Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

A craze for content has sent media companies into a consolidation race, and social media platforms alongside other digital entities toward courting creators with monetization.

Published: July 19, 2021

Technological disruption is the driving change agent for businesses, their competitive and industrial dynamics, and capital markets that fund growth. Media—including broadcast, cable, cinema, OTT, and telecom—is creating the culture of the future.

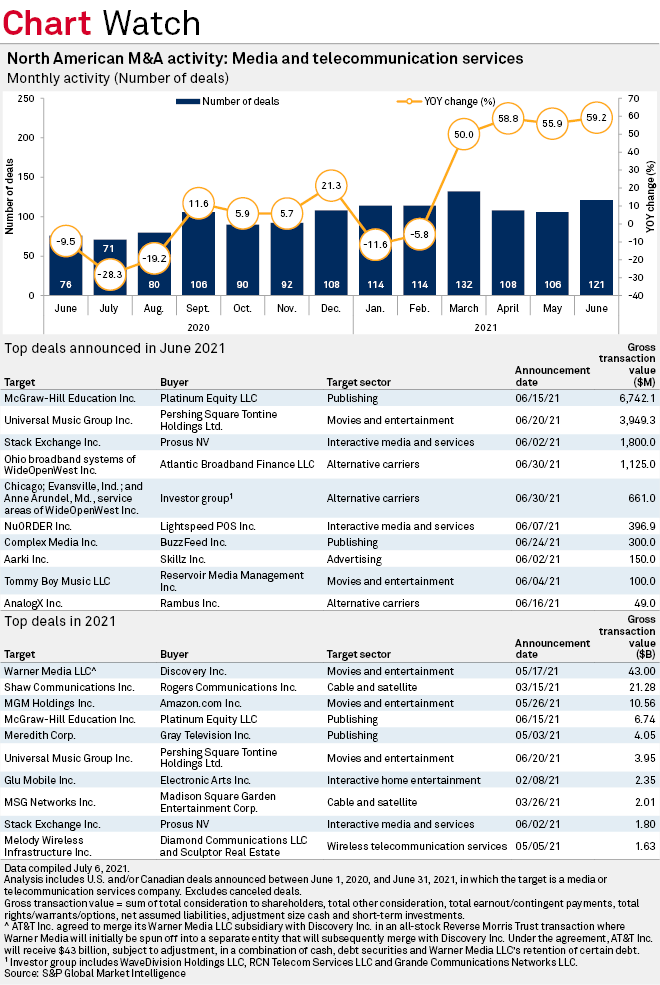

Access the Topic pageJune continued the 2021 recovery in media and telecom M&A, with a headline-making special purpose acquisition company deal accounting for one of the largest transactions announced during the month.

Sector deal announcements totaled 121 transactions in June, up from just 76 deals in the prior-year period. That was not only an improvement over 2020's pandemic era total but also over June 2019.

June's transactions were led by two big announcements, with Platinum Equity LLC's $6.74 billion acquisition of educational media company McGraw-Hill Education Inc. topping the M&A chart. However, commanding a higher total valuation and capturing more headlines was Universal Music Group Inc.'s deal with SPAC Pershing Square Tontine Holdings Ltd.

Many Possible U.S. Buyers for Channel 4 if UK Loosens Remit

The U.K. government's plans to potentially sell Channel Four Television Corp. could represent a good opportunity for a large U.S. buyer, but its value will depend largely on whether the strict rules regulating the public service broadcaster are loosened, experts said.

Read the Full ArticleContent Consolidation Drives Media Deal Adviser Fees in May

The content consolidation wave turned into a tsunami in May as U.S. media companies sought to better position themselves in the global streaming wars.

Read the Full ArticleLionTree, Goldman Sachs Cash in as U.S. Telcos Shed Media Units

May continued to a near-frenetic drumbeat of M&A activity in the information technology sector.

Read the Full ArticleAmazon-MGM Deal a Show of Force in the Content Arms Race

The content arms race is in full effect, and Amazon.com Inc. is showing some unprecedented firepower.

Read the Full ArticleWith AT&T's WarnerMedia Deal, Another U.S. Wireless Leader Retreats from Content

A grand experiment by U.S. wireless carriers to make and distribute video content appears to be coming to an end, as AT&T Inc. joins Verizon Communications Inc. in preparing to shed its media business.

Read the Full Article

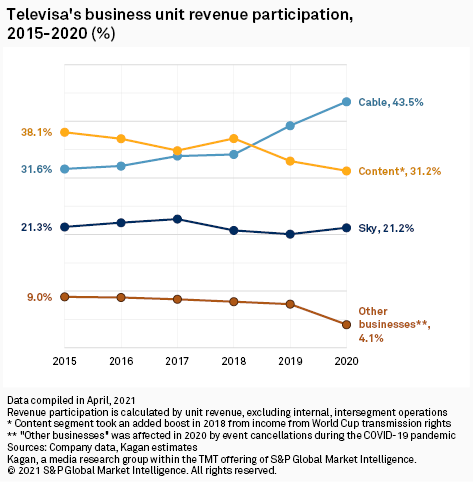

Grupo Televisa SAB's recently announced decision to merge its content unit with Univision will create a Spanish-language content giant and leave a very different company bearing the Televisa name in Mexico: a heavily focused broadband and pay TV operation looking to expand its domestic market share.

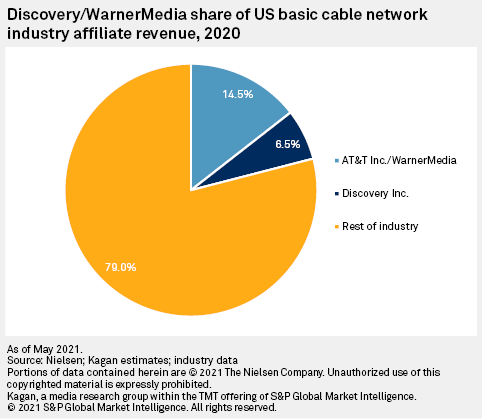

WarnerMedia, Discovery Combination Would Create New Cable Network Giant

AT&T Inc. on May 17 announced that it plans to spin off its WarnerMedia Investments division and join forces with Discovery Inc. to form a new company.

One result of that spinoff would be to place 32 U.S. basic cable networks under the same umbrella, the largest of any other cable network group, with The Walt Disney Co. in second with 29 networks.

Note that this includes partially owned networks and does not include regional sports or premium networks.

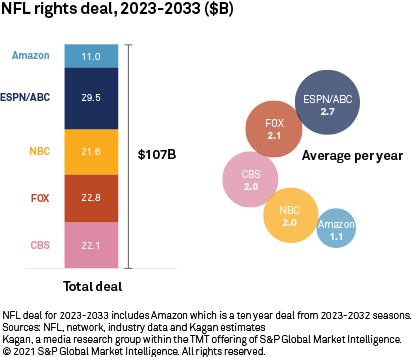

The ink has barely dried on the NFL's new long-term pacts with its media partners, rights deals that stretch into the next decade, but analysts are already looking to 2029.

That's when the NFL can opt of the deals that kept its linear roster largely intact. The newly signed rights agreements supplemented the league's revenue from its linear TV schedules with streaming rights and made Amazon.com Inc. the first digital player to hold an exclusive package. Analysts see the arrangement as a testing ground for a future in which streaming could become even more important for the league, though some question how well the financials will work out.

Univision Aims to Offer More Spanish-Language Content Than Any Other Streamer

Univision Communications Inc. is gearing up for the 2022 launch of its two-tiered, aggregate streaming service, and the Spanish-language programmer has big ambitions.

"Our vision for the offering is to grow significantly over the next three years and offer more Spanish-language content than any other streaming service globally," Pierluigi Gazzolo, president and chief transformation officer at Univision, said in an emailed interview with S&P Global Market Intelligence.

Read the Full ArticleLions Gate Not 'Distracted' by Media M&A as Starz Streaming Subscriptions Grow

As Lions Gate Entertainment Corp. continues to build its streaming business, the company said it does not want to get swept off course by the current wave of media consolidation.

Lions Gate CEO John Feltheimer on a May 27 earnings call with analysts looked to deflect the notion that the company could be a target amid the current spate of media acquisitions.

Read the Full Article

Redbox Automated Retail LLC aims to transform its $2-a-night DVD rental business into a billion-dollar-a-year digital media enterprise, and it is relying on a combination of its loyal consumer base and Wall Street to get it there.

Redbox CEO Talks Future of Video Entertainment as Company's Business Evolves

Redbox Automated Retail LLC, which is in the process of going public via a reverse merger with special purpose acquisition company Seaport Global Acquisition Corp., is aiming to evolve its business beyond its legacy DVD rental kiosks to include more revenue from streaming partnerships, ad-supported content and other business. The company, which specializes in distributing low-budget films, is attempting to coax the company's 39 million value-conscious loyalty program customers, many of whom are technology late adopters, to give digital media a try.

Redbox expects cord-cutting will accelerate among its 40 million value-conscious consumers as the cost of pay TV subscriptions rises.

Redbox Entertainment, the company's production studio, is aiming to ramp up to making 36 low-budget films per year.

The company is experimenting with distributing content through various windows, including premium video-on-demand, lower-priced transaction video-on-demand or pay-per-view, and ad-supported platforms.

This is one of a two-part series on the evolution of Redbox. The second part, a look at Redbox's prospects, can be found here. Redbox's SPAC-funded evolution from DVD rentals to digital media.

Read the Full ArticleFrom cable to broadcast, OTT to telecom, and the technology behind it, S&P Global Market Intelligence’s TMT coverage provides the critical insights you need to stay ahead of your competition.

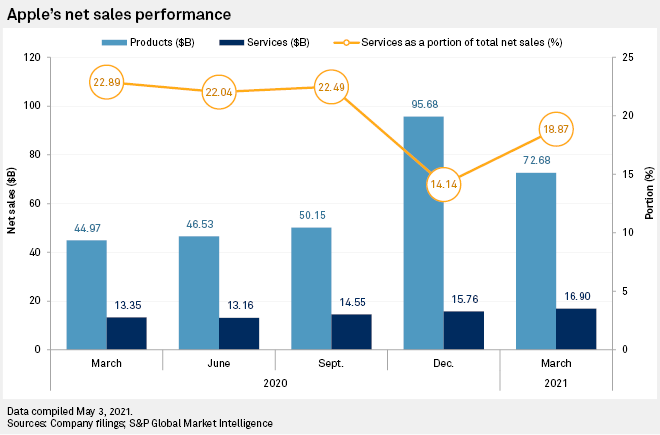

ACCESS THE TOPIC PAGEApple Inc. made it big in the 1980s with Mac computers. In the mid-2000s, it was iPhones. Now, the company seeks to capitalize on society's latest obsession: podcasts.

The company this week launched Apple Podcast Subscriptions, a subscription-based version of Apple Podcasts that allows creators and publishers to set pricing for each subscription of at least 49 cents per month.

Amid Content Creator Craze, Social Platforms Rush to Pay Up

The meteoric rise of short-form video platform TikTok Inc. is shaking up the social media business, with companies such as Facebook Inc. and Google LLC-owned YouTube LLC looking at expanding monetization opportunities for content creators.

While the idea of promoting content creators and their work has long been a focus for Facebook, Twitter Inc., Snap Inc. and YouTube, TikTok's efforts to broaden monetization opportunities for creators beyond advertising is catching on. TikTok content creators earn the bulk of their money from sponsored posts, product placements and selling merchandise on the site.

TikTok, like most internet platforms, generates the majority of its total revenues from advertising, but it also derives revenue from in-app purchases, where users buy virtual coins with real money to send virtual gifts to popular figures on the platform. The company, owned by Beijing Byte Dance Telecommunications Co. Ltd., has not disclosed detailed financial metrics.

Read the Full Article

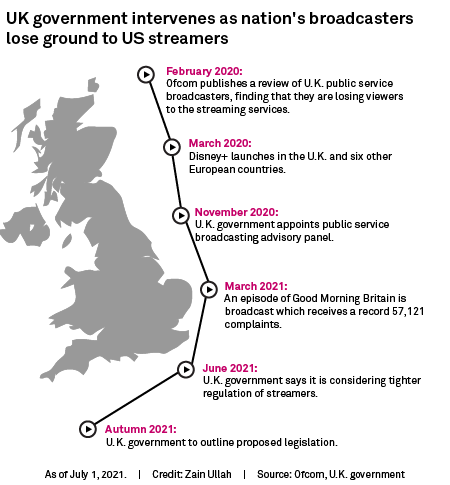

The U.K. government's plans to "level the playing field" between broadcasters and video-on-demand services are unlikely to curb the growth of U.S. streamers in the country, analysts told S&P Global Market Intelligence.

The government on June 23 said it is looking into whether tighter regulation of streaming services could help domestic broadcasters such as the BBC, ITV PLC, Channel Four Television Corp. and Comcast Corp.-owned Sky to compete with the likes of Netflix Inc. and Amazon.com Inc.

Amazon-MGM Deal Could Pressure Regulatory Review of Content Consolidation

Consolidation continues to stir through the media industry, leaving behind a soup of content companies that look much different than the individual studios, media and tech companies that were once on the shelf.

Most recently, Amazon.com Inc. said it will acquire MGM Holdings Inc., operator of the Metro-Goldwyn-Mayer Inc. film and TV studio, in a hefty $8.45 billion deal. While the pricey acquisition does pull more content studios under the umbrella of horizontally integrated tech and media companies, industry experts are divided on whether the deal does enough to impede competition so as to hit a regulatory roadblock.

Read the Full ArticleDiscovery, WarnerMedia Merger Likely to Pass Regulatory Scrutiny

Less than three years after AT&T Inc. won a hard-fought battle to acquire media company Time Warner, AT&T wants to cut its media division loose — and analysts expect regulators to be OK with that.

While AT&T's plan to combine its Warner Media LLC entertainment, sports and news operations with lifestyle network owner Discovery Inc. to form a new stand-alone company is likely to face scrutiny from U.S. regulators, media analysts say they ultimately expect the deal to win approval in time to close next year as planned. By contrast, it took AT&T about two years to close the original deal to acquire the Warner Media assets.

Read the Full Article

Most media companies are on track for recovery, thanks to the macroeconomic rebound, easing of COVID-19-related restrictions, and release of pent-up consumer demand. Subscription-based businesses, such as online service providers and data publishers, showed resilience in 2020 and steady organic growth in 2021. Some investment-grade issuers even strengthened their balance sheets during the pandemic, thanks to cost savings and lower shareholder returns.

Industry Top Trends Update: Media and Entertainment North America

Rating activity is skewing positive. The U.S. economy’s recovery has accelerated, supported by government stimulus, and widespread vaccination, allowing markets to reopen. Positive rating actions have exceeded negative actions by 3:1.

Read the Full Report