Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

15 Apr, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The recently published SPIVA® Latin America Year-End 2020 Scorecard shows that the volatile environment of 2020, though potentially favorable for high-conviction active managers, did not necessarily translate into success for active managers.

SPIVA scorecards measure the performance of active funds against an appropriate benchmark. For Latin America, S&P Dow Jones Indices began publishing the scorecard in 2014, covering Brazil, Chile, and Mexico.

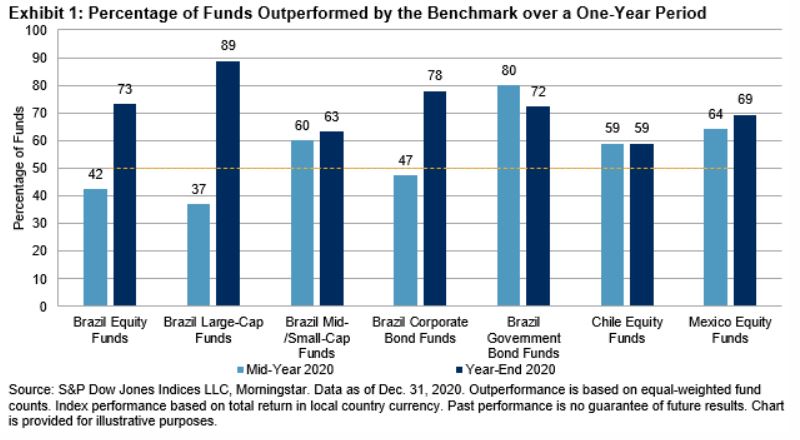

As of year-end 2020, all categories across all three countries underperformed their benchmarks over the 1-, 3-, 5-, and 10-year periods. These results contrasted those of the SPIVA Latin America Mid-Year 2020 Scorecard, in which Brazilian active managers in the Brazil Equity Funds, Brazil Large-Cap Funds, and Brazil Corporate Bond Funds categories managed to take advantage of the circumstances and outperform over the one-year period (see Exhibit 1).

Median fund managers across all the categories in the report underperformed their benchmarks over 1-, 3-, 5-, and 10-year periods (see Exhibit 2). However, in five out of seven categories, active managers in the first quartile beat their benchmarks over the one- and three-year periods (see Exhibit 3). Top-performing managers in the Brazil Equity Funds category were even able to outperform over the 10-year period.

As evidenced by SPIVA scorecards, the majority of active managers underperform most of the time, especially across the long-term time horizon. Is outperformance luck or skill? Stay tuned for the upcoming Latin America Persistence Scorecard.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Segment

Language