Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Most economies around the world are facing a deepening energy crisis—due to global supply disruptions, high energy prices, geopolitical turmoil, and an as-yet-unrealized energy transition away from carbon-intensive sources.

Published: July 7, 2022

Updated: December 12, 2022

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

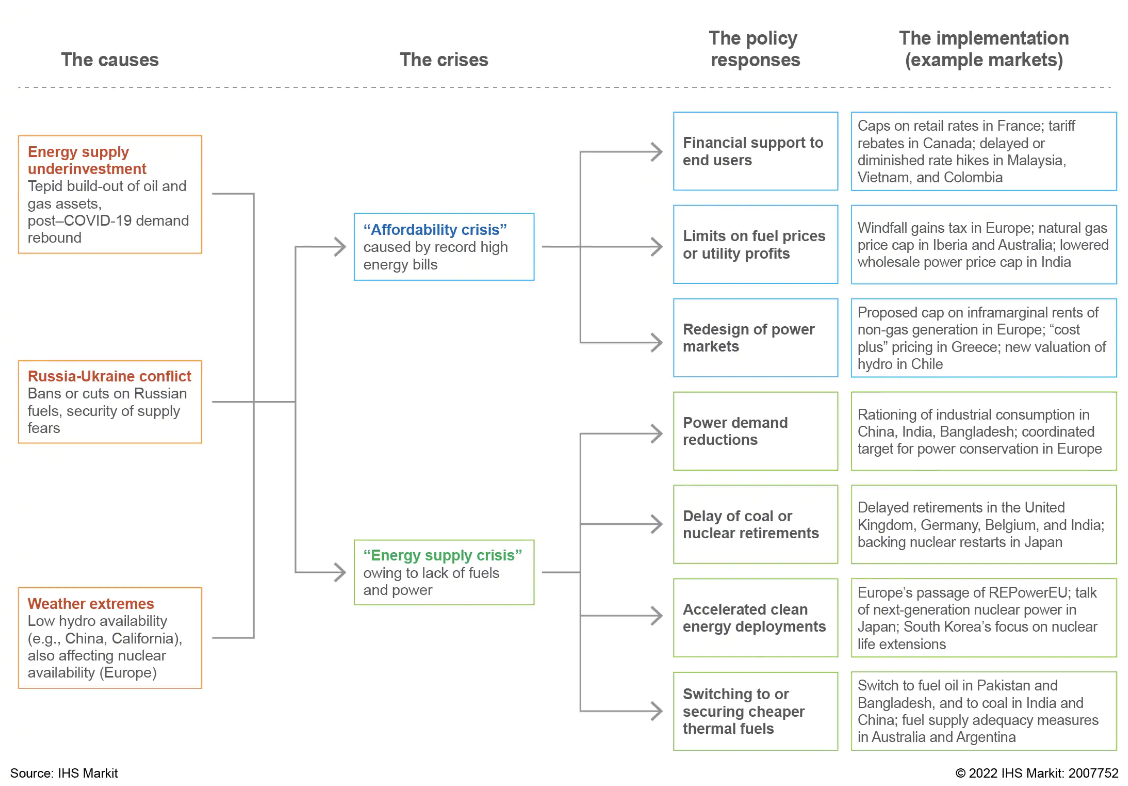

SUBSCRIBE TO THE NEWSLETTERSThe ongoing energy crisis is challenging the design of many power markets globally.

Banks Call for Better Government Guidance on Net-Zero Path Amid Energy Crisis

The Glasgow Financial Alliance for Net Zero has urged G-20 governments to provide greater clarity on how response measures to the unfolding energy crisis are impacting the energy transition. The alliance also wants better guidance on how nations intend to get "back on track" in terms of their climate commitments.

Read the articleNATO Vows 'United and Determined' Response in Event of Energy Infrastructure Attacks

The North Atlantic Treaty Organization on Sept. 29 vowed a "united and determined" response in the event of deliberate attacks on critical energy infrastructure, describing recent damage to the Nord Stream gas pipelines in the Baltic Sea as deliberate acts of sabotage and a risk to shipping that also entailed substantial environmental damage.

Read the Article

In a complicated world where one event triggers challenges for seemingly unrelated industries, the S&P Global network of over 750 global experts can provide you a 360-degree view of key trends. Get in-depth insights into the intersection of topics such as economics, shipping, automotive, commodities trading, oil and gas, financials, sustainability and more.

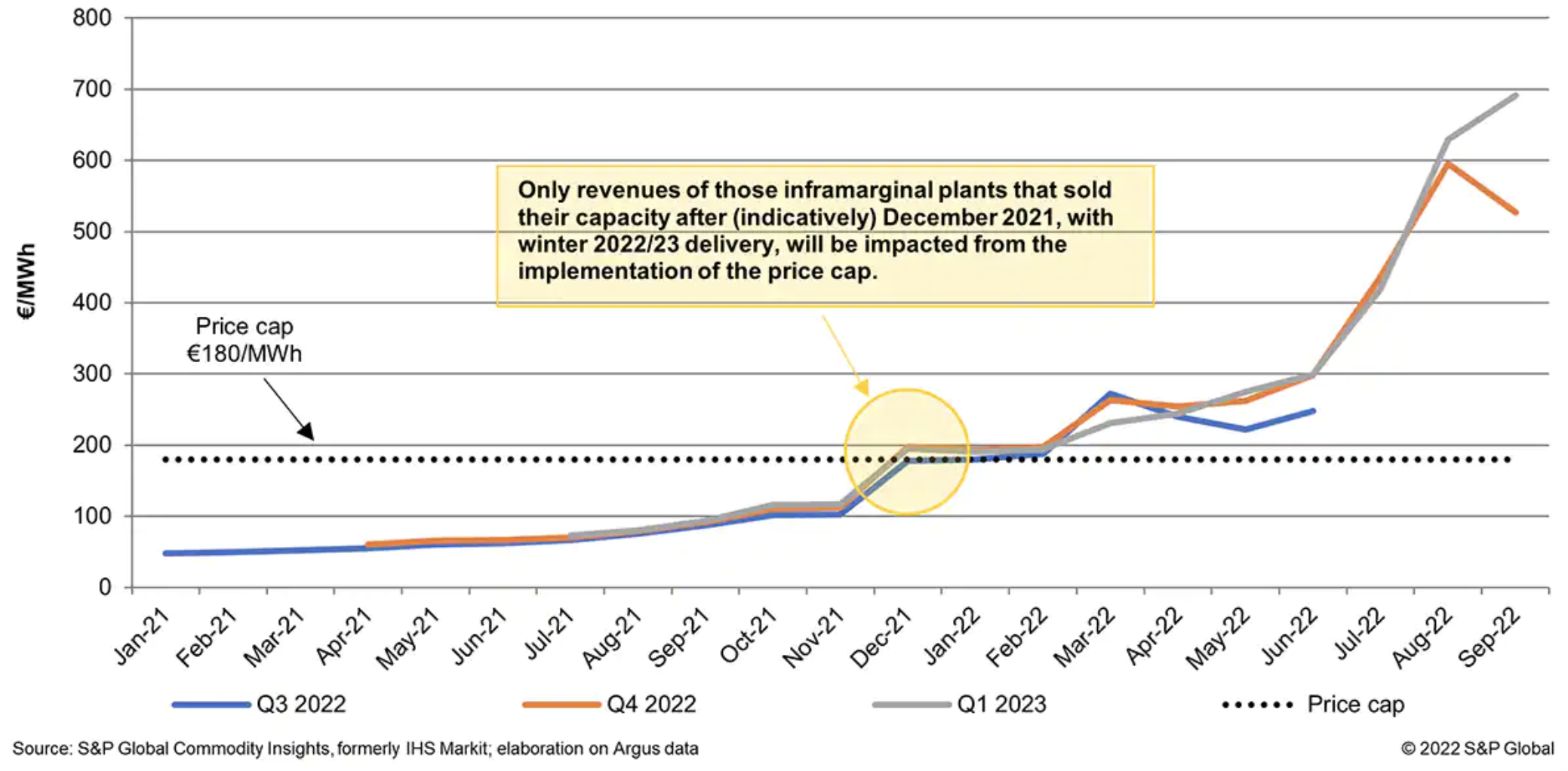

FIND AN EXPERTEurope's energy crisis has been in the headlines for most of 2022. Owing to the gas supply crisis, worsened by low nuclear availability, European power users face exceptionally high power bills this winter.

Energy Crisis to Disrupt European Banks' Net-Zero Agenda in the Short Term

More than half of Europe's major banks expect the current energy crisis to negatively impact their short-term ability to stay on track with their climate transition agenda, according to new research.

Read the articleThe ‘A’ Factor: The Role of Algorithmic Trading During an Energy Crisis

Algorithmic trading is becoming increasingly common in European natural gas and electricity markets, with traders often blaming the innovation for extreme volatility, as regional prices have been swinging this year on the back of tight supply and accelerating uncertainty.

Read the article

Do you need to understand the market value of LNG in regional and global markets? What is the value of freight rates and shipping costs between export and import locations? Or how supply and demand fundamentals are impacting the price of LNG? S&P Global Platts delivers the data and prices you need to make competitive decisions.

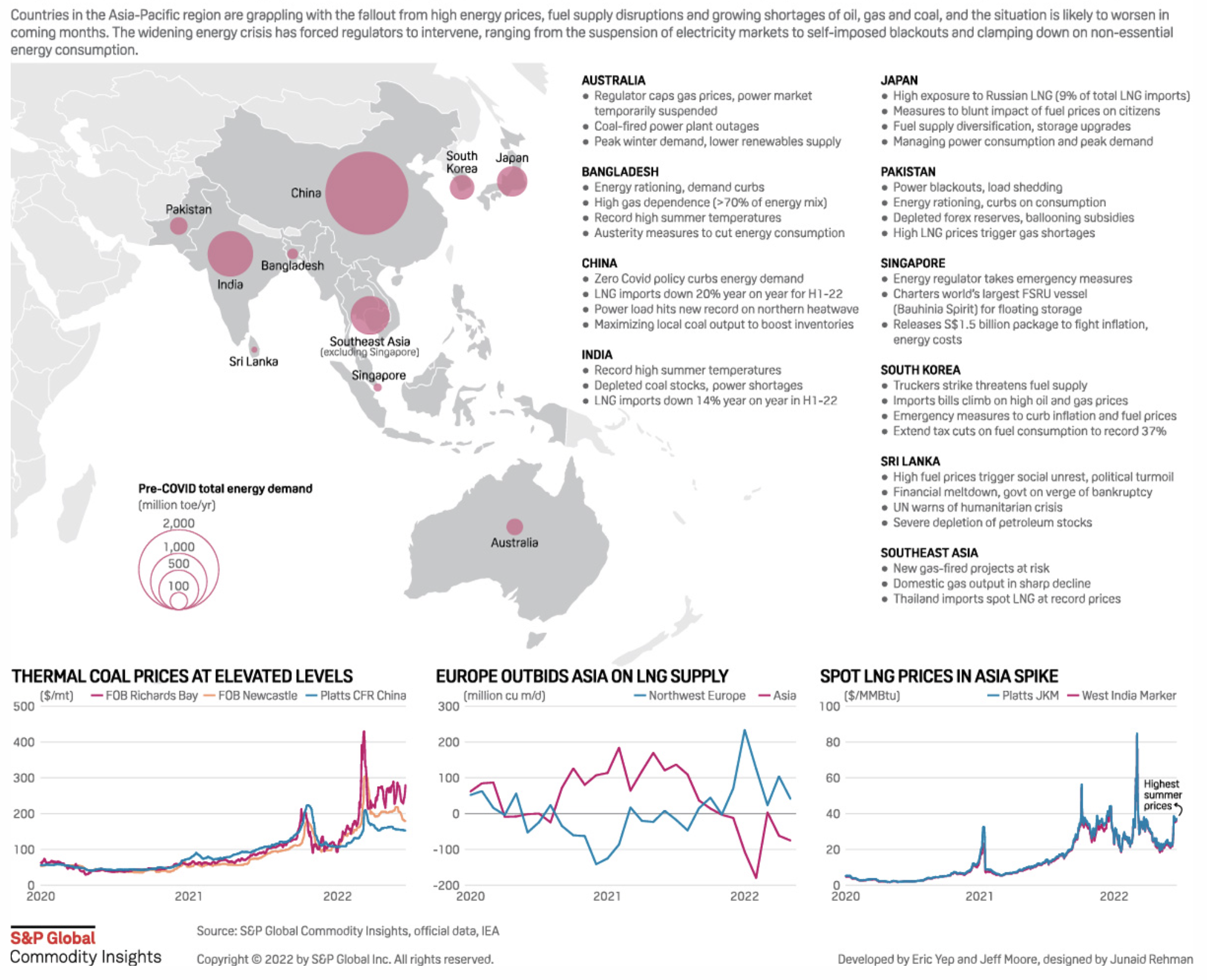

ACCESS MOREAsia-Pacific economies are facing an energy crisis that threatens to worsen in coming months and reach historic proportions if the Russia-Ukraine war continues. The magnitude of the crisis varies in different countries but broader trends are identical – high fuel prices, supply disruptions, domestic energy shortages, blackouts, involuntary demand destruction, calculated energy rationing, depleting forex reserves and market volatility.

Prices

Asian spot LNG prices for the summer of 2022 are at their highest level for this time of the year. The Platts JKM for August was assessed at $36.888/MMBtu June 24, S&P Global Commodity Insights data showed.

Trade flows

European gas fundamentals are still largely dictating global spot LNG prices and as LNG continues to replace piped gas supply into the region, Asia will lose LNG cargoes to Europe and see lower inflows for the rest of this year compared to previous years.

South Korea Outlines Crisis Response for Winter; Raises Gas and Power Prices

South Korea will undertake crisis response measures to tackle the coming winter, including curbs on energy demand, raising gas prices for city gas and power sectors, securing LNG supply and boosting finances of energy importers.

Read the ArticleBangladesh to Lean on More Coal than Natural Gas in Power Generation to Curb Costs

Bangladesh is expected to see a huge ramp up in coal-fired power generation in coming months as new capacity comes online, which will boost the share of coal in its energy mix to its highest on record.

Read the ArticlePakistan Floods Endanger Power Plants, Aggravate Energy Crisis

Severe floods in Pakistan, triggered by record monsoons and a glacial melt in the mountainous north, have endangered grid stations and exacerbated power shortages at a time when the country is already grappling with an acute energy crisis and limited LNG supplies.

Read the ArticleAsian VLCC Rates Close To 2-Year high As Tonnage Supply Tightens

VLCC freight rates for hauling crude from the Middle East to North Asia neared a two-year high Aug. 29 on the back of burgeoning oil demand and following altered trade flows which began with the Russia-Ukraine war.

Read the Article

Platts Market Data – Energy Transition provides access to the full breadth and depth of our energy transition market data, including contract price assessments.

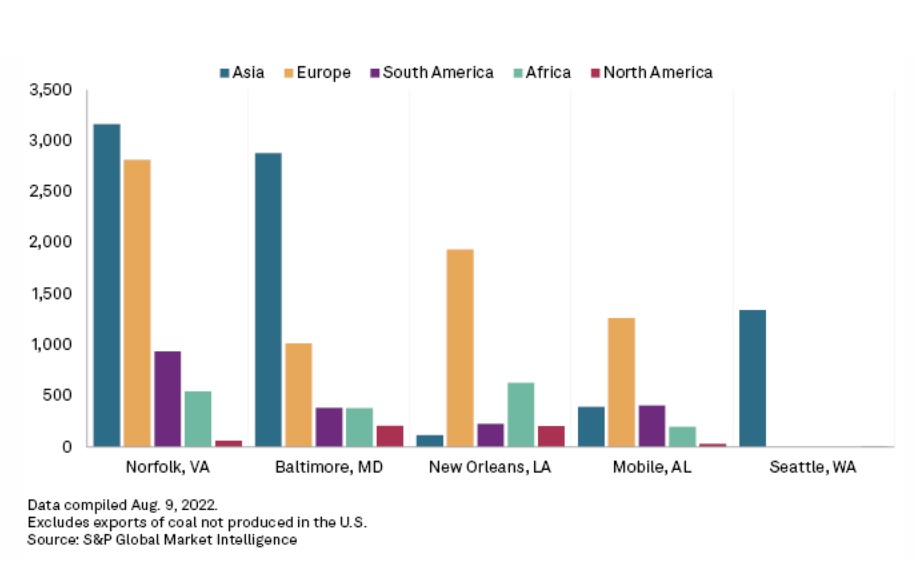

ACCESS MORE:U.S. coal exports rose in the second quarter as demand and prices remained elevated amid a global energy crisis.

Shipment volumes increased 14.8% quarter over quarter to 21.6 million tonnes and climbed 4.6% year over year, according to S&P Global Market Intelligence data.

The global coal market has become tight as several countries shunned supplies from Russia following its Feb. 24 invasion of Ukraine. High natural gas prices and the lack of new project investments have also pushed up coal prices. However, rail transportation constraints, weakening demand in China and fears of a global recession pose risks to the sector.

Asia and Europe received the most coal shipments from the five largest ports in the U.S.: Norfolk, Va.; Baltimore; New Orleans; Mobile, Ala.; and Seattle. Other destinations for U.S. coal exports included South America and Africa. All coal shipped through Seattle during the second quarter went to Asia.

OPEC+ Chops Oil Quotas, in Another Snub to the U.S., as White House Threatens Retaliation

OPEC and its allies on Oct. 5 slashed their production quotas by 2 million b/d for the next 14 months in a bid to stabilize sliding oil prices, provoking a strong backlash from the U.S., which had warned the group to avoid a potential supply squeeze and distance itself from Russia.

Read the ArticleU.S. Natural Gas Prices Could Ease in 2023, Potentially Lowering Northeast Power Prices: EIA

U.S. Energy Information Administration analysts discussed the relationship between fuel costs and power prices, and how recent U.S. LNG export growth has created uncertainty about energy supply, with the New York Independent System Operator in a podcast released Aug. 10.

Read the ArticleArgentina to Expand Tax-Free Diesel Imports for Power Sector as Demand Rises

Argentina said Aug. 8 it has authorized Cammesa, operator of the wholesale power network, to increase the amount of diesel supplies it can import under a tax-free scheme this year to 25.2 million barrels from 15.7 million barrels as diesel demand for electricity generation grows faster than previously expected.

Read the Article

As curtailed Russian gas supplies and record-low nuclear availability raise the specter of potential power blackouts in Europe, countries are allowing more coal-fired power generation, setting energy price caps and triggering emergency gas plans.

ACCESS THE TOPIC PAGECiting technical faults, safety concerns, and sanctions, Russia's technical regulator reduced the operational capacity of the Nord Stream pipeline by 60% on 16 June. This has reduced pipeline deliveries of Russian gas to the EU by about 35% to unprecedented low levels.

Saying what many were thinking, German minister of economy and climate Robert Habeck has called the technical issues "a pretext" and accused Russia of seeking to drive up prices and destabilize the gas market.

Laurent Ruseckas is a specialist on gas markets, gas midstream, politics and policy in Europe and Eurasia, S&P Global Commodity Insights.

Talk to the Expert