Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

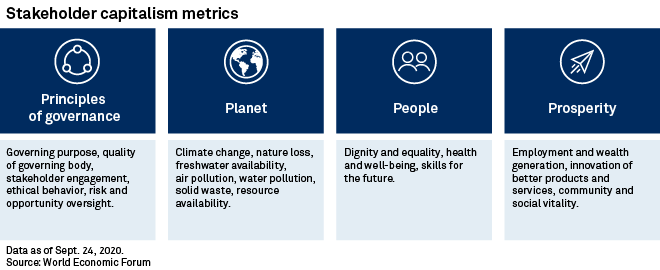

Dozens of the world's largest companies representing trillions of dollars in market capitalization pledged to use a uniform set of "Stakeholder Capitalism Metrics" in their mainstream disclosures amid broader global efforts to streamline and standardize reporting on environmental, social and governance topics.

The World Economic Forum and its International Business Council made the announcement Jan. 26, as leaders from governments and the private sector worldwide convened for a virtual version of the annual Davos conference.

Environmental, Social, and Governance: Aligning Value Creation with Protection Of Values

Companies are increasingly adopting stakeholder capitalism, focusing on long-term value creation for customers, employees, society, and the environment rather than just short-term value for shareholders. Realizing the full potential of stakeholder capitalism will require additional approaches to sustainability performance measurement and disclosure. The COVID-19 pandemic is sharpening the focus on stakeholder management: substantial government support to corporations has raised expectations of corporate responsibility to society.

Read the Full Report

CEOs from across corporate America spoke out in response to President Donald Trump's refusal to commit to a peaceful transition of power and the subsequent violence on Jan. 6 in Washington, D.C. Last week's events make it clear that expectations of business leaders in times of social unrest are rapidly changing and inaction is less of an option as the environmental, social and governance movement gains traction in the U.S.

After rioters stormed the Capitol building in an attempt to prevent Congress from certifying the Electoral College results, many CEOs issued statements condemning the violence. BlackRock Inc. CEO Larry Fink, head of the world's largest asset manager, called the riots "an assault on our nation, our democracy, and the will of the American people."

This is not the first time in recent memory that the business community has spoken out in response to social unrest. That is in part because the ESG movement is becoming increasingly mainstream. Investors are demanding that companies pay attention to social issues like the racial diversity of their boards, management teams and workforces, and in some cases are submitting shareholder proposals. Employees are increasingly holding companies accountable for their policies on social and political issues, and employers are paying attention.

'Nobody Willingly Pays Themselves Less': Exec Pay Reform Could Be Uphill Battle

The economic crisis brought on by the COVID-19 pandemic has exacerbated the disparity between U.S. shale executives' compensation and shareholders' long-term interests, according to a private equity firm with a history of shareholder activism.

"The compensation structure for U.S. [exploration and production] companies has been completely asymmetric, and all it does is result in this procyclical bias for the business," said Mark Viviano, a managing partner and portfolio manager at Kimmeridge Energy Management Company LLC, during a Dec. 3 interview.

Kimmeridge said in a Nov. 17 white paper arguing for compensation reform that executive pay in the oil and gas industry continues to rise even though it is one of the worst-performing sectors.

S&P Global Ratings expects issuance of sustainable debt--including green, social, sustainability, and sustainability-linked bonds--will surpass $700 billion in 2021. This would take cumulative issuance past the $2 trillion milestone, from $1.3 trillion as of year-end 2020. Sustainable debt issuance exceeded $530 billion in 2020, according to Environmental Finance, up a staggering 63% from 2019. Social bonds emerged as the fastest growing segment of the market, growing about 8x in 2020, catapulted by the COVID-19 pandemic and growing concern about social inequities.

As issuer attention shifted toward financing pandemic aid and ensuring recession relief measures, green bond debt slowed in the first half of the 2020. However, it rebounded in the second half, reaching a record annual issuance amount of $270 billion and indicating that issuer and investor appetite for financing climate response and other environmental objectives is strong and accelerating. S&P Global Ratings believes green-labeled bond issuance could exceed $400 billion in 2021, as global political and regulatory actions grow, serving as a catalyst for increased sovereign and private issuance. S&P Global Ratings also believes the green use-of-proceeds model will expand to include transition finance, aiding high-carbon-emitting sectors to finance their transition into net-zero emissions business activities.

Social Bond Market, Healing COVID-19 Divisions, Set to Continue Growing

The COVID-19 pandemic served as a catalyst for social bond issuance in 2020, as a way for investors and governments to address social divisions laid bare by the health crisis. And their use is expected to grow in the future and outlast the aftermath of coronavirus, according to market observers.

A total of 138 social bonds were issued in 2020, raising over $163 billion, far more than the $13 billion raised in 2019, law firm Linklaters said in a Dec. 17 post, citing Refinitiv data. Such bonds appeal to the fast-growing base of socially concerned investors, Richard O'Callaghan, partner in the capital markets team of Linklaters, said in the statement.

In fact, bonds that address social themes have been the fastest growing sector of the labelled bonds market in the past year, Sarah Gordon, CEO of the U.K.-based nonprofit organization the Impact Investing Institute, told S&P Global Market Intelligence.

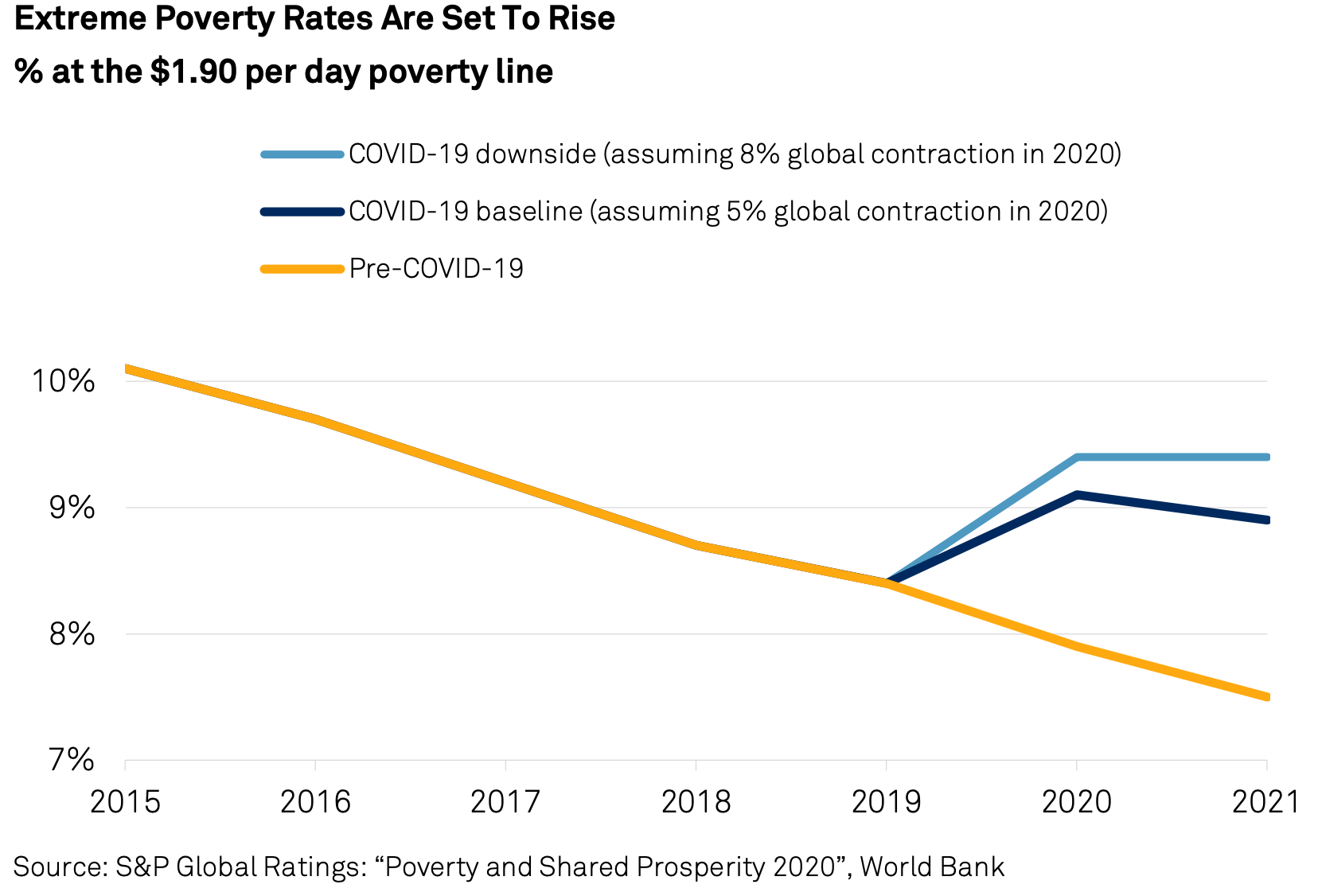

Unprecedented fiscal support cushioned the social impact of COVID-19. As this wears off, the question of equitable burden-sharing could determine political agendas in 2021. As the initial “rally-around-the-flag” effects following the outbreak of the pandemic have worn off, long-term trends toward political fragmentation and populism could gain traction.

COVID-19 has become a “great divider”, at least for now. The unequal effect of the pandemic on different socio-economic groups could put perceptions of rising domestic inequalities under heightened political spotlight in 2021. Vulnerable populations, including lower income households, ethnic minorities, but also women, have often been worst affected. The World Bank expects extreme poverty— defined as living on less than US$1.90 day—to have increased in 2020 for the first time in 20 years.

Racial Inequity 'A Systemic Risk' – State Street Global Advisors CEO

One of the world's largest asset managers is stepping up the pressure on public companies to disclose racial diversity data.

In 2021, State Street Global Advisors Inc.'s main stewardship priorities will be the systemic risks associated with climate change and a lack of racial and ethnic diversity, CEO Cyrus Taraporevala wrote in a Jan. 11 letter to boards of directors.

In an August 2020 letter, the firm urged public companies to disclose more concrete data on their racial diversity or face pushback from the asset manager in proxy meetings. Taraporevala built on this pledge in the Jan. 11 letter, outlining several specific proxy voting practices for the coming two years.

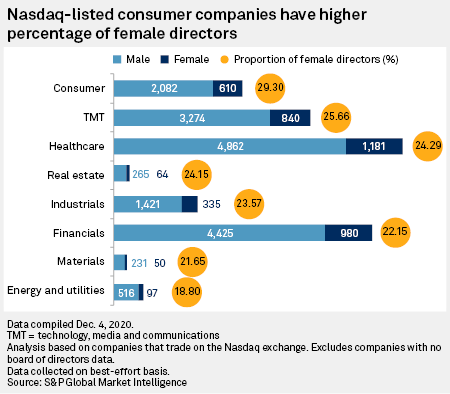

A Wall Street gatekeeper is challenging corporate America to diversify its boardrooms in a proposal that could have profound implications for leadership at thousands of U.S. companies.

In the wake of a racial reckoning in the U.S. sparked by the death of George Floyd, Nasdaq Inc. is wading into the yearslong conversation about diversity in corporate America and the benefits of increasing gender and racial diversity in boardrooms and C-suites.

Japan's Latest Push for Workforce Diversity Challenges Megabank Culture

Japan's latest policy push for more workforce diversity in terms of gender, ethnicity and employment background touches a nerve of the deep-seated culture of the nation's megabanks: male domination and lifetime employment.

Read the Full Article'Stop Favoring Men': German Law Means Big Companies Must Appoint Women to Boards

Europe's largest economy has passed legislation introducing a minimum quota for women on the boards of large listed companies, in a move widely praised by business diversity advocates as an important step toward gender equality.

Read the Full ArticleStakeholders are increasingly holding companies to a higher social standard, demanding that they demonstrate a real commitment to listening to all stakeholders, nurturing a diverse and inclusive workforce, and engendering strong community relations.

Access the Topic PageThe COVID-19 pandemic has given investors new fuel to push for institutional changes at the world's top pharmaceutical companies to ensure equitable access to medicines in lower income countries.

Lower income nations tend to wait longer to receive access to lifesaving drugs as they emerge from the research and development pipeline, according to the Access to Medicine Foundation's Access to Medicine Index. The companies on the latest edition of the index released Jan. 26 create plans for their medicines early on in the development stage, sometimes years before the drug is ever approved for use in any country.

The index comes after a year in which the pharmaceutical industry suddenly pivoted to tackle the COVID-19 pandemic, with the disease caused by the novel coronavirus becoming one of the biggest R&D focuses for many companies. Pfizer Inc., along with German partner BioNTech SE, have one of the few authorized vaccines for COVID-19. The U.K.'s AstraZeneca PLC has another that is being administered around the world.

Big Pharma Eyes Diverse Population Data in COVID-19 Vaccine Race'

When Moderna Inc. realized that clinical trials for the company's experimental coronavirus vaccine were not diverse enough, executives pumped the brakes, even as the world eagerly awaited any good news on a preventative treatment for COVID-19.

Read the Full ArticleConsumer Companies Float Incentives Over Mandates for U.S. Worker COVID-19 Shots

Consumer companies are offering incentives to thousands of their U.S. employees to get vaccinated for COVID-19 and helping out with government distribution efforts. But so far they have shied away from handing down vaccine mandates.

Read the Full ArticleU.S. EPA Finalizes Science Rule Criticized by Career Staff, Expert Scientists

The U.S. Environmental Protection Agency on Jan. 5 released a final regulation that requires the public disclosure of certain medical data used to support its rules, a move that critics said could undermine public health protections.

Read the Full Article

In the early days of the new Biden administration, U.S. mine workers may get the additional COVID-19 protections they have sought since March 2020.

After calling on federal officials at the U.S. Mine Safety and Health Administration to issue an emergency temporary standard for workers in the early days of the pandemic, the United Mine Workers of American International Union, or UMWA, later joined with United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union to sue the agency. While the U.S. Court of Appeals for the District of Columbia Circuit sided with MSHA, which said a rule was not necessary, there are indications that the agency will take a different approach under a Biden presidency.

Biden $1.9 Trillion Relief Package Calls for Worker Safety, Paid Leave Reforms

President-elect Joe Biden's $1.9 trillion economic relief package includes proposals to bolster safety regulations for workers and expand the amount of paid sick, family and medical leave workers can receive.

The COVID-19 pandemic has increased investor focus on how companies are handling paid leave related to the pandemic and mitigating the health risks their frontline workers face.

The Trump administration barred all cotton and tomato products from China's Xinjiang region over allegations of human rights abuses against ethnic minorities, spelling potentially large supply chain consequences for U.S. companies that source from the region.

The U.S. Department of Homeland Security on Jan. 13 issued a withhold release order under the authority of Section 307 of the Tariff Act of 1930 against cotton and cotton products and tomatoes sourced from the Xinjiang region in western China. The U.S. imported $9 billion worth of cotton and cotton products from China as a whole in 2020, along with roughly $10 million in tomatoes.