Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts July 2019 Special Report

Published: July 1, 2019

Highlights

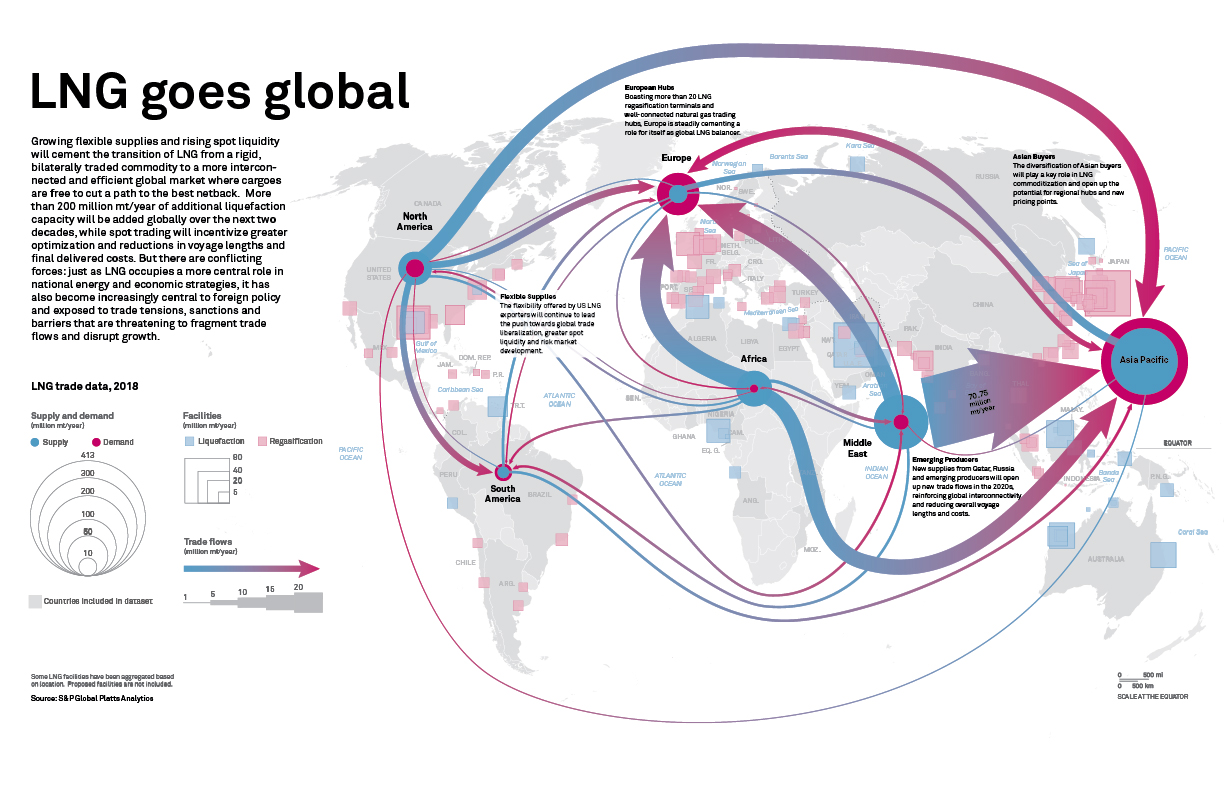

The new decade will present LNG stakeholders with immense opportunities. As significant additions of elastic supply and demand challenge traditional business models, and the trend towards LNG commoditization gathers pace, what lies ahead?

Find out in S&P Global Platts special report, featuring deep market insight and analysis, stunning infographics and exclusive interviews with the IEA's Fatih Birol and IGU's Joe M. Kang.

To read this and more additional content, please read our latest special report.

The new decade will present LNG stakeholders with immense growth opportunities, but they must be prepared to navigate complexities and challenges never seen before to build a sustainable industry.

Five years of rapid supply expansion and trade liberalization have led to a surge of liquidity in both physical and financial LNG markets, which has increased market transparency and challenged traditional supply models and business strategies.

However, the prospect of LNG supply shortfalls and gluts through the next decade to 2030 is a warning sign that the industry is still exposed to abrupt investment cyclicality, a phenomenon known to cause disruptive supply shocks, price volatility and demand destruction.

The transition to a more sustainable growth path will require a deeper transformation of LNG into a more competitive, transparent and cleaner fuel.

Cost competitiveness will be key for this capital-intensive commodity to establish itself as the fossil fuel of choice in an increasingly crowded and competitive power generation market, and accelerate the adoption of LNG in new industries such as transport and agriculture.

The industry’s biggest growth potential lies outside the traditional large demand centers of Europe and Northeast Asia, but these areas also present its biggest hurdles in the form of downstream inefficiencies, uncertain regulatory environments and highly embedded price subsidies.

Who pays the bill for building a more sustainable demand outlook will inevitably depend on the future structure of the market, and with many supply projects moving ahead without long-term commitments, buyers will likely continue to call the shots.

Enhanced transparency will be vital for stakeholders to share these new risks and gain the confidence they need to trade and make long-term investment decisions, from developers pursuing project financing to utilities deploying more capital in import infrastructure.

Transparency has grown significantly over the past few years, driven by an increasingly liquid spot market and exponential growth in LNG derivatives, which is attracting more risk management activity.

At current growth levels, trading volumes of Platts JKM derivatives could exceed global physical trade by 2021, and dwarf it many times over by the mid-2020s. Meanwhile, established gas hubs such as the Dutch TTF remain readily applicable alternatives for hedging financial and physical exposure.

This increasingly robust financial architecture is a game changer and paves the way for the development of LNG as a commodity in its own right. But it is not the endgame.

With the correlation between LNG and oil pricing forecasts breaking down, the elimination of oil indexation is increasingly considered necessary. More standardized trading practices will be required to build liquidity and efficiency, and growing flexibility in term contracts needs to be accompanied by a solid risk strategy at both ends of the supply chain.

The green credentials of LNG will also face increasing scrutiny in a world where the environmental and economic costs of climate change are becoming ever clearer. The dirty coal card is too low a bar, and effective solutions will be needed to reduce the industry’s carbon footprint.

The stakes are high. Global fossil fuel demand is expected to peak over the next decade, threatening trillions of dollars in energy asset investments. As we enter the era of renewables, these green credentials might determine whether LNG becomes simply a transition fuel or a true partner in a more environmentally sustainable future.

To view the rest of this report and more additional content, please read our latest special report.