Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 10 Jun, 2021

By Jason Ye

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The Chinese financial market has continued to evolve and mature over the past decade. More and more domestic Chinese investors are starting to take note of investment opportunities from global markets. What are the potential benefits of allocating globally for Chinese investors? In this blog, we will use the CSI 300 Index as a proxy for the China A-shares equity market and the S&P 500® as a proxy for the U.S. equity market to illustrate that investing globally may provide diversification benefits and could improve risk-adjusted return.

As long as two assets are not perfectly correlated, combining them may reduce a portfolio’s overall standard deviation, a common measure of risk.

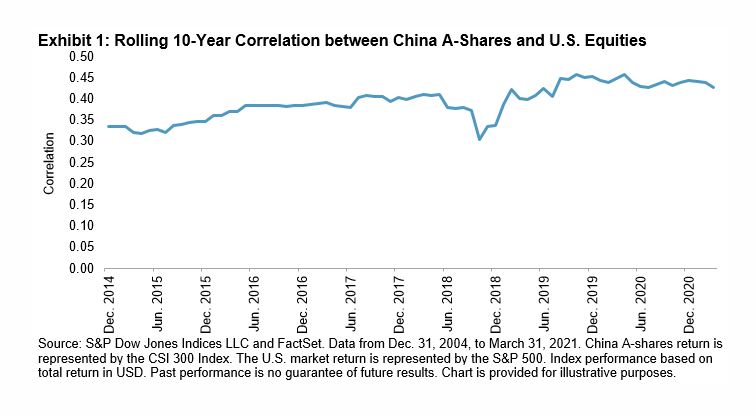

Despite rising in recent years, the historical correlation of returns between China A-shares and U.S. equity markets has generally been below 0.5 (see Exhibit 1). The low correlation suggests a potential reduction in portfolio volatility when adding U.S. equities to a portfolio of only China A-shares.

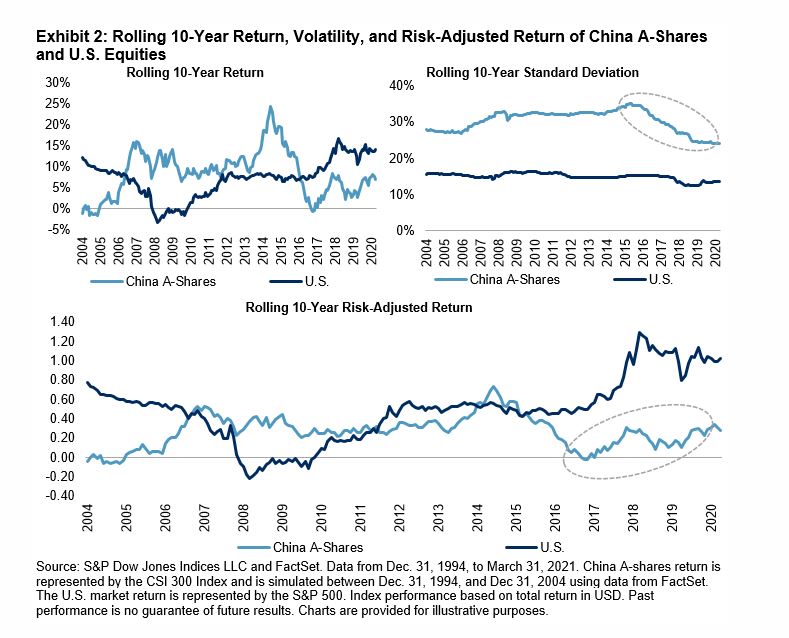

On a rolling 10-year basis from Dec. 31, 1994, to March 31, 2021, the U.S. market had a higher risk-adjusted return than the China A-shares market during most periods.

This is driven primarily by different volatility levels observed in the two markets. The China A-shares market was significantly more volatile than the U.S. market, despite a meaningful downward trend in volatility over the past five years.

Looking at absolute return, the U.S. and A-shares markets showed distinct cycles. The average rolling 10-year return for China A-shares was 8.42%, versus 6.98% for U.S. equities.

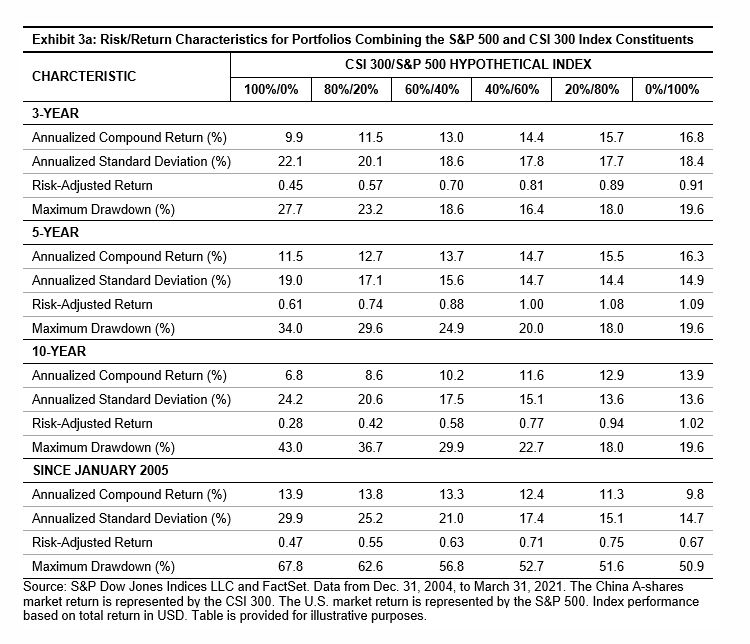

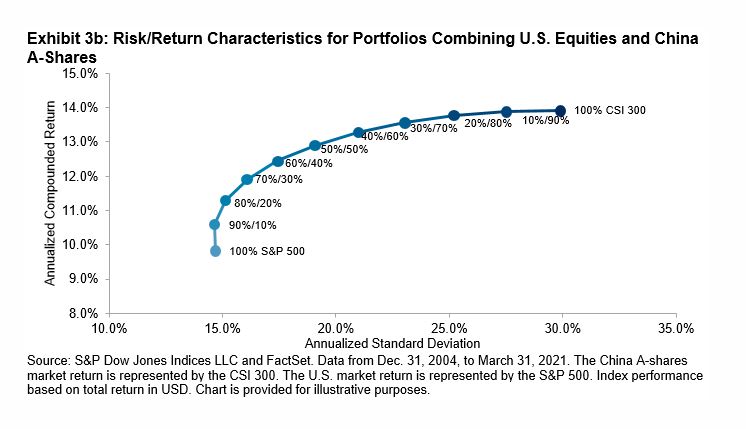

Exhibits 3a and 3b show the historical risk/return profiles of hypothetical blended indices created from combinations of the CSI 300 Index and S&P 500 ranging in 10%-20% increments, assuming a monthly fixed-weight rebalance. In the past 3, 5, and 10 years, a hypothetical blended index with weighting to the S&P 500 not only reduced the blended index’s standard deviation but also increased the annualized compounded performance.

Between 2005 and 2020, increasing weights to the S&P 500 improved risk-adjusted returns for the blended index; the reduction in standard deviation more than offset the impact of lower performance. The in-sample optimal allocation of 77% U.S. and 23% China A-shares in the blended index generated a risk-adjusted return of 0.75, higher than both the standalone S&P 500 (0.67) and CSI 300 Index (0.47).

Historically, Chinese investors’ allocation to global equities, including U.S. equities, has been low. By underallocating to U.S. equities, Chinese investors have less diversification. Increasing exposure to the U.S. equity market may result in improved risk-adjusted return for Chinese investors. For more details, please refer to Why the S&P 500 Matters to China.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Theme

Segment

Language