Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 19 Jan, 2021

By Ved Malla

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Indian capital markets had an exceptional year in 2020. The COVID-19 pandemic initially had an adverse impact on Indian capital markets, as indices across size and sectors fell during the period from February 2020 to May 2020. However, from June 2020 onward, all size and sector indices had a bull run through the end of the year. The S&P BSE SENSEX TR increased from 60,211.40 on Dec. 31, 2019, to 70,543.23 on Dec. 31, 2020—a one-year absolute return of 16.31%.

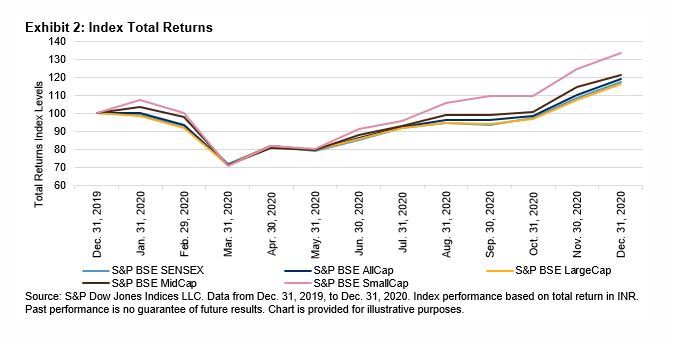

Exhibit 1 and 2 showcase returns for India’s leading size indices in 2020.

From Exhibits 1 and 2, we can see that all five size indices performed well, and returns were promising for large-, mid-, and small-cap segments. The returns of the small-cap and mid-cap segments were better than those of the large-cap segment. The S&P BSE SmallCap and S&P BSE MidCap posted one-year absolute returns of 33.53% and 21.31%, respectively, while the S&P BSE LargeCap and S&P BSE SENSEX returned 16.31% and 17.16%, respectively.

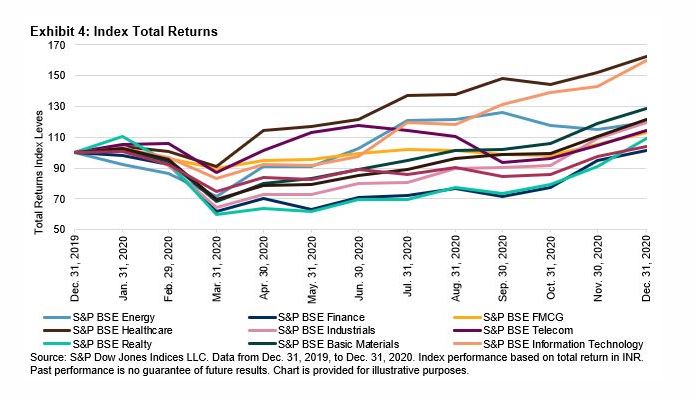

Exhibits 3 and 4 showcase returns for the 11 leading sector indices for India in 2020.

In Exhibits 3 and 4, we can see that most of the sector indices posted promising returns in 2020. The S&P BSE Healthcare and S&P BSE Information Technology performed exceptionally in 2020, with absolute returns of 62.61% and 60.05%, respectively. The S&P BSE Finance and S&P BSE Utilities were the worst-performing indices in 2020, with absolute returns of 1.25% and 4.18%, respectively.

To summarize, we can say that except for the couple of months at the beginning of the COVID-19 pandemic, the bulls had their way in 2020, and indices across size, segments, and sectors gave promising returns in 2020.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Theme

Segment

Language