Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Highlights

Weak financial sector contributed to falling GDP growth last year. The need for conducive financing rose further as the pandemic sharply hit cash flows.

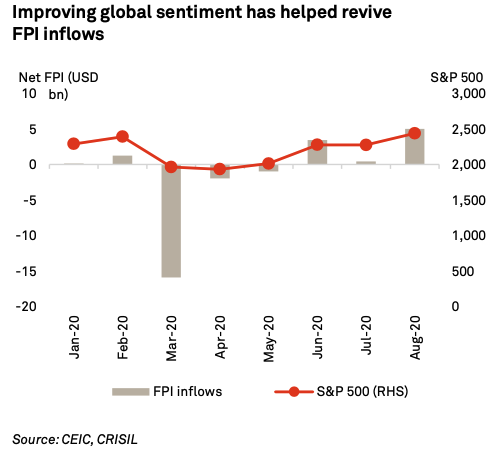

Like the RBI, central banks across the world have swiftly eased monetary policy, with the US Federal Reserve cutting rates to the zero lower bound and restarting quantitative easing. This has significantly boosted global sentiment, leading to rallying equity markets and easing bond yields across the globe.

Monetary policy has done most of the heavy-lifting so far in supporting the economy. This was needed since financial conditions had seen a severe tightening in India and via spillovers from rest of the world. Recent months have shown that RBI’s monetary easing, coupled with improving global sentiment, helped ease financial conditions. However, some segments of the financial sector are facing growing stress fundamentally, which could bite back once the excessively easy monetary policy normalises.

Weak financial sector contributed to falling GDP growth last year. The need for conducive financing rose further as the pandemic sharply hit cash flows, especially for small and medium enterprises. Restricted access or costly financing could aggravate their liquidity crunch, possibly pushing many firms into bankruptcies. Financial conditions also reflect transmission of monetary policy to the broader market. Further, the efficacy of fiscal stimulus depends on functioning of the financial sector, given that ~65% of the stimulus was oriented to boost liquidity for businesses.

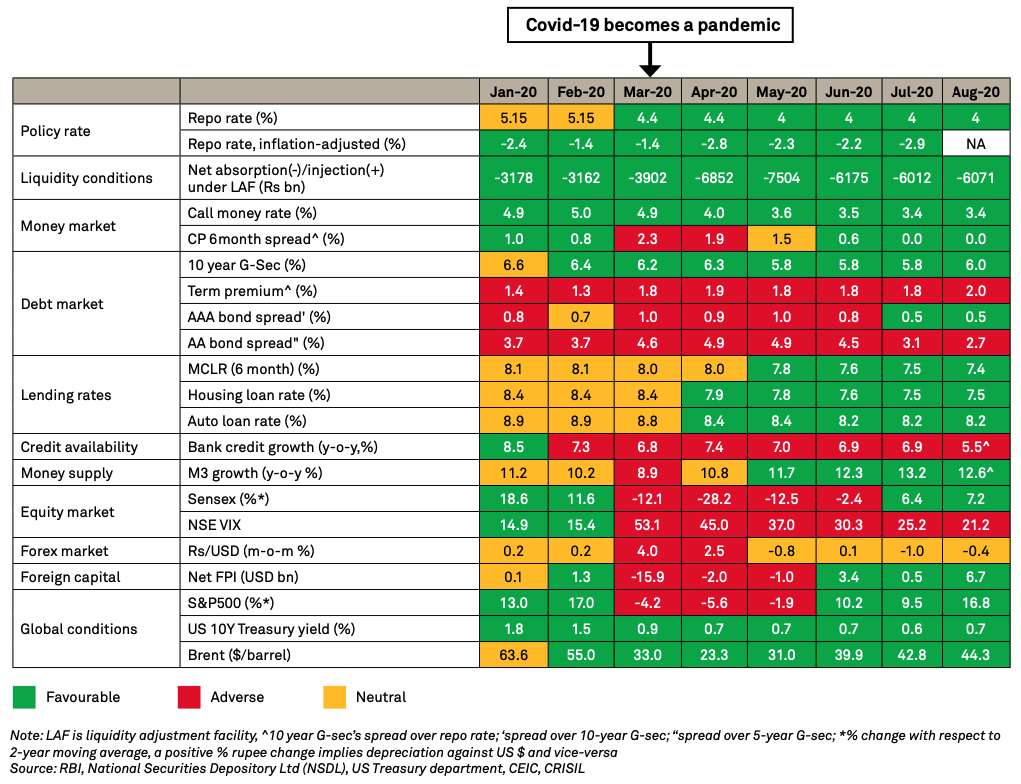

The pandemic amplified the pre-existing weakness in financial conditions. As shown in the following heatmap, the tightening was broad based across financial markets, with maximum severity in March and April. It started with a sudden tightening of global financial conditions, which led to recordhigh foreign portfolio investor (FPI) outflows and sharp rupee depreciation. Equities tanked, with their volatility at a record high. Corporates faced an acute liquidity crunch, as reflected in sharp rise in spreads for commercial paper and corporate bonds. Term premium for 10-year government securities (G-sec), which was already above historical average, spiked further.

Come June, some easing is apparent. FPI flows have returned and exchange rate has stabilised, even appreciating in the past 2 months. Equities have almost erased the losses suffered post February. Interest rates eased across most segments - in- cluding for lending rates and bond yields. Overall money supply has recovered as well.

However, the extent of easing has not been uniform. Short-term money market rates have fallen more than long-term bond yields. Among bonds, safe-ha- ven G-secs and AAA-rated public sector bench- marks have eased more than lower-rated corporate bonds. The spreads of lower-rated corporate bonds (such as AA paper given below) over government benchmark remain much higher than long-term averages. Bank credit growth remains weak.

Even before the pandemic hit, RBI’s monetary policy was in an accommodative stance with several conventional and unconventional measures (such as Operation Twist and long-term repo operations, or LTROs) implemented

With Covid-19 becoming a global pandemic in March, the RBI accelerated the easing measures with sharp rate cuts and a raft of unconventional measures. Many measures on regulatory relaxation were also undertaken to ease pain in the financial sector, including permitting moratoriums and restructuring of debt by banks

Swift policy action helped calm financial markets. The sharp rate cuts – totalling 115 bps since March 2020 – coupled with regulatory relief for corporates contributed to a rally in stock markets. There is also evidence of rate cuts getting transmitted to the markets, with some easing seen in lending rates, money market rates and bond yields

Moratoriums threw a lifeline to most vulnerable companies to tide over liquidity crisis. According to a recent analysis by CRISIL Ratings, 2,300 companies out of CRISIL’S total rated universe of about 8,000 corporates availed of moratoriums. 75% of these 2,300 corporates have sub-investment grade ratings (rated BB+ or lower by CRISIL). These were the very companies worst impacted by lockdowns. At a sectoral level too, moratoriums helped those worst impacted. In highly impacted sectors such as gems and jewellery, hotels, automobile dealers, power companies, packaging, and capital goods, every fifth CRISIL-rated company availed of moratorium

Pressure in government bond markets also eased, but that might build again. Bond markets are facing huge supply pressure from the central and state governments due to fiscal stress. But despite higher supply, 10-year G-sec yields have eased significantly this year, helped by RBI’s rate cuts and measures such as Operation Twist (i.e. selling short- term G-secs and buying long-term G-secs to flatten the yield curve)

Like the RBI, central banks across the world have swiftly eased monetary policy, with the US Federal Reserve cutting rates to the zero lower bound and restarting quantitative easing. This has significantly boosted global sentiment, leading to rallying equity markets and easing bond yields across the globe

For India, this has meant a return of FPI inflows, after record outflows in March

FPI inflows have mostly gone to the equity market, with inflows to debt market much weaker

Capital inflows, along with weak dollar and low trade deficit, has led to appreciation of the rupee

Weak credit growth: Bank credit growth, which was already weakening before the pandemic, has fallen even further in the recent months. Credit growth will largely be concentrated in working capital requirement of corporates and MSMEs

High government borrowing: G-sec yields are under pressure on account of high government borrowing. While RBI’s policy easing so far has capped the rise in yields, the pressures are likely to resurface once RBI support wanes off. Despite 10-year G-sec yields easing, their term premium over repo rate remains stubbornly above 100 bps, reflecting the fiscal risks factored in by investors

Risk aversion for lower rated papers in corporate bond market: While the RBI’s measures has helped lower corporate bond yields in general, spreads of lower rated corporate bonds (from AA+ to A-rated) over government benchmarks remain higher than long-term averages, reflecting risk aversion among investors. Any rise in benchmark G-sec yields and tightening bond market conditions would push corporate yields up further, significantly raising costs of borrowing for vulnerable enterprises

Content Type

Location

Language