Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Oil, gas, and renewable energy producers have turned to mergers and acquisitions to weather the storm of pressure that the COVID-19 pandemic continues to rain on global demand. The consolidation of oil and gas companies that, faced with bankruptcy, joined together to stay solvent will reshape the industry landscape for years to come—especially as they invest in the transition away from fossil fuel generation to clean energy.

Published: February 1, 2021

Make plans to join senior executives, generators, renewable developers, investment bankers, regulatory officials, asset managers and senior analysts, and legal and management advisors, to see how you can navigate a turbulent landscape in the power and utilities sector in 2021 and beyond.

Register for the WebinarThe sector is experiencing a huge, unexpected demand shock. COVID-19 has drastically altered the 2020-2021 outlook and caused a supply overhang. The demand collapse has had severe consequences for refining too.

Companies are still struggling to generate breakeven cash flow, which resulted in a brief wave of mergers and acquisitions (M&A) in the U.S. upstream space. Most of the M&A has been completed with low premiums and financed through all-stock transactions. Exploration and production (E&P) and oilfield service companies continue to see a wave of defaults and distressed exchanges due to lack of capital market access.

For many drillers and oilfield services companies, many market and financial risks have already materialized in the past two oil price downturns. Even as the sector continues to restructure operationally and financially, with some exits and mergers, it remains beholden to expectations for oil prices and producers spending in 2021 and the long term.

Oil, Gas Deal Tracker: 2021 Starts with Billion-Dollar M&A

Large-scale oil and gas M&A deal-making got a boost in January from a pair of billion-dollar acquisitions by New Fortress Energy Inc., according to S&P Global Market Intelligence data.

Read the Full ArticleCan Energy Companies Prevail?

Refining margins have been hit hard. This as COVID-19 pushed down demand and excess capacity resulted in low utilization rates. If consumption and refining margins don't improve in 2021, more plant closures and conversions to biorefineries in mature economies are likely.

Read the Full Article

An epic oil price collapse preceded a wave of M&A transactions in the second half of 2020 that included some of the largest in recent memory, which saved what had been an unusually slow year for M&A among global oil and gas producers.

Upstream Firms Ride An Inevitable M&A Wave Amid Industry Pressure

S&P Global Ratings expects continued exploration and production consolidation given a lower–for-longer price environment, lack of capital for the high reinvestment rates required to feed the shale production treadmill, and investor unwillingness to continue funding smaller-scale companies given historical losses and the inevitable transition to renewable energy sources.

Read the Full ArticleCoronavirus Fallout Spurs M&A Across U.S Oil and Gas Sector

Soft oil prices, strained balance sheets and a lack of support from outside funding sources have left many US independent oil and gas companies close to bankruptcy. For some, joining forces may be a way to stay solvent.

Read the Full Article

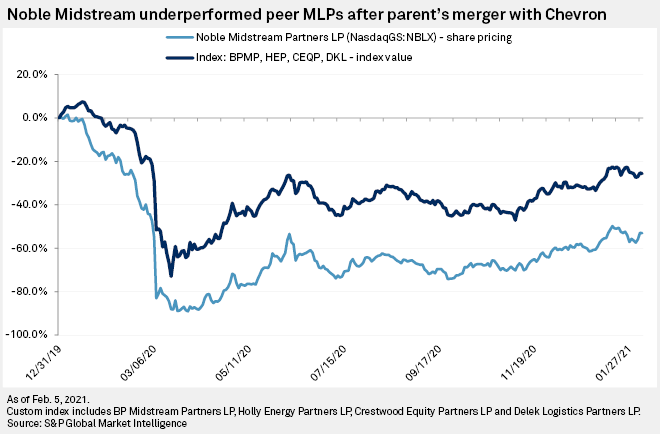

Chevron Corp. will probably need to increase its $12.47 per unit bid to buy out Noble Midstream Partners LP in order for the pipeline master limited partnership to agree to the deal, midstream industry experts said.

Pioneer CEO: U.S. Crude Output to Remain Relatively Flat for Years

US crude oil production should remain relatively flat near 11 million b/d for years to come with any upticks in Permian Basin output coming at the expense of other shale basins, the CEO of Pioneer Natural Resources said Jan. 6 during a virtual Goldman Sachs energy conference.

Read the Full ArticlePermian Consolidation Wave Could Continue after Pioneer-Parsley, Conoco-Concho Deals

A sudden wave of consolidation in the Permian Basin after many months of deal-making silence is expected to continue in spurts in a trend that should expand to other regions such as the Bakken Shale and DJ Basin, energy analysts said.

Read the Full ArticleThe global oil production cut agreed to by the OPEC+ countries and the economic disruption caused by COVID-19 have led to volatility within global oil markets. Access our latest essential information and insights on the industry’s present and future.

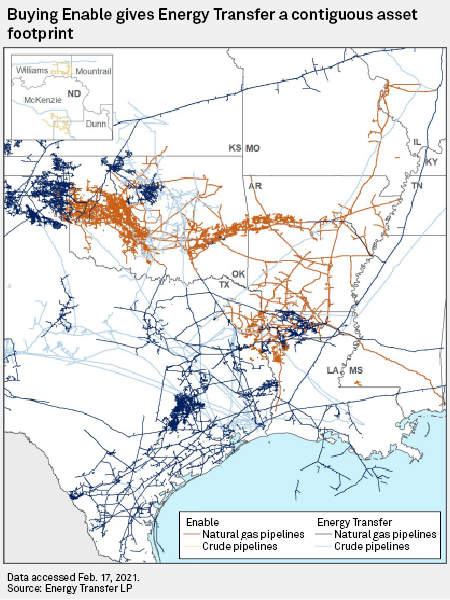

Access the Topic PageEnergy Transfer LP's $7.2 billion all-equity planned acquisition of Enable Midstream Partners received mixed reactions from shareholders and analysts as the oil and gas pipeline giant announced its second midstream corporate takeover in less than two years.

Buying May Be Better Than Building to Grow U.S. Gas Footprint: Kinder Morgan

Kinder Morgan expects more natural gas utilities to shed pipelines like Dominion Energy did last year, and it may scoop up some of those assets if the price is right, executives said Jan. 27 during the company's annual investor day presentation.

Read the Full ArticleUGI Signals Confidence in Gas Utility Business with Mountaineer Gas Purchase

UGI Corp.'s $540 million deal to acquire West Virginia utility operator Mountaintop Energy Holdings LLC demonstrates the energy delivery company's confidence that natural gas distribution will remain a growth business for decades to come.

Read the Full Article

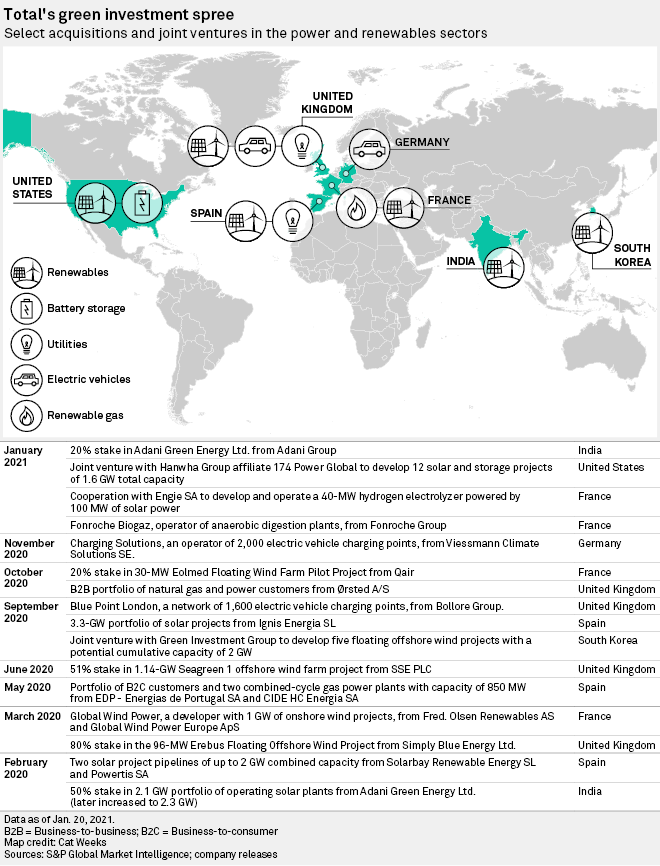

Total SE has pulled ahead of the competition in reinventing itself as a broader energy company, deepening its push into renewable energy by buying up companies and assets at a much faster pace than any of its peers in the oil and gas industry.

BP, Rosneft Strike Deal to Work on Energy Transition Projects

BP and Russian energy giant Rosneft signed a cooperation agreement Feb. 4 to work on joint energy transition projects, including low-carbon technologies and hydrogen, the companies said in a joint press release.

Read the Full ArticleCarlyle Doubles Stake in Swiss Refiner Varo, with Eye on Biofuels Expansion

Private equity giant Carlyle Group has doubled its stake in Varo Energy, a downstream venture with the world's biggest independent oil trader Vitol, buying out the third partner, the companies said Feb 3.

Under the deal, Carlyle will acquire the 33.3% Varo stake owned by Reggeborgh, a Dutch private investment company, making it the majority owner with a 66.6% interest, a Carlyle spokesman said.

Track the shifting deal landscape as companies and investors navigate uncertainty and seek strategic footing in their markets. Our data insights cover global M&A activity across sectors and transaction types.

Access the Topic PageAccording to hydrogen advocates and members of the finance community interviewed by S&P Global Market Intelligence, the industry now sits on the verge of its next phase.

"Things are moving out of day trading ... into M&A ... and then the financing of major projects," said Daryl Wilson, executive director of the Hydrogen Council, a global membership organization for hydrogen. "There is a maturing going on here and that is reflected in the nature of the transactions."

Hydrogen Finance Maturing From Day Trading to M&A

The stock price of Latham, New York-headquartered Plug Power Inc., a hydrogen fuel-cell maker that trades on the Nasdaq, has increased almost sevenfold since the beginning of the year.

The company is one of a small cohort of hydrogen stocks to have soared in value in 2020, as droves of investment managers flock to bet on businesses that either produce or utilize the fuel.

Read the Full Article

Americas' power and utilities merger and acquisition activity picked up considerably in the fourth quarter of 2020, with deal value increasing 45% from Q4 2019, while the outlook for clean energy in 2021 remains positive, EY said in a report.

After 'Very Active' 2020, European Renewables M&A Poised to Accelerate Further

European utilities and renewable energy investors ended 2020 on a strong note, with M&A deal volumes reaching a three-year high in the fourth quarter — refuting predictions of a slump in dealmaking caused by the coronavirus pandemic.

Companies announced or closed more than 230 transactions across the renewables, power and gas sectors during the three months ended Dec. 31, 2020, according to S&P Global Market Intelligence data. That made it the most active quarter since the closing months of 2017, despite travel restrictions and business disruption that got 2020 off to a slow start and led market observers to predict that deals would dry up.