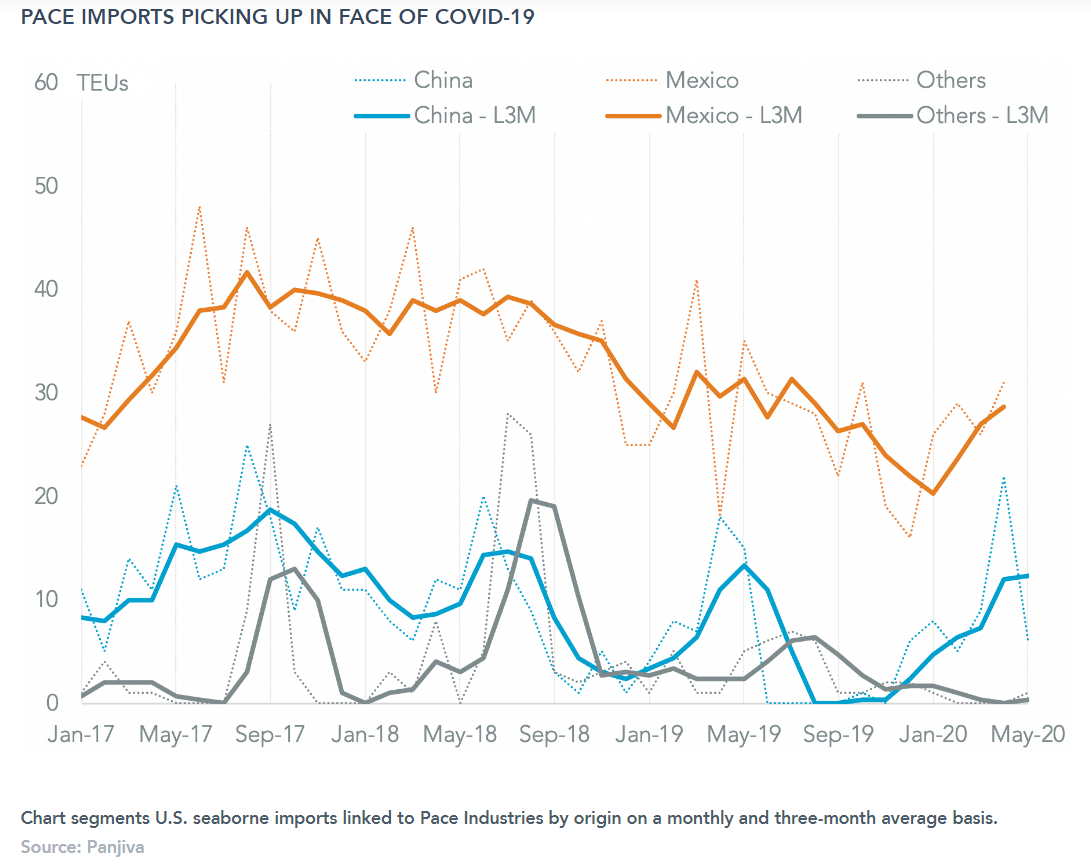

In prior research, Panjiva identified four broad stages for corporate supply chains in tackling COVID-19. The first was supply chain disruptions centered on Asia and then more widely. The second was demand destruction in the large Western markets. The third is the staggered reopening of markets, while the fourth will involve long-term decisions around supply-chain structure.

This report is a three-part series providing a guide to developments we expect for global supply chains in Q3 2020. The impact of COVID-19 has been the defining factor for supply chains in the first half of the year. Recovery will mark the second.

As the trade dispute between Washington and Beijing threatens to boil over, talk of cutting China out of U.S. manufacturing supply chains has intensified. But the idea that American firms can simply shift to suppliers in other Asian countries (or to those at home) may be just that—an idea, rather than an implementable initiative.

A number of factors stand in the way of the public and political push for American manufacturers give up their reliance on China. These include the potentially prohibitive costs of alternative manufacturing, the lack of an efficient labor force elsewhere, and the need for readily available raw materials/resources.

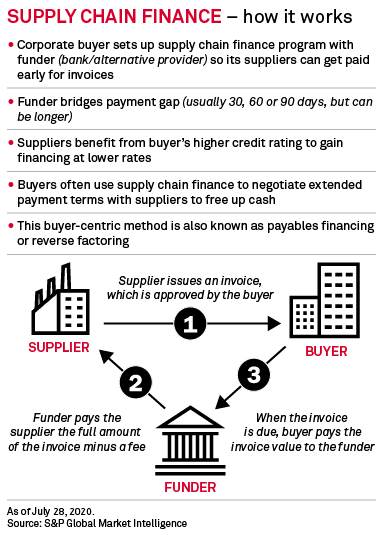

As the coronavirus pandemic exposed the fragility of global supply chains, it prompted a renewed focus among brands and corporations on how to rebuild them in a more resilient and sustainable way. As a result, banks are now seeing a growing interest in what is still a nascent funding tool: sustainable supply chain finance.

A Conversation with NanoGraf's Francis Wang

NanoGraf Technologies CEO Dr Francis Wang talks to S&P Global Platts senior pricing specialist Jacqueline Holman about the COVID-19 pandemic's impact on China's dominance in the battery metal supply chain, as well as the challenges and opportunities of the supply chain becoming more global.

Listen to the PodcastDeglobalization Trend Gains Pace in Lithium Battery Supply Chain

The COVID-19 crisis has exacerbated concerns across the lithium-ion battery industry about China’s dominance of the supply chain. The pandemic has also highlighted the need for local supply chains, in order to improve sustainability and work towards net zero targets.

Read the Full Article

S&P Global Platts metals market experts dig through datasets and digest some of the key trends of the last quarter in iron ore, metallurgical coal, steel, scrap and alumina.

Looking ahead, the team also explores what the next few months could bring, from supply and demand shifts, to new arbitrages, and to quality spread fluctuations in the spot market.

Click to read Platts Asia Metals Quarterly Trade Insight

Of Cars and Cans: US Aluminum and the Pandemic

The coronavirus pandemic has obliterated global metals demand as one of the main end uses, automotive applications, has seen major disruptions to the supply chain.

The US metals market, in particular, saw the removal of an estimated 33,000 vehicles per day from production as all major auto producers across the country halted operations in response to government mandates and concerns over the welfare of workers.

Because the transportation sector is the largest end user of aluminum, accounting for around 35% of aluminum consumption, it is easy to see why so many market participants expressed concern over the lingering effects coronavirus would have on the health of the industry.

Events around the globe affecting trade, commodities, policies and government.

Read More on this TopicThe global toy industry faces a dilemma heading into the peak shipping season ahead of the western economies' pre-holiday shopping period. On the one hand, drawing imports in via normal seaborne shipping patterns runs the risk of excess inventories if consumer demand does not recover in the wake of COVID-19. On the other hand, not importing as usual runs the risk of having to absorb increased costs with last-minute, airborne shipping particularly for must-have ranges.

Quantamental Research Brief: The Information Supply Chain Begins Recovering from COVID

The COVID-19 shockwaves emanating through the global supply chain continue to reverberate. The information that decision makers have traditionally relied have also been disrupted but is slowly showing signs of normalizing. S&P Global Market Intelligence processes 64,000 financial documents each day, placing it in a central position in the information supply chain with a unique view into the specific areas and magnitude of information disruption.

A significant source of information for both investors and decision-makers is found in company annual (10-K) filings. Many firms experienced delays in completing these filings in April, leading to earnings calls delays and reduced visibility. The number of filings fell by over 300 in April but has since rebounded in May largely driven by companies with smaller market capitalizations. This report examines delayed earnings and events, analyst forecast revision, and corporate key developments.