Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 3 Nov, 2016

By Emily Ulrich

When it comes to sustainable investing, three factors are typically used as measurements: social, environmental, and governance. For most of us, the benefit to reducing our environmental impact is obvious. The importance of governance has also been well researched by S&P Dow Jones Indices—just look at the S&P LTVC Global Index.

The social factor, however, has been less examined. As I mentioned in a previous blog post, social refers to mentalities in the workplace (e.g., diversity management, human rights, etc.), as well as any relationships surrounding the community (e.g., corporate citizenship and philanthropy). It includes criteria such as human capital development, corporate citizenship, and occupational health and safety.

This “S” factor has become increasingly relevant to market participants. In January 2016, the U.N. set the Sustainable Development Goals (SDGs)—17 goals with the ultimate purpose to “end poverty, protect the planet, and ensure prosperity for all.” Many of these incorporate crucial social factors, including the following.

Exhibit 1 shows all 17 goals.

We are not just seeing social factors in government policy—we are also seeing an increase in interest from market participants.

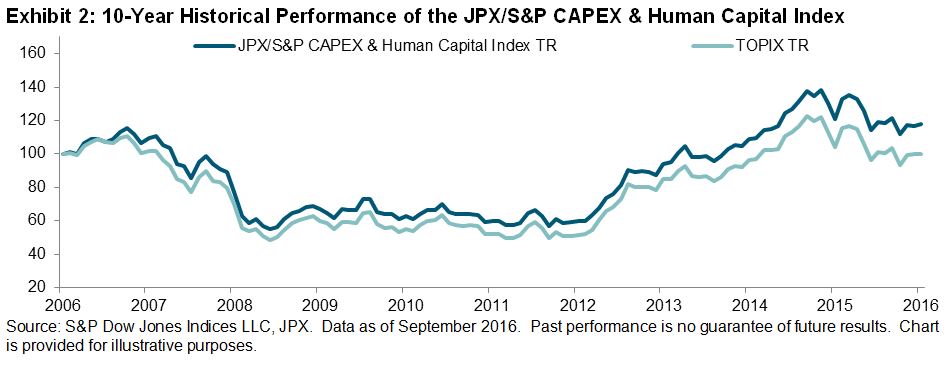

In 2015, the Bank of Japan launched an initiative to invest in companies that are “proactively making investment in physical and human capital.” In response to this announcement, S&P DJI and JPX launched the JPX/S&P CAPEX & Human Capital Index. To measure something so abstract, we focused on three factors.

This approach enabled us to capture both quantitative factors (CAPEX + R&D expense growth and CAPEX revenue effect) and qualitative factors (human capital score). Quantitative factors are rather typical for finance, but non-financial factors can be a challenge—so how does one measure human capital?

We took certain criteria from RobecoSAM’s Classic ESG score that we felt encompassed human capital, including talent attraction & retention, labor rights, employee development, human rights, and employee turnover. Exhibit 2 illustrates the 10-year historical performance of the index.

The index has performed quite well, providing further evidence that sustainable investing may not include a sacrifice of performance. Equally important going forward, we expect interest in the social factor to continue to grow among market participants, particularly as millennials enter the investment landscape.