Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 22 Dec, 2020

By Fei Mei Chan

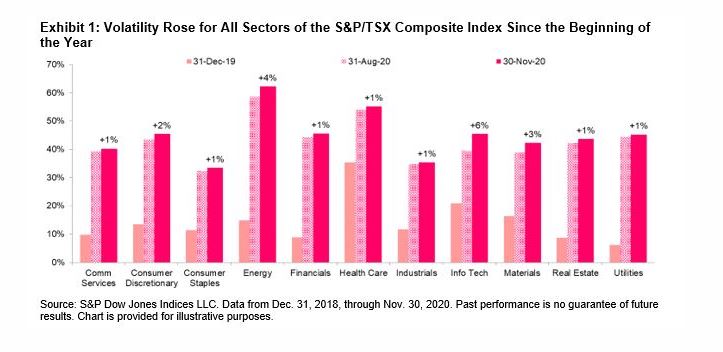

To say that the world is different now than it was a year ago would be an astounding understatement. COVID-19 brought about once unimaginable conditions and changes. In the financial realm, market volatility spiked and remains markedly higher across all sectors compared to the beginning of 2020. Yet, observing the market based purely on performance, it would almost seem as if all was normal. The S&P/TSX Composite Index, after March’s blip, is up 6.8% through Dec. 17 and continuing its uptrend heading into the new year.

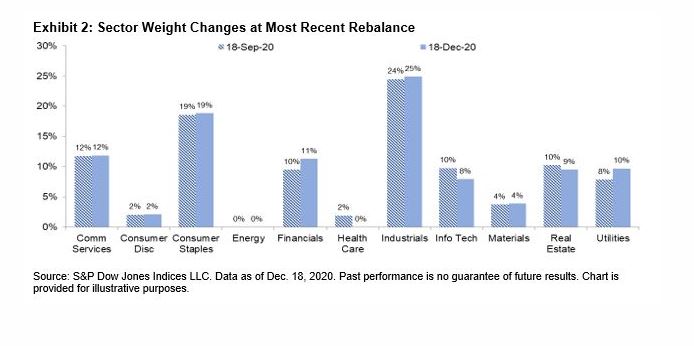

The changes in latest rebalance of the S&P/TSX Composite Low Volatility Index, effective after the close of trading on Dec. 18, 2020, were predictably small based on the changes in sector volatility in the last three months shown in Exhibit 1. The index shifted 2% of its weight away from Health Care and Information Technology, while shifting the most weight into Utilities and Industrials. There were only three name changes.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Language