Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 22 Mar, 2021

By Maria Sanchez and Gaurav Sinha

EXECUTIVE SUMMARY

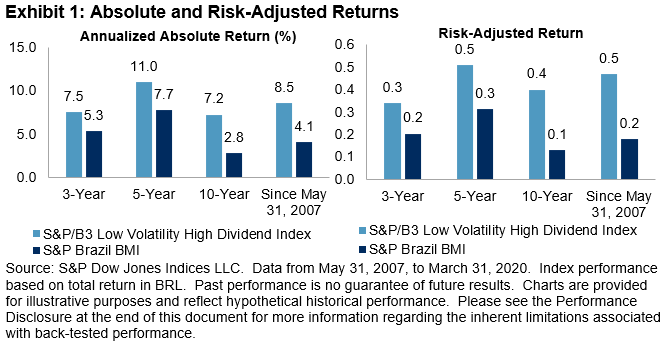

For investors who seek higher dividend yield and lower volatility for better risk-adjusted returns, S&P Dow Jones Indices has proposed a two-step constituent screening method. In this paper, we discuss how this analysis can be applied to Brazilian equity markets using the S&P/B3 Low Volatility High Dividend Index.

1. INTRODUCTION

Almost one year after launching the S&P/B3 Low Volatility High Dividend Index, we examine the potential advantage of incorporating a low volatility screen into a high-dividend-yield portfolio. We also compare the S&P/B3 Low Volatility High Dividend Index to other S&P Dividend Indices in the Brazilian equity market across various aspects such as sector composition, dividend yield, and historical return, among others.

Historically, the percentage of dividend payers in Brazil has ranged between 71% and 92%, making it a favorable environment for implementing dividend-focused strategies. In Brazil, S&P Dow Jones Indices has three different dividend-focused strategies, using different constructions and targeting different objectives:

The highest-yielding stocks in high-yield strategies often come with greater portfolio volatility, and Brazil is no exception. Therefore, an income strategy may require some form of volatility management for portfolio construction.

Content Type

Theme

Segment

Language