Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Despite current economic and geopolitical crises, the energy transition is accelerating — but not fast enough to meet Paris Agreement climate goals.

Published: January 13, 2023

By Ashutosh Singh, Roman Kramarchuk, and Karl Nietvelt

Highlights

Although geopolitical turmoil, macroeconomic headwinds and focus on energy security present bumps in the road to a lower emissions future, the long-term energy transition is accelerating.

There is a wide gap between S&P Global Commodity Insights’ base-case forecast and the net-zero by 2050 trajectory required to meet Paris Agreement on climate change goals of < 1.5 degrees C warming. We forecast greenhouse gas emissions will exceed Paris Agreement goals by 8 billion metric tons of CO2 equivalent by 2030 and 41 GtCO2e by 2050.

The share of renewables in the energy mix will grow, but it could fall significantly short of the levels needed to meet warming goals. The share of oil and gas is declining, but not fast enough.

The challenge is how to bridge the gap while ensuring a just and smooth transition that maintains the security, reliability and affordability of energy supply for all. The fractured geopolitical environment has created new headwinds.

The energy transition is bumping against energy security requirements in the short term as countries try to navigate numerous immediate crises. While the long-term transition continues to accelerate, this is not sufficient to meet Paris Agreement on climate change goals.

S&P Global Commodity Insights analysis suggests a funding gap of almost $25 trillion to meet Paris Agreement goals, but funding alone is not the challenge. We identify key gaps in the transition pathways that need attention if we are to meet warming goals.

To date, governments and the private sector have not lived up to commitments made at the 2015 COP conference held in Paris or to those made since. Action on decarbonization varies across the world based on country- and region-specific interests and is closely linked to perceptions of (and responses to) the energy security debate.

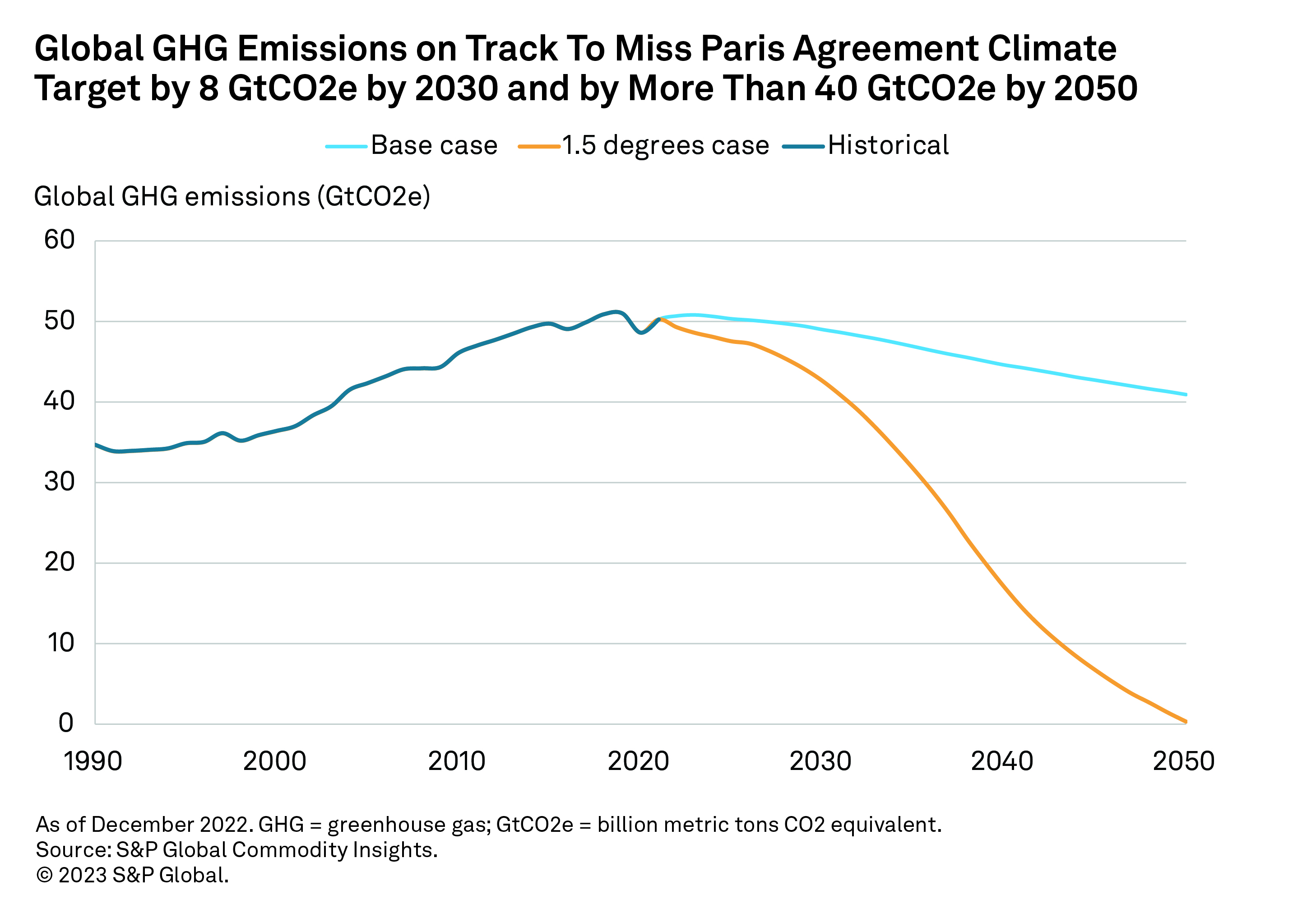

Chart 1

Although a broad range of fundamental changes across policy, technology and markets have accelerated the energy transition, there remains a wide gap between the reference energy transition path and the net-zero goals of the Paris Agreement.

S&P Global Commodity Insights analysis suggests the world is on track to exceed the greenhouse gas emissions required to meet Paris Agreement climate goals of keeping the temperature rise below 1.5 degrees C by more than 8 billion metric tons of CO2 equivalent by 2030 and by 41 GtCO2e by 2050. Since most emissions come from energy usage, it is important to analyze how the share of energy from different fuel sources will change over time.

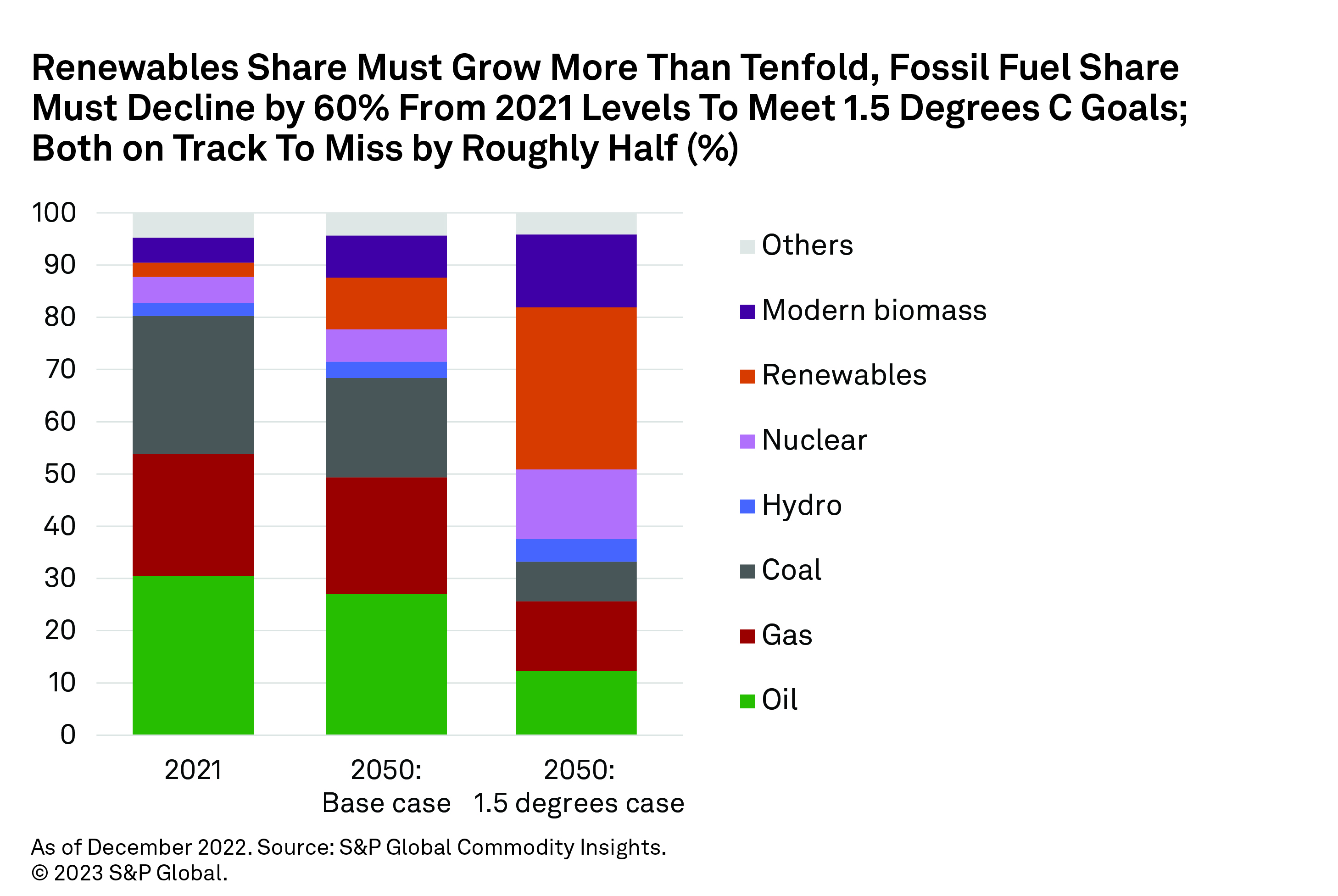

To meet Paris Agreement climate goals, the global share of energy that comes from renewables needs to increase from 3% currently to 31% by 2050; a tenfold increase. At the same time, fossil fuel (oil, gas and coal) energy usage must decline from 80% currently to 33% by 2050. This outlook assumes significant roles for carbon capture use and storage (CCUS) and direct air capture (DAC). Without these technologies, renewables’ share will need to go up by another 10%, and fossil fuels’ share will need to fall by the same amount. But our reference case forecast suggests that renewables’ growth will fall significantly short of those targets, and fossil fuels will not decline fast enough.

Chart 2

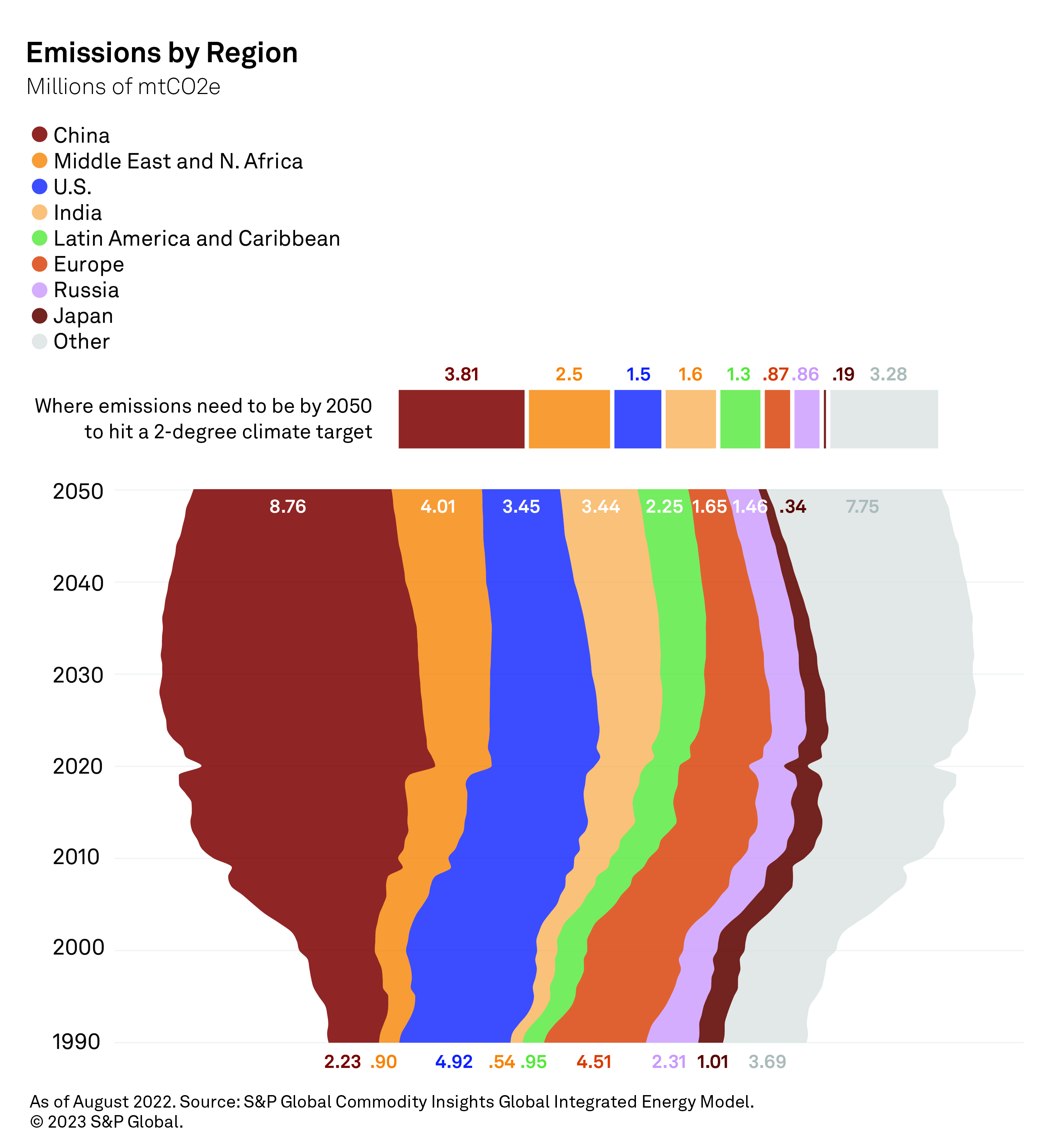

Most countries are falling short of their emissions targets to meet even a 2-degree warming goal. S&P Global Commodity Insights’ base-case forecast suggests warming levels of around 2.4 degrees by 2050.

China’s greenhouse gas emissions are by far the most above the 2-degree target, followed by the Middle East, the U.S. and India. While U.S. and EU emissions are on a steady decline, they are set to miss the 2-degree emissions target by more than 100% by 2050. China’s emissions will not peak until the late 2020s, and those of most other developing nations will not do so until 2050.

The gap between ambition, hope and reality is wide.

Chart 3

The world faces several major crises, including an energy crisis, a food shortage, a global economic downturn, a divided world and increasingly frequent weather disasters. These crises may be setting us further back.

If we look past the current hurdles, however, the transition to a lower emissions energy future is accelerating — just not fast enough to meet Paris Agreement goals.

The three largest energy consumers and greenhouse gas emitters — China, the U.S. and the EU — have all put significant energy transition policies in place in the past year to accelerate their transition pathways.

Government and industry responses to these key challenges will significantly impact how successful we are at closing the energy transition gap. All credible solutions will require global cooperation with an eye toward security and affordability of energy for all.

COP27 Special Report: Advancing Climate Objectives Amidst Conflict

Inflation Reduction Act: Landmark Legislation Supercharges U.S. Clean Energy Effort

Atlas of Energy Transition™

Next Article:

The World Isn’t in a Commodity Supercycle, but It Should Be >

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.

Content Type

Language